Badger Meter Inc. (BMI) - Quick Writeup #1

An expensive but thoroughly wonderful water business

Disclosure: This is not financial advice. If you like the idea, conduct extensive research and consult a financial advisor before making any investment decisions. All investments, including this one, carry the risk of financial loss. I own Badger Meter stock, thus I am biased in favor of the company and one should view this article through that lens. This article comprises my personal beliefs and convictions around owning any securities mentioned, and is not intended to be used as a recommendation to buy or sell any securities. Please be careful everyone.

*as of 10/01/2024, I no longer hold any position in this company.

Industry and Product Portfolio

These guys do water flow meters, water quality monitoring, water pressure monitoring, valves for all kinds of industrial applications, data logging, transmission, and networking for these systems, and a home-brewed software system that allows customers to better track their water metrics. This system also includes customizable dashboards with specific alert conditions and visual aids, so customers of all kinds can monitor their water assets and operations round the clock, from anywhere. The company works with multiple cell carriers to ensure its best in class data transmission network functions smoothly. Somewhat like IOT, but very water specific.

They sell to commercial/industrial clients such as HVAC, auto, manufacturing, construction, water utilities, wastewater/runoff managers, and residential customers in the US, Mexico, Western Europe, Middle East, and Asia, with over 119 years of experience in the industry and an end-to-end product portfolio. They sell through a direct sales force in the US, and internationally through distributors/resellers. They have 4 distribution centers in the US and export internationally, and they manufacture in several countries including the US.

BMI water flow meters are either mechanical or ultrasonic, and can be read either on a register attached to the meter or through a network connection. They were first to the market with ultrasonic metering, and have taken significant market share in networked metering since 2021. They have also seen significant growth in the software component, sporting a 28% revenue CAGR since 2019, representing 6% of revenue in 2023.

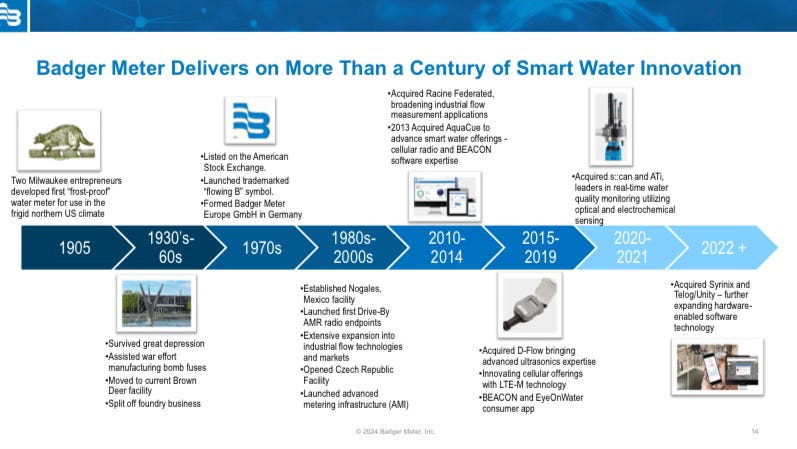

BMI has been the innovator in the space for the past few decades at least, being the first company to come out with ultrasonic metering and cellular radios for networked metering, as well as the first to develop a software system for water use tracking.

They also offer leak detection through acoustic sensors, optical and electrochemical water purity sensors, hydraulics diagnostic sensors, and precision controlled valves for steam, liquids, and other industrial and chemical compounds.

BMI’s products are best in class and complement each other very well. They offer a full and comprehensive suite of high quality products that their loyal customer base has been relying on for decades and decades.

The company was founded in 1905 in Wisconsin and was listed in 1972. They have been making water meters this entire time, though they briefly manufactured bomb fuses during one of the world wars. They have been audited by EY since 1927!

Financials/Company Metrics

5.6bn market cap

200mm cash, 80mm receivables, 207mm in liabilities, no long term debt. The company paid off all debt in 2020 and they retain an untapped 150mm revolver

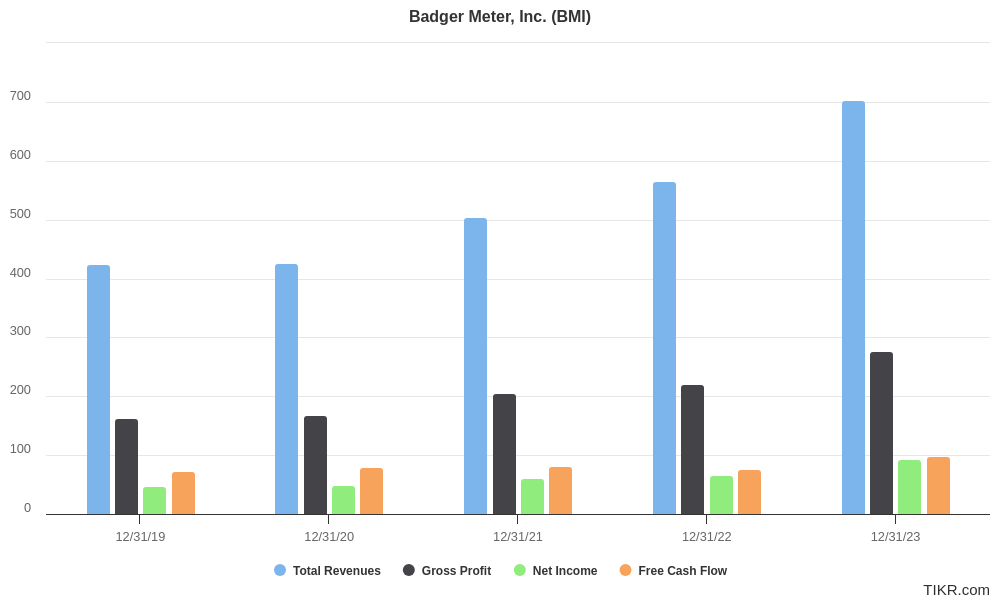

703mm revenue in 2023, 196mm in Q1 2024

92mm net income in 2023, 29mm in Q1 2024

FCF of 98mm in 2023

17% operating margin

14% FCF and Net Income margins

trades at 53x earnings, 45x fwd

Revenue

Revenue is running at a 10.6% CAGR since 2019, closer to 20% over the last 3 years. Total revenue grew 24% in 2023, with international utility revenue up 30%, albeit from an easy comp. 85% of annual revenues are driven by replacement volume, 86% are from US water utilities, another 4% from other US customers, and roughly 10% are from international end markets. No single customer accounts for more than 10% of annual sales, and there are over 50,000 water utilities of varying sizes in the US. I should warn you, this company thinks about revenue growth a little weird. Management seems to prefer measuring dollar amount increase over the long term instead of targeting some % increase year over year. The CEO has stated they think about growth stages in 5 year periods, due to the long replacement cycle of the products they sell, usually 15-20 years. Most of their customer base has been with the company for 60 or 70 years. Also, revenue does not grow linearly, but could increase by 5% one year, 30% the next. In general, it’s best to look at long term metrics for this company's sales through the different upgrade cycles it’s products have seen - though, I will be using 5 year metrics strictly because I refuse to pay for Tikr Premium.

Margins

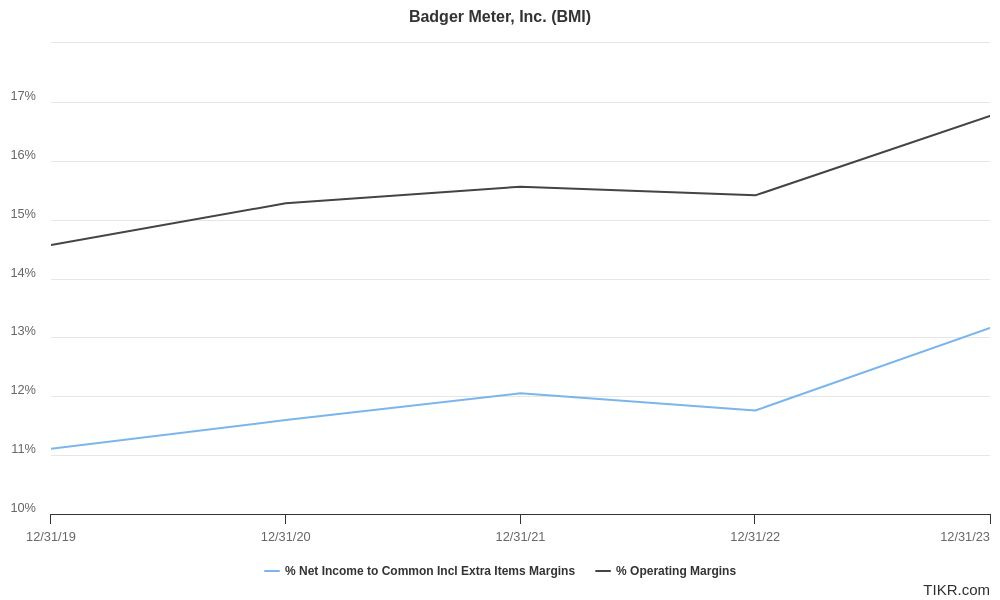

Since 2019, operating margin has risen from 14.6% to 17.5% and net income margins from 11.1% to 13.8%. Net Income margins have grown by 15% per year over the past 5 years. Gross margin is up as well, but to a lesser degree.

This can be attributed to a few factors. One, the software component, though it makes up just 6% of current sales volume, is likely a much higher margin business than their core business, and it has grown rapidly in recent years. Two, the company has demonstrated very disciplined cost maintenance, as annual operating expense has grown by 58% since 2019 compared to revenue increase of 74%. Three, they adopted a value based pricing model a few years ago that has potentially increased margins from certain customers and deals. Note, net income to common margins will have lagged a tiny amount due to a corresponding tiny amount of share dilution, <1% in the last 5 years. The company’s main cost metric is SEA, selling, engineering, and administrative. The business is super capex light, but they’re not skimping on the R&D spend.

Another thing on the software component, I think eventually all of BMI’s customers will adopt this, it’s just too damn handy. Adding this onto all their existing sales is a great way to increase margins because software is just a high margin business to begin with. They could even charge a small annual subscription to get a little more revenue out. It’s likely that the enhanced visibility and accessibility this software provides a water utility would more than pay for any subscription the company charges. They may already be doing this, I don’t know. But it shows you that the people running this company are some creative badgers indeed.

Management has commented that at some point, the margins will top out and cease walking up the “stairway to heaven” due to various fundamental factors inherent in any business, but the margin could be improved significantly further - they haven’t commented where exactly they see margins topping out and I like them to increase further, considering BMI’s deep customer connections and a literal century of innovation and industry experience under their belt.

Capital Management

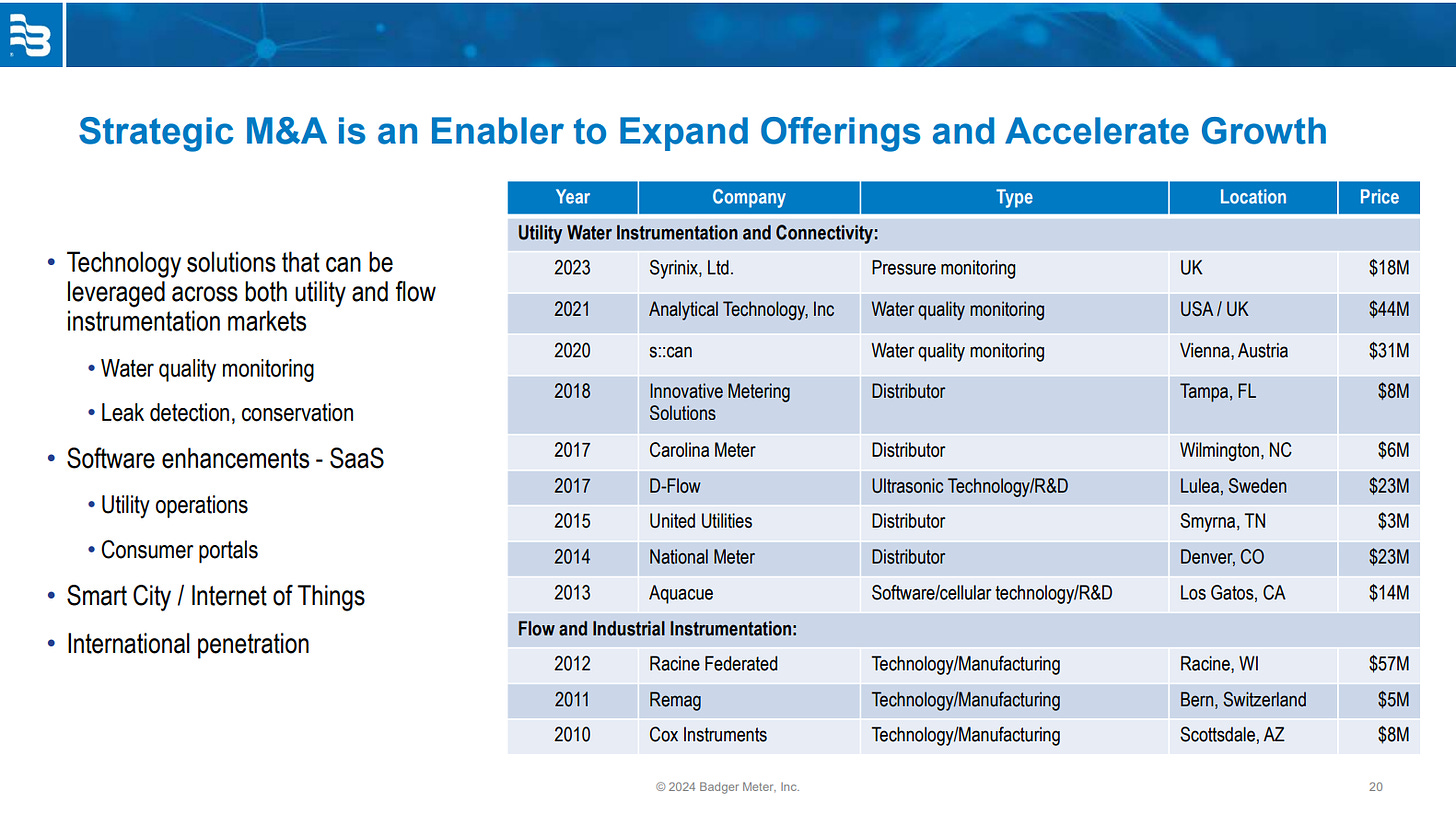

They pay a 0.6% dividend, with the payout pegged at 30% and growing with earnings. This company has increased its dividend every year of the last 31 years, making it a dividend aristocrat. Now, I’m not a dividend guy but this is admittedly a little cool. Most importantly, the payout is relatively small and doesn’t detract from the company's main capital allocation strategy, good old fashioned M&A. This company is a serial acquirer, and that’s a good thing:

The company has consistently acquired other companies with products that enhance and complement their existing portfolio, and used their sales expertise and distribution channels to push these new technologies to their existing base of loyal, long term customers. These acquisitions have not only proven themselves to be accretive to EPS immediately and over the long term, but are also additive to their product portfolio in a way that has allowed them to take market share during this upgrade cycle, and protect and expand their own market share over longer time horizons. They give specific contribution numbers for newly acquired businesses out to a year, at which point that contribution gets sloshed into regular revenues.

Management doesn’t comment on market share numbers (on investor calls anyway). On a call from 2022 or 2023 I forget, the CEO said after much coaxing that the company had in fact taken market share in recent years, though as usual he didn’t give any specifics. Fortunately, some YouTube diving revealed an interview he gave, where he mentioned that BMI has roughly 30% market share across all 50,000 US water utilities. The most recent 10K stated that BMI and 2 other companies, Xylem and Neptune, have an estimated 85% market share in the US. Furthermore, their strategic M&A over the years and enhanced product offering have allowed them to hit more “home run” upgrade deals, where a customer will choose BMI products exclusively to upgrade their systems, and BMI has enjoyed more deals as a prime contractor.

Cyclicality and Near Term Revenue Growth

A large part of the tailwind this company has seen over the last decade has been from utilities upgrading manually read meters to networked meters, with a small part coming from the software system they’re selling. They’re also still coming out of a supply chain imbalance entered during COVID, which has been beneficial to them over the past few years as constraints have eased.

But fear not - BMI’s sales are only slightly cyclical in nature. Housing starts contribute to annual revenue to a small extent. While there are long upgrade periods for the businesses this company sells to, 85% of annual revenues are driven by replacement, which is a solid block of ARR. BMI also has a significant order backlog that everyone seemed to assume peaked out in mid 2023, but they stated that they entered 2024 with a higher backlog than they had in 2023. We can feel reasonably assured that it will take some time to chew through this, especially if it keeps increasing.

On the ending of the current upgrade cycle and beginnings of the next one: in their most recent 10K, the company estimated that approximately ⅓ of water meters in the US have been upgraded to have networking features.

The CEO has stated that once this upgrade cycle is done, the replacement cycle for those already installed will be up, and they will have AI upgraded units ready for deployment. Now, I would take this with a grain of salt.

When you think of water meters, you probably don’t immediately think of an AI B2B SaaS opportunity. These guys apparently do - but I am honestly somewhat doubtful as to the actual realizable value of this upgrade or how they’ll go about it. They could go for AI chips in the meters for local data processing or some AI software that interprets data from a network of meters and can make predictions that way. Either way, I wouldn’t put a ton of stock in this, but we don’t really need to. Their SaaS program is already selling like hot cakes, beautifully adorning their product portfolio, you just don’t hear the term AI associated with it as much.

On increased infrastructure spending due to government projects like the IRA, management has said they “didn’t need infrastructure money to grow, and in the couple of years since that bill was passed we’ve seen little to no uplift from the infrastructure bill.” - CEO, Q1 2023 call. Looking at the provisions for water under Biden’s infrastructure act and the Inflation Reduction act, there doesn’t seem to be much if anything that would help BMI directly. Most of the projects just reference “facility upgrades”, and you don’t really need to upgrade water meters unless they already need to be replaced, which is just business as usual for BMI. Not to mention - most of this funding is going to drought stricken areas and I don’t think it’s going to dry up any time soon (pun intended) mostly because these areas are more likely to remain drought stricken than they are to suddenly become an oasis. Fundamentally the planet is getting warmer, and that means already dry areas will have less water going forward.

Even assuming recent growth is due entirely to increased government spending which is highly unlikely, we needn’t fear. The greatest traders in the world, who just so happen to be the people spending all this money, are buying the stock themselves:

On Feb 7th 2024, Senator Markwayne Mullin bought $30k worth of BMI. He represents Oklahoma, who announced they are upgrading their water meters. Mullin sits on the Senate Environmental Services Committee. He’s up 37% on the stock.

Because of these reasons, I do not think this business will experience a cyclical revenue downturn in the coming years. Maybe a slowdown from the rapid pace of recent growth, sure, but not an overall drawdown, and I would not call the business cyclical overall. In fact, I believe this business is poised to grow significantly over time, outpacing population and GDP growth into the future, but more on that later.

Thorough Business Quality and Sustainability

BMI was recently named for the first time in Barron’s Top 100 Most Sustainable Companies, they were one of USA Today’s Best Places to Work in 2023, and they have 4.1 / 5 stars on Glassdoor. They have 2100 global employees.

15% of their workforce was promoted in 2022, 30% of open roles were filled through internal promotions, and 17% of roles were filled through employee referrals. Employees get tuition reimbursement, professional mentoring and promotion tracks, healthcare, and the majority of US employees get a 401k with a 25% contribution match up to 7% of total salary, as well as a stock ownership program. Looking at the stock price chart should tell you that these employees are happy campers indeed.

This business leverages 119 years of experience and industry connections, and has a deeply loyal and familiar customer base.

Insiders admittedly don’t own a ton of stock, but they have executives compensation plans to incentive continued outperformance. The CEO owns by far the most at 85k shares, around $16 million worth. Execs get a typical base + bonus structure, bonus % varies by executive role and the payout % by financial performance, and of course these guys are maxing that shit out every year.

BTW, their CEO Ken joined in 2017 at a lower level and was appointed CEO in 2019. Half of the other directors joined 2017-2018, the other half have been there since 2010 or earlier. Listening to a bunch of calls, you can tell the CEO might be slightly autistic about running the company, in a good way. Listen to the way this guy talks. He sounds like he knows what he’s talking about and is totally self assured, but there’s the slightest hint of awkwardness in the way he just says “sure” when analysts say the usual “Thanks for answering, I’ll pass it on.” He’s the company’s 6th ever CEO in 119 years, pretty crazy. In that interview I linked earlier, he literally refused to drink bottled water because it would be an insult to his customers, what a guy. He grew up in Watertown, Wisconsin as well, like he was born into this role.

The company does not guide, and management gets almost snippy when new analysts keep asking about it as well, which I like. WM does not guide either, they’re killing it, same with WIRE. I like a management team that analysts have to almost coax information out of when the stock is doing well. Like, everyone knows the company is killing it and you can tell the analysts have to really try to get anything resembling an answer for guidance, like the power dynamic is firmly in favor of the company. You have other companies who aren’t doing so hot, that in turn almost have to beckon and attract analysts to the stock by talking about tons of different shit like they’re advertising. BMI does not need to advertise, and they know it:

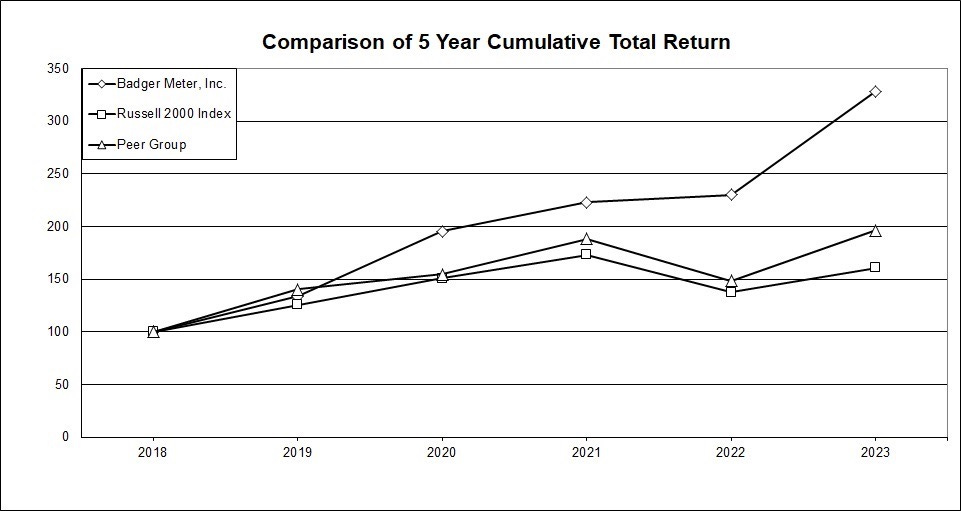

This is from the 10K. They’re outperforming the Russel massively and the S&P by a smaller margin, though not shown there.

Also, they’ve got an adorable relationship with this one aussie analyst who’s covered them a while, he’s usually first to ask questions and there’s a resounding “Good morning!” when he gets on the line. Cute stuff.

Oh, and I can’t not include this informational video they put on YouTube 9 years ago that is probably much older than that:

Listen to that groovy ass background music. This is peak 80s/90s informational video aesthetic.

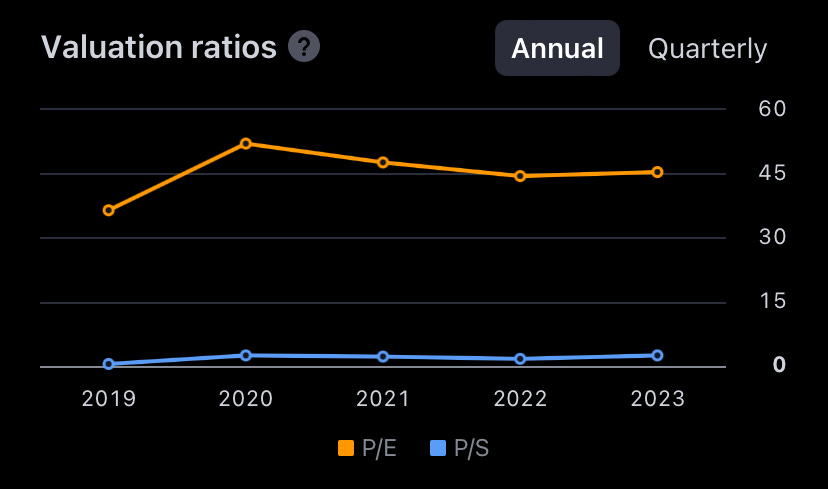

Valuation and Sentiment

BMI trades at 53x earnings, 45x fwd, which is admittedly a steep price to pay, but I think it’s justified looking at it’s historical valuation. In fact, it was more expensive in 2021 and the stock is up 74% from it’s highest point that year. Since 2019, the stock has gone up 264% while the P/E has rose from 37 to 45. Earnings are up 114% in that period. While it would have been amazing to discover this stock in 2019, I’m not going to keep myself from an amazing long term opportunity just because some other people also recognize it as an amazing opportunity.

It’s interesting, their CEO was made appointed in 2019 and that’s when the price began to really shoot up, seems like he knows what he’s doing.

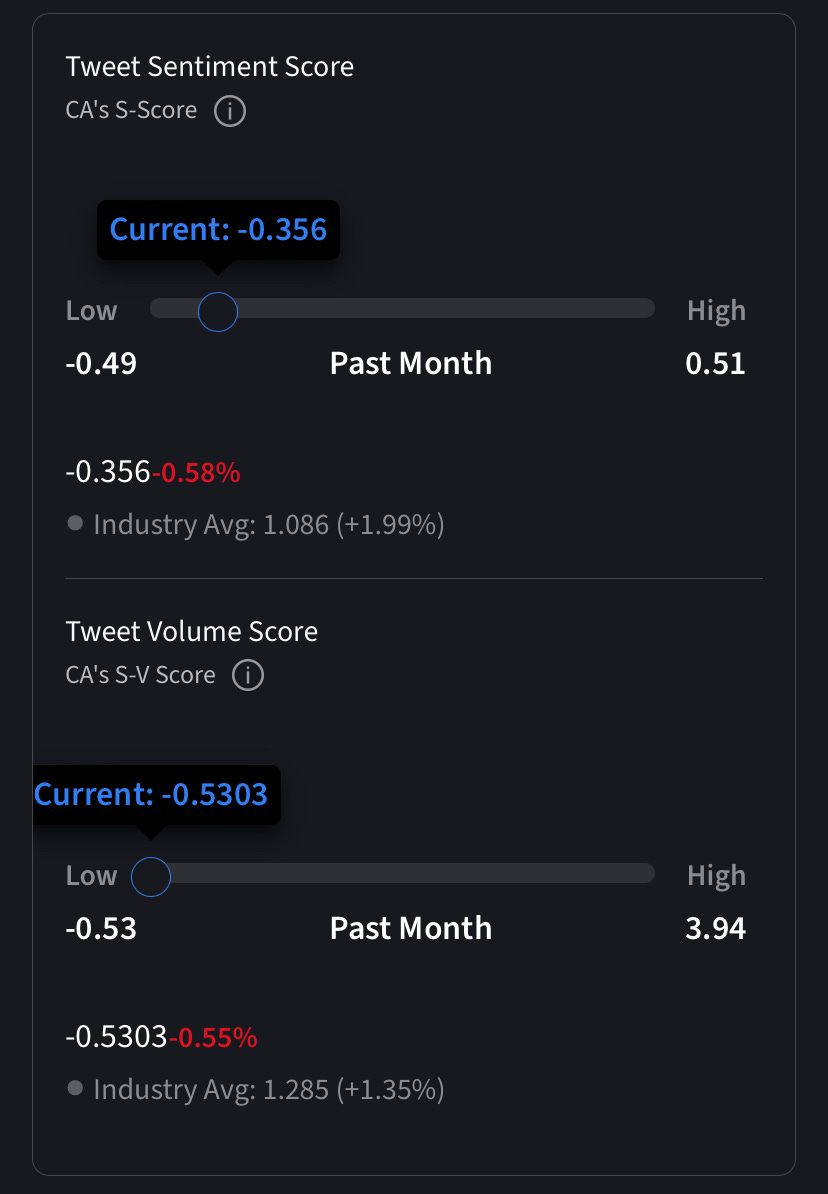

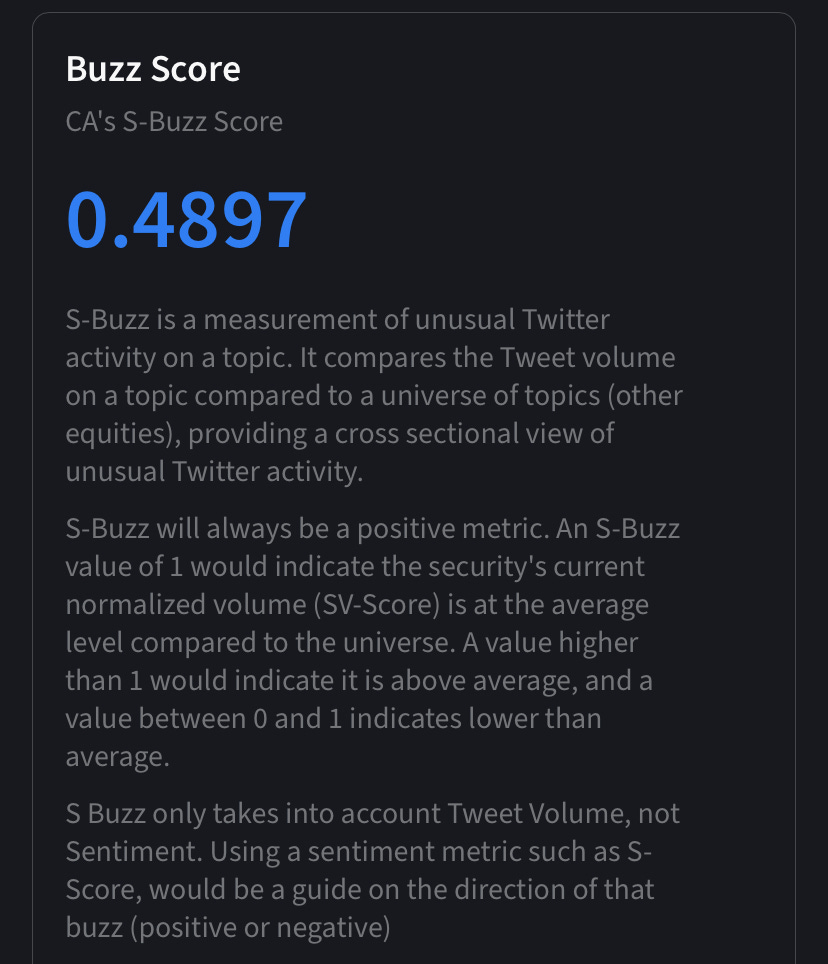

Short interest is currently at 3.5% on IBKR, fairly low in my opinion for a stock that’s run up so much and a multiple so high. Value investors on SeekingAlpha think the stock is too expensive. FinTwit sentiment is not great either:

If there is one thing I’ve learned since coming to twitter, it’s that FinTwit is wrong more often than not.

Personally, I’ve had much better results buying expensive companies that are expensive for a few good reasons than buying companies that are cheap for (seemingly) no good reason. BMI is expensive for some very good reasons, just like WM (32x) and IOT (250x), stocks that have done very well for me over the past 6-8 months. People have said COST is overvalued for years and years, and yet it keeps going up. I’m putting money on the same being true here with BMI.

Why, you ask?

Long Term Growth Drivers

Water. One of the most important substances known to man - we need it to survive, if anything ever happened to it on a large scale we’re seriously fucked, etc, but you’ve heard this pitch before.

I’ve got a better one: As global temperatures rise, not only is water becoming scarcer, but weather events like hurricanes and flash floods occur more frequently, and though tragic, both of these are good for BMI.

Scarcer water supply as global communities experience droughts will lead to increased water conservation efforts, and BMI is involved in every step of that process. Water quality testing becomes more necessary as available sources dry up and communities are forced to turn to, well, sketchier water sources, and water flow monitoring and leak detection will be in more demand as well to conserve as much water as possible. On a long enough time frame, this could bite us in the ass if all the water dries up, but if that happens we will probably have bigger things to worry about. But importantly, BMI’s products have proven themselves to materially reduce the water their customers use, saving customers some money, and saving more water, which is always good.

Additionally, BMI sells to companies that manage wastewater and runoff produced during flooding or other environmental events. For example, the average hurricane drops more than 9 trillion liters of water per day, and when this water floods populated areas, it can pick up all kinds of nasty shit like pesticides, waste products of all kinds, trash, and countless other pollutants that will leak into local waterways and require further water testing and handling systems.

See Dubai: practically underwater for two days? Hell of a lot of wastewater just got generated, and BMI has offices in Dubai and sells to the Middle East through these guys:

Doesn’t that look encouraging? I personally would love to buy Badger Meter at best prices, wouldn't you?

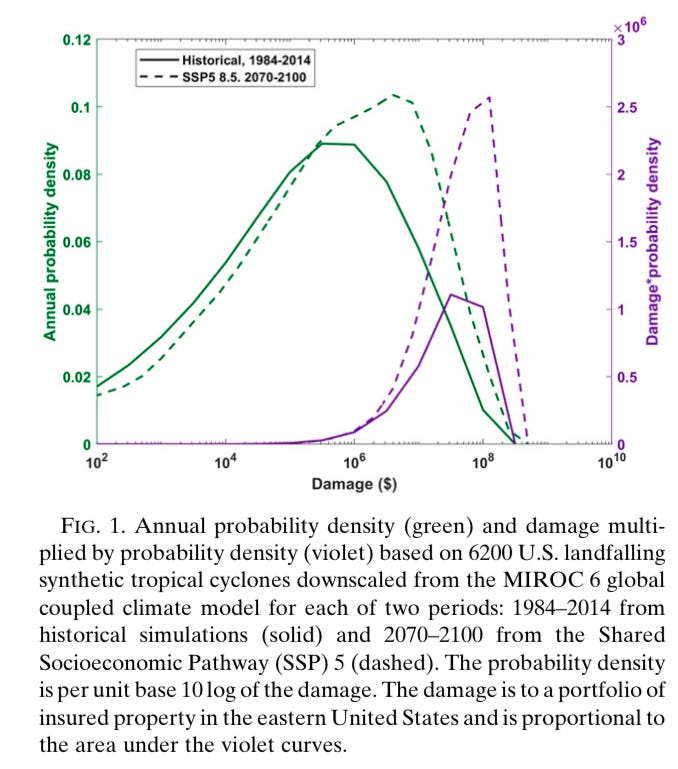

On average the US is hit with two hurricanes per year, and this number may increase as Atlantic sea temperatures rise but has not done so in recent decades, although some projections show that the number and intensity of hurricanes (quantified by the dollar amount of damage caused) is likely to increase in an atmosphere with higher CO2 levels.

https://texmex.mit.edu/pub/emanuel/PAPERS/cmip6_TCs_2020.pdf

Increased government regulation has and will continue to lead to more environmentally sound water treatment. This company stands to benefit from any legislation passed that increases scrutiny and sustainability in water quality, treatment, collection, disposal, and other industrial applications and disposal situations. The company states that any legislation of this nature has had no adverse affect on their operations and is likely to help them going forward.

I am confident that the growth of this business will outpace population growth and GDP long term as water conservation and management become more necessary in the coming decades. I also believe this company will continue to outperform the S&P long term (BMI shares are on a 16% price CAGR over the past 18 years), due to the thorough quality of the business and the skill management has demonstrated in growing the business, when combined with these long term secular drivers. They have been doing this for 119 years and it fucking shows. This is a beautiful, exquisite company hiding in plain sight. Only these guys could make water meters into a profitable B2B SaaS business. Godspeed, beautiful badger.

Fin.

First article, no pressure to subscribe obviously, I am not expecting anything from this, its just for fun really. If anyone does subscribe, know I will spend the money on Tikr premium and increased IBKR data perms, and you will be furthering my crippling gambling investing habit.