End of Q1 Portfolio Performance, Holdings, and General Discussion | -0.86% YTD

Shaky Q1 foundations, Trump tariff woes, lamenting my awful hedging ability, plus newsletter updates

REQUIRED READING DISCLOSURE: This is not financial advice. I am not a financial advisor. You should conduct extensive research and consult a financial advisor before making any investment decision. All investments, including those referenced in this article, may result in financial loss.

I hold a beneficial ownership position in all stocks outlined in this article (unless otherwise stated), therefore I am inherently biased in favor of these companies. One should view this article, and all companies discussed herein, through that lens.

This article comprises my personal beliefs and convictions around any securities mentioned, and is not intended to be used as a recommendation to buy or sell any securities. I may buy or sell any securities mentioned in this article at any time and without any warning. This article may contain errors or incorrect information - you should verify all information presented here through your own research.

Hello again ladies and gentlemen! I’m a bit late getting this out, so we’ll jump straight into things this time. We saw a pretty rough Q1 (it wasn’t that bad to be fair) and it’s looking like Q2 could be much worse. As I’m writing this, the SPY is down 3% after hours on Trump’s tariff announcements (that’s a really large AH move, wow). We could very well be in for a rocky rest of the year, in fact I might even say that’s likely here…

It is with mixed emotions that I say this; through Q1 I massively outperformed the Mag7 (now in a bear market) which would have been admirable last year. Unfortunately, I am getting handily beat by both a shiny yellow rock (Gold +17% YTD) and a 94 year old value investor (Berkshire +18% YTD - I joke, I love Buffet as much as anyone else). Side note, I think Berkshire is doing so well because everyone knows Buffet is sitting on an a quarter trillion in cash (literally), ready to be deployed as everything else drops.

So far I’ve mitigated my losses better than the S&P, which I’ll take - my main stated goal with this portfolio is to demonstrate sustained outperformance of the S&P 500, whatever that looks like. I accomplished that goal very well last year and have been holding steady throughout Q1. But I haven’t been handling the volatility nearly as well as I’d like to be.

At one point this year I was up 14%, riding the last little bit of momentum in broader markets, until Trump decided to kick everyone off the dance floor. Since then, I’ve had two large positions, OPRA and VBNK, go down 15% or more, without any big winners to mitigate the damage and crucially, no hedges on. Most of my other positions are down some as well, so I’m currently sitting on unrealized PnL (losses) worth 5% of my portfolio. Not ideal, but not the worst.

For Q1, I outperformed SPY by 3.4%, the Russel 2000 (IWM) by 8.7%, but I am lagging Berkshire by a whopping 18.1%. I probably shouldn’t even be using Berkshire as a benchmark, it’s more of a little “see if I can beat Buffet” game, but still.

I am rather proud of my Russel outperformance especially, given that almost my entire portfolio has been in small caps through Q1, with the only notable exception being IBKR at a $60Bn-ish valuation. But to be fair, the Russel is a pretty crappy index and I don’t think its very hard to beat. 40% of it’s 2,000 companies are unprofitable and is it generally shunned by 90% of the investing masses - not hard to see how it’d drop 10% at the slightest whiff of danger.

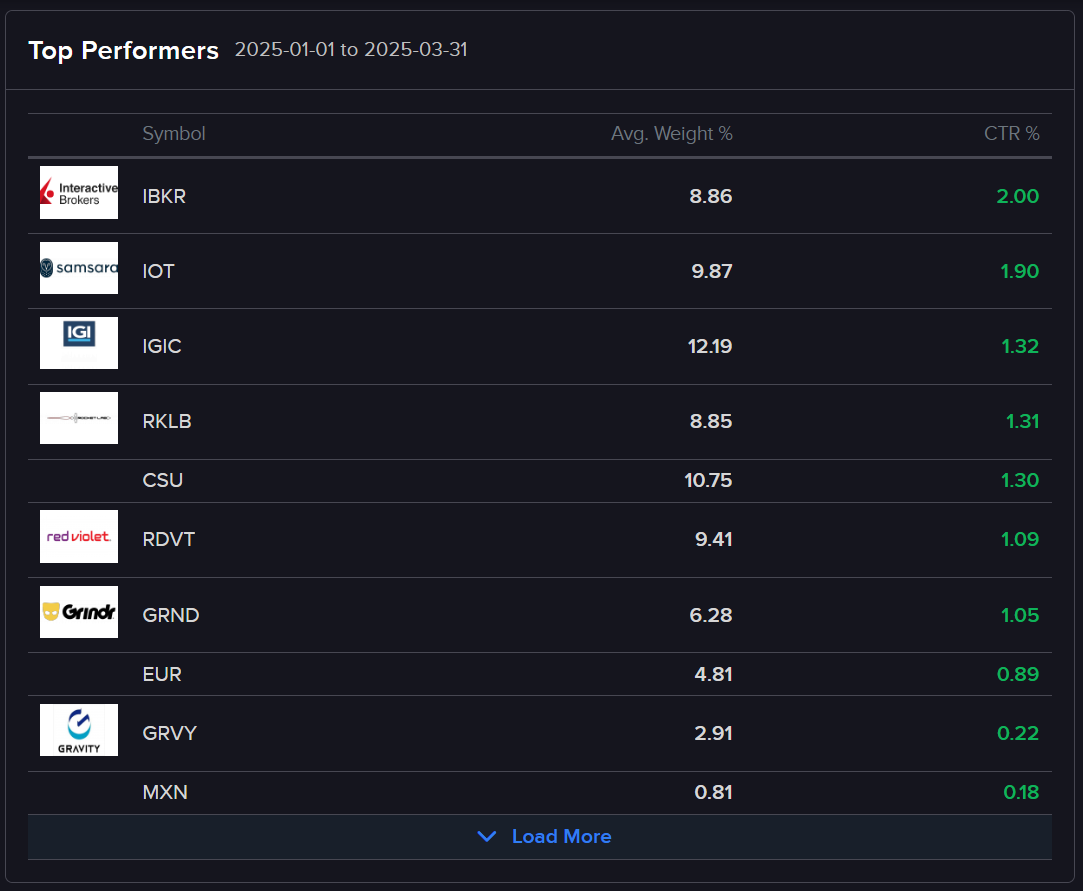

Here are my top and bottom performers during Q1:

From these screens you can see the impact of my early Q1 momentum, and my undoing in OPRA and VBNK nosediving later on in the quarter. VBNK specifically is now in a 44% drawdown since its highs last November. My current position is down 22.6% - that hurts, quite a bit. Thanks to a lot of trimming last year while VBNK was doing well, I’m close to breakeven on the overall trade. I’d check the exact figure, but IBKR PortfolioAnalyst appears to be down at the moment. The market hates VBNK right now, vehemently. I still think they’ll have their day eventually, though - its really a neat and quite promising little company, in my humble opinion.

Here are my current positions, as of April 2nd, ranked by unrealized PnL - look towards the bottom to see the real damage. Seeing this, it’d probably come as a surprise to you that I’m only down 1% for the year so far.

Now, with a heavy heart, I come to the topic of hedging. For a few months now I’ve been thinking about the practice of hedging and what it could or should look like for my portfolio. Given that I don’t use options and don’t short anything (yet), it’s been pretty difficult to manage the volatility that Q1 gave us.

So far, all I’ve really done is transition a little more towards value-esque stocks such as OPRA, that are reasonably cheap (IMO) and pay a dividend. Add to that a large cash balance (down now after recent withdrawals) and a 10% allocation to TLT - all these are what I’m calling passive hedges. Passive in the sense that they’re not directly benefitting from other assets going down, like a put option might, but simply assumed to go down less than other assets, like the SPY.

At some point in the future, maybe not this year but likely the next, I want to get much more involved with active hedging - taking trades that directly benefit from the downside of other assets. I have a basic framework already picked out, more or less, that would consist of:

A small allocation to RYLD puts

I generally love the idea of shorting the Russel while owning small caps, to minimize overall volatility. The Russel is basically a crap index, as I see it. If you can pick out a handful of Russel stocks that aren’t crap, buy those, and short the index, you should do just fine. However… why short the Russel when you could short something with less upside and more sustained downside?

I give you, dear reader, the RYLD ETF - a Russel 2000 covered call ETF - a vehicle that seems to be designed to obliterate it’s own share price. Just look at how it has performed against IWM (in pink), the Russel 2000 ETF, since 2021. Every time the Russel goes down, it goes down. When the Russel goes back up, it stays down. Amazing, isn’t it?

As you can see, this thing kicks out loads of dividends (10%+ yield), so the total returns aren’t completely shabby. But if we were to buy a put option on this ETF, we would capture almost all the downside of the Russel 2000, with a fraction of the upside risk - clearly all the upside this ETF could see is paid out through dividends, funded by the overwriting of call options on the fund’s core Russel holdings. Holding put options on this ETF does not come with dividend risk, which you would be subject to if you sold calls or shorted shares (dividends payed to whoever lent you the shares).

It really does look pretty great for hedging against my small cap heavy portfolio - the only thing I’ll be looking to watch is the premiums on those puts… by now, a lot of people already know this ETF almost always goes down, and that it makes a great hedge if you own small caps - if all of those people are also buying puts, the premiums on those puts could rise too high for the hedge to be economical. I haven’t looked at the options chain recently, but I’ll definitely be looking out for that when the time comes.

A small short book

I’ve wanted a short book for a while now. This would be very small - each short position would probably be no more than -1% of my portfolio. It’s just that there are companies I’ve found the past few months, that I am almost certain will either go nowhere or down. These include but are not limited to:

Tesla - kinda obvious

Palantir - also obvious, so dangerous to short, much like TSLA

Nike - I am fully convinced this company is in decline, and I have been for some time. They’re seeing declining sales, declining brand regocnigition and relevance, increased competition from the likes of On Running and others, yet it still trades at a P/E over 20 - it was around 25 a few months ago - I think that’s completely nuts. I don’t know if they will recover from this slump, but I am doubting it. If I were actually in the practice of shorting stocks, I would have been short Nike for months. I do not think it deserves that P/E ratio whatsoever and I think the executives will have a steep hill to climb in getting the company back to where it once was, if that’s even possible anymore.

Starbucks - another once beloved dividend-paying compounder, now fallen on harder times. Admittedly, I haven’t looked at Starbucks quite as much. I just think the stock will almost certainly go down if we get any big economic shocks. I mean, come on; they are primarily in the business of selling caffeinated, sugar-rich “milkshakes” branded as coffee, with pretty insane prices from what I’ve seen in stores. If people are going to cut spending during a downturn, I really think Starbucks will see it right away. Their stock price has done much better than Nike recently, but still…

There are more short targets I could write about, but I’m pressed for time at the moment… while I’m still here, let’s cover everyone’s favorite topic: newsletter updates!

For a while now I’ve wanted to improve the regularity of the newsletter, but only recently have I had some consistency around that - you may have noticed that I’ve been releasing this year’s Deep Dive writeups around the first day of each month, excluding January, which didn’t get one. I think a monthly schedule for those articles is more than achievable provided I can find enough companies I’d like to write about.

So, going forward, I’m expecting to publish a deep-dive report at the beginning of each month, 12 every year. I may also come up with a dedicated template for those reports so they’re more consistent, but I’ll still customize each one to the specifics of the company.

At some point this year, I will likely begin paywalling every other Deep Dive, or simply leaving some specific articles out of the paywall and keeping the rest in. Either way, each of those takes nearly a week’s worth of research and many hours of writing, formatting, and designing charts. I can’t keep releasing them all for free, that would just be unfair to myself past a certain point.

Also, they have been doing pretty well if I do say so myself. Since the close of the nearest trading day after each one of my writeups was released, through to today’s close (April 2nd), here’s how the stocks I’ve written about have performed:

Deep Dive #2 RKLB | Aug. 24, 2024 | +190%

Quick Writeup #2 RDVT | Sept. 14, 2024 | +35%

Deep Dive #3 IBKR | Oct. 6, 2024 | +17% *though I did mention trimming the position when it would’ve been up 40%

Deep Dive #4 CNO.V | Dec. 16, 2024 | -6%

Deep Dive #5 SOC | Feb. 4, 2025 | +6%

Deep Dive #6 OPRA | Mar. 2, 2025 | -5%

Deep Dive #7 GRND | Apr. 1, 2025 | too recent to be meaningful

I’ve unpublished the articles on BMI - QR #1, and IOT - DD #1, as those were earlier on in my writing journey and I feel like the quality of those articles is lower than what I’d like for my standard. IOT is down around 5% from my first article on it, and BMI has barely changed, maybe +/- 5%. All in all though, I think this is pretty solid performance.

I’ve also wanted to start putting out more content at higher frequency, but I haven’t really found a way to focus my urge to write about stocks and markets into a weekly series… until now.

Introducing Welfare Weekly. Featuring:

A weekly summary of the events from the past week - global index and asset class performance summaries, newsworthy events & noticings, anything I find particularly interesting to write about during any given week

A “look-ahead” to next week - important events to look out for, interesting situations to monitor, random trade ideas that may or may not work out

Weekly portfolio performance and updates - corporate events, earnings, dividends, you name it, as well as any & all buys and sells I make during any given week

Weekly watchlist and basket monitoring - over time, I want to curate many detailed watchlists of differentiated stock baskets. The first of these might be a basket of serial acquirers (CSU.TO, TOI.V, ROP, PTC to name a few). Another will likely be a basket of what I’m calling “market access businesses,” which includes any company that facilitates access to markets, such as brokers (IBKR), stock exchanges (ICE and NDAQ), and other providers of trading services (TW and MKTX). I think it would be extremely helpful to have weekly updates across these various baskets, to see how different classifications of stocks are performing during any given market environment.

Anything you suggest - if any one of my readers has ideas or subjects that they would find valuable when covered with a weekly release, please let me know. I’m trying to structure Welfare Weekly with anything and everything that I would find valuable and worth reading, but input from those of you who might actually read what I write would be very much appreciated - don’t hesitate to drop any ideas you’ve got in the comments below.

The first few releases of Welfare Weekly will be free, but past that most releases will be paywalled under the current $10/month tier. That’s really a good amount of value in my opinion - for $10 every month, paying subscribers will get one large-scale investment report (monthly Deep Dives) and 4 updates on markets, trading, news, stock basket performance, and any situations I find interesting.

The initial goal of Welfare Weekly will be to more-than-surpass $2.50 worth of value and insight for each release, so there’s a fair exchange of value. I’ll have to see what the topics and formatting will work out to be, but I feel like it will be a nice little weekly publication once I’ve got the initial kinks worked out. We’ll have to see if anyone reads it first though, I suppose.

That’s all for now, folks - I’ll be writing you all again soon with the first ever edition of Welfare Weekly (exact date to be determined - we’ll see how lazy I am in getting the first one out).