Grindr Inc. (GRND) - Deep Dive #7

A rapidly growing cash flow machine disguised as a dating app

REQUIRED READING DISCLOSURE: This is not financial advice. I am not a financial advisor. If you like the idea, conduct extensive research and consult someone who is a financial advisor before making any investment decisions. All investments, including this one, carry the risk of financial loss.

I own Grindr Inc. stock, thus I am biased in favor of the company and one should view this article through that lens. This article comprises my personal beliefs and convictions around owning any securities mentioned, and is not intended to be used as a recommendation to buy or sell any securities. This article may contain errors or incorrect information - you should verify all information presented here through your own research.

Introduction

Hello everyone, I hope you’re all having a good day by the time you read this. In beginning, I’d like to mention that I’ve had just as much success buying companies that are expensive for a few good reasons as I have buying cheap companies that are cheap for no good reason - I think Grindr at ~35x forward earnings (my estimate) is a great example of the first scenario here.

If you’re an adult in the U.S. or another developed country, chances are you’ve heard of Grindr. In the off chance you haven’t, Grindr is (by far) the dominant dating app within the gay/LGBT space, a very quickly growing demographic within America and across the globe.

Gen-Z adults are twice as likely to identify within LGBT as Millennials, who are in turn twice as likely to identify within LGBT as Generation-X members - there’s an impressive demographic trend here that is only set to continue thanks to increased freedoms of sexual expression worldwide and increased awareness.

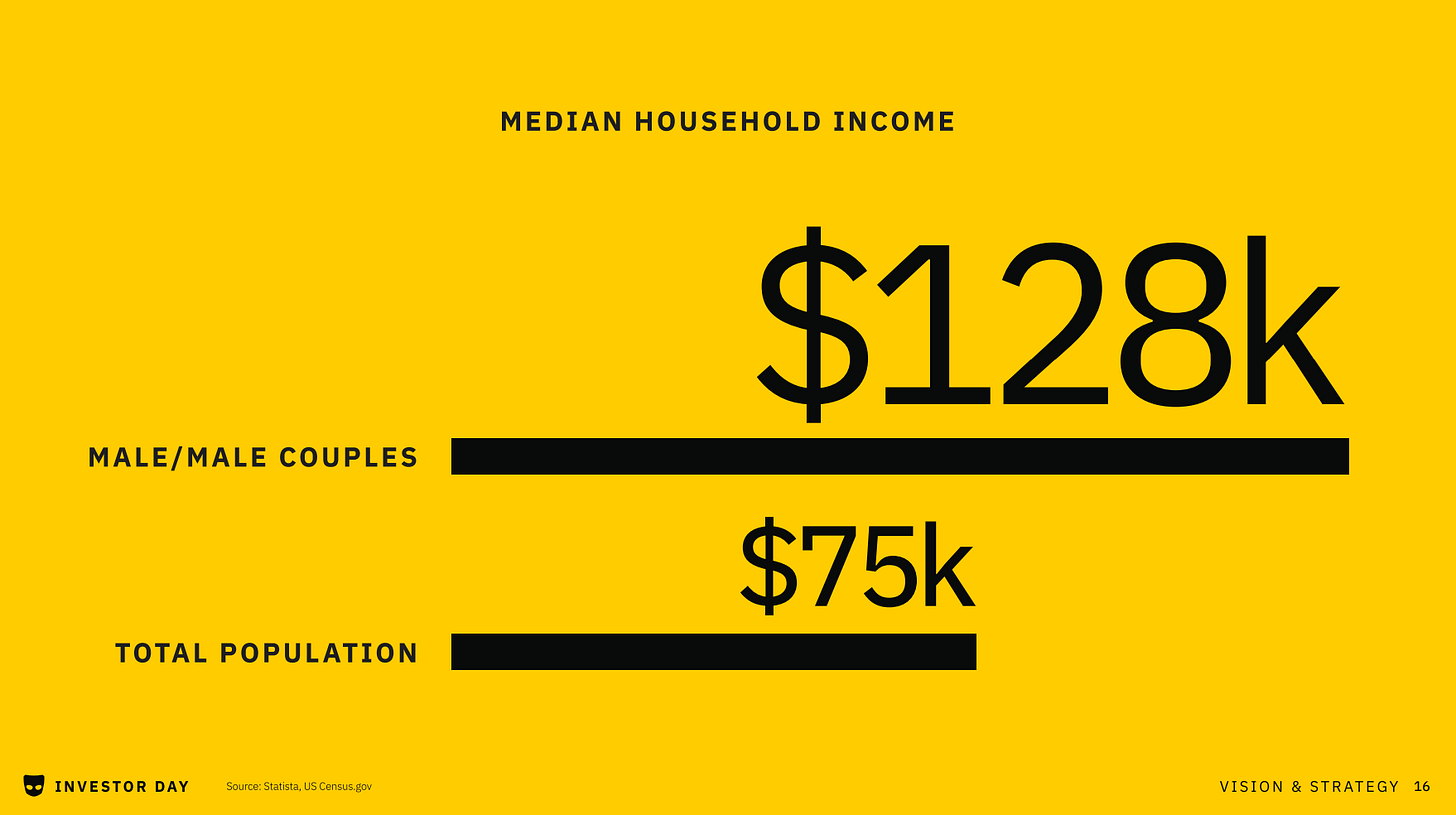

Additionally, Grindr’s core user base (98% gay or bisexual men) is one of the strongest demographics to serve - gay households have almost double the median income of the total population, with higher educational attainment, higher disposable income, and higher spending capability on average. Grindr’s users also travel much more frequently than the general population (25%+ travel every week).

I think the gay/LGBT demographic in general is a fantastic long term bet, and this company is the best way to get exposure to this small yet very powerful demographic tailwind.

Grindr is the gay dating app - there are a few others, but Grindr is known and still very widely used as the app of choice, to the point that they have what I’d call a near monopoly. I think Grindr is poised to keep this level of market share going forward, given it’s already entrenched position and unique product innovation targets that should continue attracting new users to the app well into the future.

Grindr has by far the best economics of any publicly traded dating app, the others being Match Group (MTCH - owners of Tinder and Hinge), and Bumble (BMBL). The first proof of this to be seen is that Grindr has handily outperformed these competitors over the last few years:

Further proof of this claim comes from their user demographics and the way the app is built. Gay dating is fundamentally very different than straight dating. For one, men in the gay community typically wait until age 38 to find a long-term partner, compared to 30 for straight people, on average. This means that gay men are likely to spend a longer amount of time on dating apps like Grindr before they settle down with a long-term partner (thus eliminating their need for dating apps).

Grindr is also essentially a hook-up app where users who want the “instant gratification” of casual sex can easily get it - the app works very well to connect users for casual hook-ups. Because of this users can continue to get much more value out of Grindr’s products than straight people might on Tinder or Hinge, as far as “instant gratification” goes.

In researching Grindr I found a podcast the CEO went on, where he mentioned that the average Grindr user spends 60 minutes on the app per day. One Grindr user commented that users only spend such a long time on the app because it takes them that long to find a suitable partner for a hook-up.

Initially I viewed this as a negative, but then something struck me: 60 minutes to find a suitable partner for casual sex is a shockingly low amount of time, considering straight dating culture on Tinder or Hinge.

While users on Tinder or Hinge might spend hours if not days or weeks swiping through profiles for even the smallest chance of securing a date, Grindr is almost purpose built specifically for hook-ups and it enables its userbase to be very successful in achieving hook-ups. It might take a Grindr user only a few minutes or an hour to actually secure a hook-up opportunity, which is extremely impressive compared to straight dating apps.

Because of this, Grindr’s user base has a much higher incentive to spend money on the app’s paid features - the value to users (and thus the value that they’re willing to spend) is much higher than it might be with other dating apps.

The reason “sex sells” is because people enjoy sex and generally can’t get enough of it. As Grindr is an app that can (in many cases) almost instantly facilitate casual sex in exchange for watching some ads or paying a nominal fee, why wouldn’t it have fantastic economics?

Bumble and Match likely never stood a chance compared to Grindr considering these factors. If you’re going to invest in the online dating space at all, I think Grindr is by far the most attractive opportunity and I think it will very likely continue to be so.

Table of Contents

Introduction

Thesis

Risks

Product & Product Updates

Business & Financials

Company History & Management

Conclusion

Thesis

I think that Grindr has real potential to operate as a quickly growing, capital light cash flow machine serving the gay/LGBT dating scene, a great demographic to target with numerous long-run tailwinds, for years and years to come.

I think the company will continue to see outsized revenue growth over the long-term of 20-25% annually, and strong operative leverage with margins increasing from 27% today to 35-40% over the long term, given it’s efficient operational characteristics, lean workforce, strong demographic tailwinds, further monetization prospects, and through other natural leverage that I believed is baked into the financials (see Business & Financials).

Grindr initially seems expensive at 10x sales and ~30x forward earnings, but the long-term returns I’m expecting from their business can more than justify this high price - Grindr could even be considered relatively cheap (in this U.S. equities market anyway) compared to a lot of other U.S. listed companies with lower earnings growth and less impressive operating characteristics, given their flashy 75% gross margin, high growth, and rapidly scaling bottom line margins. Grindr is also the largest provider of a very in-demand service for a quickly growing demographic, with excellent margins, which should be priced in. You get what you pay for and all that.

As Grindr’s business is just an app, it should require very low incremental investment to continue generating strong and increasing cash flow over time. 2024 CAPEX was under 6% of operating cash flow, and I’m expecting similar long term efficiency there - In other words, I think Grindr is and will remain a capital light cash flow machine for years to come.

I believe that Grindr can continue to operate as a near-monopoly within their niche given the brand’s strong recognition and already very entrenched presence. When it comes to dating apps, people tend to “Fish where the fish are,” so to speak, and the vast majority of “fish” are already using Grindr. The brand has over 90% recognition in the US, and 60% internationally - almost everyone, gay or straight, knows Grindr as the gay/LGBT dating app.

Grindr’s management have said they’d be open to M&A - if any other their competitor apps gain a little too much traction, I’m sure the company could acquire them pretty easily (further satisfying the textbook definition of monopoly). Grindr made $94mm in 2024 free cash flow and this metric should continue rapidly scaling over the coming years to support M&A capability.

Grindr has established a basic capital allocation program with their Q4 release - currently, the company is sitting on 10% of its market cap in cash (pro-forma) after their warrant redemption completed earlier this year, and they generated $94mm in free cash flow in 2024. They announced a $500mm (13% of today’s market cap) two-year buyback program with their Q4 release and hinted at future dividends and buybacks in their 2024 Investor Day, though they said that these capital returns would be dependent on market conditions. At the very least, we can be reassured knowing that Grindr is open to further capital returns in the future.

I bought a smaller position (5%) in Grindr at $14.65 after Grindr dipped nearly 23% following their recent Q4 2024 earnings release, but I have since increased the position with a few more buys as my research has gone on - currently I have a 9.5% position at $15.89. I’m actually pretty happy with my timing and sizing in establishing this position, normally I almost struggle to take advantage of such dips on decent stocks.

Risks

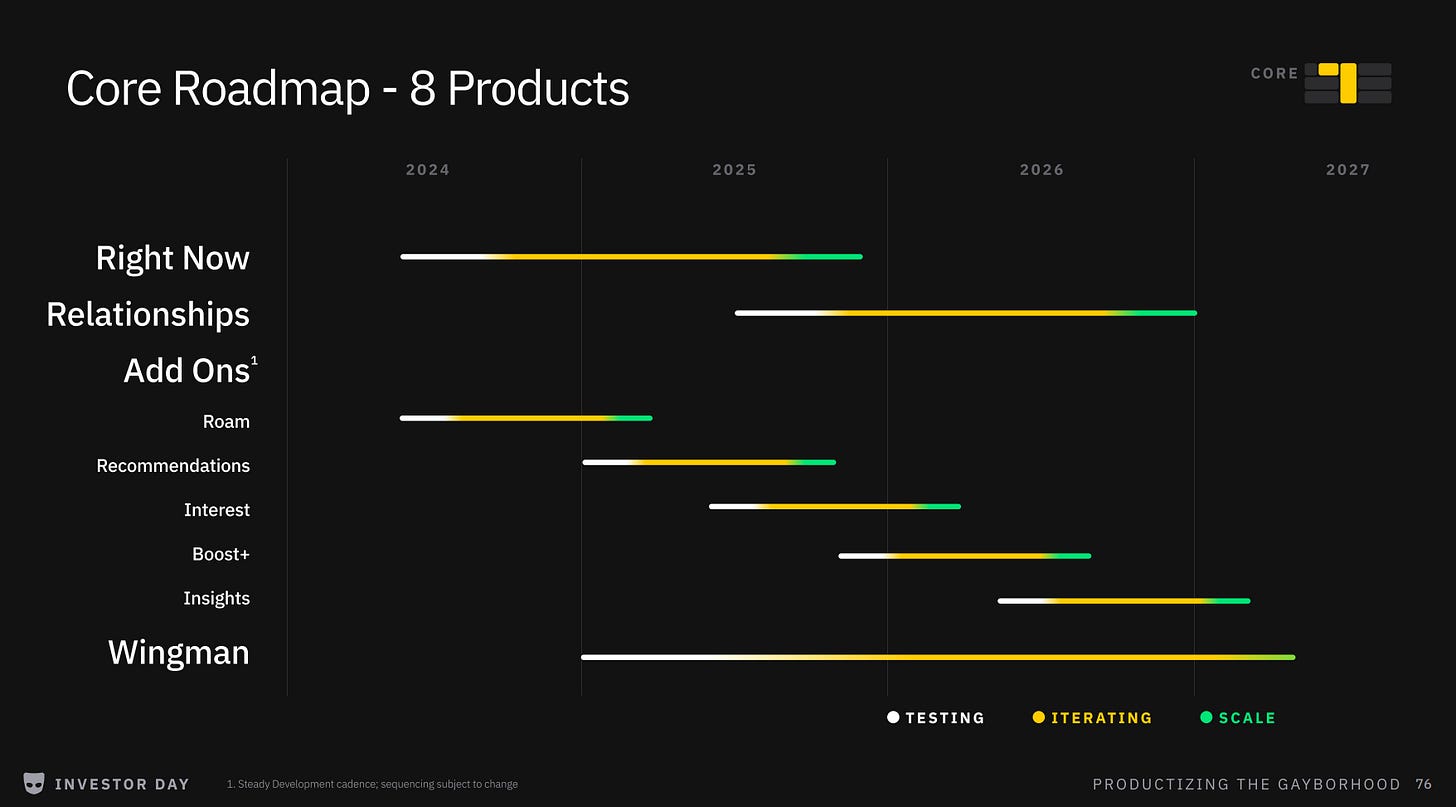

I think the biggest risk is product mismanagement - if the company fails to truly improve the product, that will hurt user growth and retention as well as future monetization opportunities. Grindr has smaller competitor apps that I’m sure would love to see this scenario play out. Management has a roadmap of product updates in place through 2027, but if they don’t implement these successfully or if the userbase doesn’t find use from them, we could see MAU growth (7% in 2024) decline or even go negative as competitors eat away at market share.

The Grindr app is not perfect, far from it in fact. Many users describe the app as a laggy ad-filled mess, which is accurate from my testing. Despite this, people continue to use it at higher rates than every other app simply because everyone else is already using it. However, if a competitor app can develop a better user experience and attain sufficient scale to pull users away from Grindr, Grindr could suffer serious MAU and revenue declines.

If Grindr’s management team has to invest more than expected into the product to retain and monetize new and existing users, that will definitely hurt the company’s bottom line margins going forward.

Grindr is a relatively expensive stock (30x forward earnings, 10x sales). I do believe there are good reasons why Grindr should trade at a premium, but nevertheless, a broad decline in stock prices will more than likely result in Grindr’s share price falling, possibly even more than the overall market due to it’s already expensive trading price today.

The majority of Grindr’s shares (>50%) are owned by those who took it public via SPAC circa 2022. The company’s chief executives own very little compared to this - their CEO owns just around 1.5% (~$55mm worth) of outstanding shares, though he’s got some RSUs and performance-based targets in place. The company’s named executives together own just 2.3%. This relatively lopsided ownership structure may present some risks:

1) The free float of shares is pretty low, around 25%. Stocks with lower free floats can receive discounts from the market due to liquidity concerns and the inability of outside shareholders to sway company operations, and they can be ineligible for inclusion into certain indexes like the S&P 500.

2) These large controlling shareholders may enact policies that hamper value creation for smaller shareholders. So far, they haven’t done anything like this to my knowledge and they are well incentivized not to do so, but it may always remain a risk.

Product & Product Updates

The core app product is pretty simple, which is a good thing. If you have something that definitely works (and Grindr does a very good job at connecting users for casual dating), why change it up and make it more complicated than it has to be?

In fact, Grindr has seen relatively little product innovation between it’s creation in 2009 and today when compared to an app like Tinder or even Instagram or Twitter - they’ve got an app that works well for its users, can’t fault the company for that.

We know the app works well enough, but how is it monetized?

Firstly, a lot of ads - we’ll talk a bit about advertising later in Business & Financials. Beyond that, there are two paid subscription tiers - XTRA and Unlimited. You can see above the features that these tiers come with. A year’s subscription to XTRA costs $99 ($8.25/month) and Unlimited costs $170 for an annual subscription (~$14.15/month), but these prices vary geographically. From my testing and from commentary from others, Grindr uses a nearly excessive amount of ads mostly to drive users toward the paid, ad-free subscriptions (85% of revenue).

The Grindr app today is far from perfect, and management is aware of that - their CEO explicitly mentioned that he knows the product has been under-invested in, and that they’ll be working on increasing the quality and ease-of-use of the app - I sincerely do hope the company takes this task seriously.

At the company’s June 2024 Investor Day they outlined a pretty solid roadmap of product improvements to be carried out through 2027, seen below:

They’re already trialing Right Now (a side-channel for people who are strictly looking for hookups, not dating) in 15 U.S. cities.

Roam is a feature that allows users to change their location within the app for one hour, so they can connect with users in another location before they might be traveling there, or just to see how the dating market might be in another part of their city.

Wingman might be the most contentious new feature, and it’s also the one that I have perhaps the least faith in. It’s designed to be an AI chatbot that acts as a “wingman” for users, either talking to users on it’s own before users talk to each other to gauge the potential chemistry between users before they’re even directly conversing. This is a little weird… I don’t think many people will end up finding value from this.

Really, all I think the Grindr team needs to do to enhance the user experience is improve the performance of the app to make it more fluid and less lag-prone, and to increase the quality of the advertising (they have mentioned working to improve both of these).

Genuinely, I think these two changes would immediately improve user’s perception of the app, and they should be pretty simple to implement… I’m no software engineer, but still. I am quite frankly really hoping they prioritize fixing the lag, and bringing the base product up to scratch before releasing too many (probably paid) new features - going too far into monetization without meaningful product improvements is one tried and tested method of drawing ire from a userbase, which is the last thing we want to see as investors.

Business and Financials

Grindr generates revenue through it’s Direct (paid services) and Indirect (advertising) lines within the Grindr app. Today, advertising is around 15% of their revenue with paid services being 85%, but I see the higher-margin advertising segment shifting up a bit in the revenue mix over time, towards 18-19%.

Avg. annual MAU (monthly active users) growth has been hovering around 7% annually for the past few years, but ARPU (average revenue per user), payer penetration, and ARPPU (average direct revenue per average paying user) have consistently been increasing as well, which just compounds growth further.

Advertising:

Advertising revenue is more profitable for the company than paid services (including subscriptions), because advertising is generally high margin to begin with, and Grindr’s advertising revenue is not subject to Apple and Google’s app store fees - 30% and 15%, respectively, for subscriptions and in-app purchases - that’s a huge boost to advertising gross margins right off the bat.

In 2024 they grew advertising revenue by 56.8% through what I’m assuming is increased ad presence within the app (plus 7.4% MAU growth) - from my channel checking, Grindr is chock full of ads, almost annoyingly so. Most of the ads I saw were “slop tier” ads, like ads for poorly made mobile games or AI girlfriend/boyfriend apps - not the highest quality stuff.

Currently, Grinder’s advertising is mostly fulfilled through 3rd party advertising network services like Google, with a smaller amount of dedicated partnerships to push ads for specific brands. Management is keenly aware that they need to continue upgrading the advertising business - on a podcast their CEO stated that over time, he’d like their direct partnership ads to become a much stronger share within advertising which should result in higher quality ads, with more targeting potential and thus higher purchase intent from users and much more revenue for Grindr.

Gay and bisexual men (98% of Grindr users) are generally much stronger than the average consumer due to their higher average income (both take-home and disposable) than straight people, higher education status, and higher opportunity to seek experiences like traveling given that the majority of gay households today do not have children.

It’s no surprise that advertisers would want access to this generally affluent and highly successful demographic - Grindr is probably the best way on Earth for advertisers to target this demographic, given that the average user spends upwards of 60 minutes on the app per day.

So, I think Grindr still has ample opportunity to scale their advertising business over time, potentially even doubling it within a few years. Compared to 2024’s 56.8% growth, I think Grindr’s advertising revenue can grow another 30-40% in 2025 with continuing impressive growth beyond that. Their Q4 advertising revenue was up 85% year-over-year, driven much higher by one direct advertising partnership that “significantly outperformed expectations.” As they scale up the number of direct partnerships they’re running within advertising, I think the revenue generated can grow similarly to what we saw in Q4 over the coming quarters.

Paid services:

The lion’s share (85%) of Grindr’s revenue is from paid services, which can include one-time “a la carte” purchases or subscription services, being Grindr Xtra and Grindr Unlimited.

Grindr’s paid services revenue increased 29% in 2024, helped by a 14.8% annual increase in paying users, and a 12.4% annual increase in ARPPU.

Note, ARPU (average total revenue per user) inflecting above ARPPU (average Direct revenue per average paying user) and attaining accelerating growth YoY in the chart above is indicative of the company’s advertising strategy paying off so far.

Given both of these business lines, Grindr grew overall revenue by 32.7% in 2024 up to $345mm, its 3rd straight year of revenue growth over 32%. Management has guided for 2025 revenue growth of over 24%, and at their June 2024 Investor Day they guided for a 23% revenue CAGR through 2027.

Very much like another of my favorites, Interactive Brokers (IBKR), Grindr can grow revenue very efficiently over time with minimal required investment, thanks to unique factors within their business model and user demographics. They spent just 2% of revenue ($8mm) on marketing during 2024, yet still delivered 32% revenue growth.

Grindr’s new user acquisition is driven mostly through word-of-mouth and growth in the target demographic. Their brand is already so unanimously recognized that as more and more people begin to identify within LGBT over the years, they’ll probably just download Grindr as there are no alternatives to it at sufficient scale for the majority of users. Grindr should be able to continue growing very efficiently with minimal marketing expense, allowing for higher long-run operating margins.

Grindr has 75% gross margins, with operating and free cash flow margins at 27% and rapidly expanding - there is a really sweet amount of operating leverage baked into this company.

They’re already operating pretty efficiently at $2.3mm revenue/employee, $600K FCF/employee, but I think those numbers will only rise further over time. Their CEO seems like he really means to run a lean operation, the company is already more efficient per employee than Match Group and Bumble on FCF.

Depending on operating expenses, we could see long term operating margin expansion from today’s 27% closer up to the 35-40% range within a few years. Total operating expenses grew just 0.4% in 2024, and I think this company can put up similar efficiency around opex going forward.

They’ll unlock a lot of leverage when they can scale the higher margin ad business - though we know advertising is higher margin than the company’s paid services, it is currently just 15% of the revenue mix - the coming advertising spool-up should give us higher gross margins over time, which is accretive to operating margin.

Income line margins are only set to improve (after a positive inflection coming in 2025) as the company no longer has any outstanding warrants (no more warrant fair value charges) and will continue deleveraging down to ~1.5x debt/EBITDA from 2.1x today, further reducing interest expense. The only reason they reported negative net income in 2024 is the non-cash warrant fair value charges.

They have almost no CAPEX, coming in at less than 6% of 2024’s operating cash flow. I think their already impressive 26% FCF margin has room to go higher over time, buoyed by higher income margins and very minimal investment necessary to continue generating strong cash flows.

2024 financial highlights:

Revenue up 33% to $345mm

Gross profit up 34% to $257mm, at 74% margin

Operating income up 67% to $93mm, at 27% margin

FCF up 164% to $94mm, at 27% margin

The company currently has $276mm in long-term debt and $370mm in pro-forma cash (given 2024 ending cash of $59mm and $314mm in proceeds received from February 2025 warrant redemption), giving us an enterprise value of $3.63Bn.

Currently Grindr is trading at 23x EV / my estimate for 2025 FCF of $158mm - relatively pretty cheap compared to other software companies you’ll see listed on U.S. exchanges, given its very impressive operating characteristics and further monetization potential. Give it a year, I really think this could be a $25 or $30 stock and further down the road, the sky is the limit as long as the company can continue to execute well and retain users.

My 2025 estimates are:

Revenue: $448mm, 30% growth

Operating income: $166mm, 79% growth

Earnings: 54¢/share (using net income of $110mm and post-warrant redemption shares outstanding of 202 million - assumes no buybacks during 2025 and no Q1 warrant liability charges)

Free cash flow: $158mm, 76% growth

*Note, these are just estimates and as such they are likely to differ materially from actual business performance - don’t take these too seriously.

Here’s my model for these estimates:

Revenue:

Direct revenue is driver-based, using ARPPU and Avg. Paying Users as inputs

Indirect revenue growth is directly estimated (35% for 2025)

COGS:

COGS increases a tad below revenue, leaving gross margins at 75% but basically unchanged from 2024

Operating Expenses:

SG&A ex-SBC grows 20%

SBC expense is pegged at 10% of revenue

Development expense grows 10%

D&A expense is pegged at 2% of revenue - I haven’t built a schedule so this is inaccurate

Total operating expense growth of 8.8%

Projecting $18mm interest expense based on avg. debt levels and 7.2% interest rate - I haven’t made a schedule here either, this is also inaccurate

Income taxes are assumed at 21% giving us net income of $110mm.

Shares outstanding of 202 million reflects ending 2024 shares outstanding + 27.3 newly issued shares after the warrant redemption. I assume no buybacks in 2025.

For the cash flow number, I’m adding back SBC and D&A expenses to net income for an op. cash flow estimate, and subtracting $5.8mm in projected CAPEX to arrive at $158mm.

Now is a good time to note that modeling is often highly inaccurate - these estimates I’m providing are just estimates, and they should be treated as such. This model will very likely be proven wrong quickly, as most models are - don’t treat these numbers as gospel.

Company History & Management

Grindr was founded in 2009 by Joel Simkhai and was profitable from day one, never requiring financing or VC investment to continue growing.

In 2016, Kunlun, a Chinese tech company, acquired a 60% stake in Grindr for $93mm, before buying out the remaining 40% in 2018 for $152mm. Joel Simkhai also stepped down from the role of CEO in 2018.

Under Kunlun’s ownership Grindr saw a number of national security related concerns in 2018 and 2019, given that Kunlun is a Chinese company and Grindr had access to sensitive American user data - the U.S. Committee on Foreign Investment in the United States (CFIUS) later forced Kunlun to sell Grindr in 2019.

In 2020, Kunlun sold Grindr to San Vicente Acquisition LLC, a U.S.-based investor group, for ~$600mm. San Vicente comprises American investors like James Lu (ex-Baidu executive), George Raymond Zage (Tiga Investments), and Michael Gearon (Atlanta Hawks co-owner). These investors still own the majority of Grindr today.

Grindr IPO’d in November 2022 via SPAC, raising $384mm at a $2.1Bn valuation. New long-term executive officers were selected around this time, including CEO George Arison in October 2022 and CFO Vanna Krantz in January 2023.

What do we know about the CEO, George Arison?

Arison has built and sold multiple businesses over the years, with varying degrees of success - one of his companies, Shift, IPO’d in 2020 and declared bankruptcy in 2023 after Arison left in 2022 to join Grindr as CEO.

Arison is a gay man, which is honestly crucial to the investment thesis. Grindr as a company is heavily dependent on it’s core gay/LGBT user demographic, so their executives really need to understand the product and the culture around it to make any helpful progress on improving the product.

He’s a really technical, product oriented guy. From all the earnings and conference calls I’ve listened to, it sounds like he genuinely does have the product’s best interests at heart with great innovation targets going forward.

Arison has commented that he’s been familiar with the app since 2009, the year of it’s release. He has hired employees through the app as well, funnily enough.

I’ve listened to a podcast episode with the CEO as a guest - he seems like a decent guy, really. I know many have concerns around management with this company, but I think all things considered, Arison is a pretty good pick for CEO. He has a good amount of business experience and domain-critical knowledge (being a gay man) - he should do a pretty solid job, in my opinion. He owns 1.5% of the company today, around $55mm worth, with some RSUs in place - I feel like that’s more or less enough to consider him well incentivized to act in shareholders best interests going forward.

Conclusion

Grindr is basically a cash flow machine disguised as a gay dating app. From this business I am expecting strong long-term growth potential, strong operating leverage, high terminal margins, and low investments required to continue growth. I believe it’s trading at a more-than-reasonable price today considering it’s future prospects. It’s really a fantastic business all things considered, and I think the executive team in place should be competent enough to manage it well and continue growing the company far into the future.

In closing, I would recommend you also check out two other Grindr writeups, from Value Zoomer and Buyback Capital. These are great reports and they both helped me get a feel for the company as I was beginning my research process, so you should check them out if you’d like to learn more about the company. That’s all for now, I’ll be writing you all again soon!

Good read mate. Exciting future ahead of this biz for sure.