Opera Limited (OPRA) - Deep Dive #6

Meet the unique software company with 3 layers of growth, a clean balance sheet, rule of 40 for 3 straight years, aggressively returning cash to shareholders - trading at 14x fwd earnings

REQUIRED READING DISCLOSURE: This is not financial advice. I am not a financial advisor. If you like the idea, conduct extensive research and consult someone who is a financial advisor before making any investment decisions. All investments, including this one, carry the risk of financial loss.

I own Opera Limited stock, thus I am biased in favor of the company and one should view this article through that lens. This article comprises my personal beliefs and convictions around owning any securities mentioned, and is not intended to be used as a recommendation to buy or sell any securities. Please be careful everyone.

Introduction

(If you hate lengthy preambles, feel free to skip down to the Thesis section just below - the core thesis for this one is short and sweet)

Hello ladies and gentlemen, I hope you’re all doing well. Opera is a company I’ve been following for a few years now, since before I knew they were public. I’ve seen their advertising and I have multiple friends who’ve used the browser and liked it well enough. As the company is coming off of a solid dip here, I’ve decided to do more research and buy a decent sized position, worth 5% of my portfolio - I will likely be adding to this name soon as well, as I recently saw yet another person I know using Opera’s browser for mobile, which I’m taking as a sign that I should size up.

I think Opera Limited is a solid investment at this price with potential for significant and continuing growth, potential margin expansion, and multiple expansion from here - the Holy Trinity of ideal equity investment circumstances. I also believe that Opera today is discounted from other software companies that have achieved similar performance results due to its majority Chinese ownership and admittedly extremely sketchy history… (see Risks). But Opera today is in a much better place and has a lot of hopeful potential to stay on the right track, in my opinion anyway.

Opera has been building internet browsers (and competing with hardware defaults like Microsoft Edge on Windows or Safari on IOS) for 30 years now - despite the fact that their browser does not come pre-installed on any devices, they have been able to take impressive market share in the historically tough browser market, having attracted a loyal base of 296mm MAU, or 7% of global internet traffic ex-China. Microsoft has been pushing browsers like Bing and Edge for years (with a distinct hardware and operating system advantage), and yet those platforms continue holding low market share and are mocked by pretty much everyone - Opera must be doing something right then, no?

Safari comes pre-selected on Apple devices such as iPhones and Macbooks, and Google comes pre-selected on Android devices - even most users who boot up a new Microsoft device with a Windows operating system will immediately use Edge to search up Google Chrome, download it, and then leave Edge by the wayside - I have repeated this exact process countless times. Given this sort of winner-take-most dynamic where Chrome is dominant by far and Safari is generally in second place, what Opera has accomplished around creating a unique and in-demand product and marketing that product successfully is quite impressive indeed.

Opera’s products are no doubt niche and more specialized than your average browser like Chrome or Safari - these large market share browsers that come pre-selected on whatever given device need to be useable by everyone that might use said device, young or old, technical or non-technical. This allows them very little innovation in terms of UI or customization features - these browsers basically need to look and function the same for everyone that could possibly use them to maintain a sense of consistency and very simple, intuitive functionality.

Opera’s browsers are quite different. Because Opera’s products do not need to appeal to the average internet user, they’ve been able to carve out some impressive niches by focusing on serving these specific niches very well. Thus, they can afford to really shake things up on the product side, with countless unique features and customization options around visuals, UI, computer hardware usage, sound effects, add-ons and modifications, and more that Chrome and the other large browsers would never dream of implementing.

“So we make a browser that’s not intended to be the least common denominator, let’s say for everyone, but actually be really interesting to a few.” - Opera Limited CFO Frode Jacobson

Suffice it to say, features like these are extremely attractive to certain user demographics, like gamers or Gen-Z members (myself included in both categories), and that has allowed Opera to grow its userbase by focusing heavily on these niche and emerging segments. Notably, many gamers spend more time online than the average browser user and have a much higher propensity to spend money online, supporting Opera’s drive to capture and monetize these markets.

Thesis

I think that Opera’s core browser products are defensible and are poised to continue growing into the future. I also think the stock is cheap-ish at 14x forward earnings compared to the rest of the U.S. listed software market considering Opera’s high growth, strong profitability, squeaky clean balance sheet, and impressive shareholder returns. These few points are my core thesis with this investment.

I believe that Opera’s shares are discounted relative to software competitors due to three potential reasons:

1) People may not take the business model seriously. An “internet browser for gamers” does not exactly jump out at you as a strong and lucrative niche upon first glance.

2) Opera may be discounted due to its majority ownership (69%) by a Chinese firm, Kunlun. This factor might scare people away from Opera initially but I do not see it as a risk - Opera is based in Oslo and has American depository shares listed on the NASDAQ, so I doubt the company will draw any undue regulatory scrutiny based on it’s ownership. Considering that I am long a few companies based in China or Hong Kong, I have no issues buying something based in Norway just because it has Chinese ownership.

3) Opera has quite the troubled past (see Risks) which earned the company a short report by Hindenburg Research in 2020, and I believe that many investors today have not realized that Opera is a legitimate company now. When I posted a query about this company on Twitter, one user commented something like “I hope this scam company goes to 0.” I asked him why, but he did not elaborate. What I’m guessing is that this investor knows Opera’s troubled history but has not taken a look at the business today; if many other investors are in the same boat, that provides a perfectly legitimate reason for a discount. I could be totally off here, but that’s just what I’m feeling.

I think that Opera’s products have plenty of room to continue growing. The company’s most profitable and fastest growing product, the GX browser tailored towards gamers, is just 8% penetrated among their target demographic and I think their penetration rates will only increase from here after examining the product myself, and hearing testimonies from friends of mine who have used the product.

I find Opera’s shareholder returns extremely attractive - they have returned over 25% of today’s market cap to shareholders since 2020, they have bought back 30% of the company’s shares since 2020, and they pay a recurring 40¢ semiannual dividend for a forward yield of 4% - that’s higher than almost every other company I own, despite the fact that Opera is growing quickly (20%+ annually) and is solidly profitable (17%+ FCF margins). Most of the buybacks came when the company was trading very cheaply during 2023, when they reduced the share count by a whopping 17%. Management might have their own controversies but their CFO is a smart guy and knows when to buy back shares, as I see it.

Risks - Picture of a Troubled Past

Opera’s history is that of a phoenix rising from the corporate raider ashes - after more or less struggling with browser market share for decades, Opera was bought by a consortium of Chinese firms led by James Yahui Zhou in 2016, before a 2018 IPO that offered ~10% of the company’s shares for gross proceeds of $115mm. It seems that Mr. Zhou didn’t expect Opera to actually do well, as he promptly began raiding the company’s cash reserves through a series of extremely sketchy related party transactions, and spinning up a separate and highly predatory (and money losing) short term lending business in Africa, where Opera’s flagship browser had a solid chunk of market share. After a few years of control by Mr. Zhou, Opera’s global market share began to decline substantially - this, along with the aforementioned corporate raiding earned the company a well-deserved short report by Hindenburg Research in 2020. I would highly encourage you to read the entire report (linked below) so you can understand Opera’s troubled past and why many people might be looking over Opera’s potential today, over 5 years later:

Opera’s shares proceeded to decline 45% immediately following the report, then traded sideways for years before bottoming at $4 during the 2022 bear market. What’s saved the company since then has been the Opera GX Browser, launched in 2019 (the phoenix in our story) - they actually do have a solid product on their hands now and have grown its users and ARPU at very impressive rates. I do believe that Opera’s controlling shareholder, Mr. Zhou, has now realized that Opera is much more valuable as a decent and legitimate company and has ceased his corporate raiding for good - Opera also sold off its remaining stake in the predatory African microlending business in 2022.

Opera Limited is 69% owned by Kunlun Tech Co. (300418.SZ), a Chinese public company - Opera is in other words a publicly traded consolidated subsidiary of Kunlun. James Yahui Zhou, Opera’s CEO and board chairman, is also a controlling shareholder of Kunlun. Though, I doubt this will bring any undue risk towards the company from here unless he does something unfavorable - Opera is headquartered in Oslo, Norway, with American Depository Shares (ADS) listed on the NASDAQ. I do not think that American regulators are likely to come after a company with this HQ location and listing specifics just because they’re majority owned by a Chinese company.

In fact, Kunlun recently reduced their stake by around 3%, selling 2.4 million ADS for around $49mm in early December 2024 - this is their first such substantial sale since mid-2023, I believe. James Yahui Zhou, the CEO and Chairman, has conducted smaller sales of Opera shares over the years through a wholly-controlled Cayman Islands based holding company, Keeneyes Future Holdings Inc. Future sales by the parent company and related insiders could put downward pressure on Opera’s shares, which is a risk. I do not think that Kunlun sold shares out of fear though, as Opera blew out both top and bottom line with their recent Q4 2024 earnings, leading to a modest rise in share price. Unfortunately, I am doubtful that Opera’s parent company will ever relinquish full control now that the company is actually doing well, and the Chinese majority ownership could prevent Opera from reaching valuations similar to other U.S. listed software companies in the future.

Mr. Zhou still owns 69% of Opera, and the company’s share price has been doing well over the past few years. Because he has so much money on the line, and the company is catching more attention as a legitimate business today, I believe it is very unlikely that Zhou throws out a take-under, or would do anything to compromise Opera’s credibility in the eyes of the market. But this is still a risk factor… you can never ever be too sure with management of this type. If this company had no history of suspicious practices or failed microlending endeavors, I think it would likely be fetching a higher multiple today.

The company still retains a 9.5% stake in Opay, a legitimate African fintech “super app” with services ranging from food delivery to POS systems and services, along with some banking functions like checking accounts (think Venmo on steroids) - importantly, absent lending. Opay has been massively successful, having tripled its userbase in recent years and attracted $400mm in investment from Softbank in 2021. Today Opay is valued at nearly $3Bn on Opera’s balance sheet, and Opera’s 9.5% stake at $269mm. Private market valuations are strange, but if something awful happens to this app Opera will have to take a write-down, which could substantially hurt net income. On the other hand, if Opera is able to monetize their stake in this company, they’re very likely to return the cash to shareholders with a special dividend as they have done in the past with other asset monetizations.

Opera generates 32% of its revenue through an ad partnership with Google, its largest competitor (in a way). There is a reasonable amount of risk here, as Google is a behemoth compared to Opera and they technically could choose at any time to not renew that contract. The contract is a 3 year term, with an option to add one more year if Google chooses so - last year, they added the additional year (2025) 9 months early. In earnings calls, Opera’s CFO has mentioned that this agreement with Google has been in place since 2001, and they typically just renew that partnership every 3-4 years or so - management is expecting a contract renewal by 2H 2025, but if Google chooses not to renew, Opera would lose 1/3 of its revenue. I do not think Google will decline to renew the contract as Opera is essentially just generating them extra revenue here, but there is a small risk.

Everyone finds different browsers appealing, and there are many of them out there to choose from. Opera has been criticized as a “scam” by some more technical consumers because they collect information and “sell it to China.” But simply put, every browser collects information about you, usually for advertising purposes. Most of the reason people are worried about this is the fact that they’re Chinese owned. I don’t think this fact will have any long-term merit - I highly doubt the Chinese Communist Party themselves wants to dig through anyone’s search history… and besides that, who doesn’t collect and sell your data? Every company does that at this point, and many users point out that fact when Opera is criticized on forums like Reddit - just because the company is owned by a Chinese investment fund does not make it spyware, and the majority of users and potential users are aware of that fact. I think there is a small risk of a potential growth scare around this point, but I do not see it affecting the company long-term. If anything, Gen-Z consumers (1/2 of the target demographic) have shown that they could not care less about who owns the products they use, considering their adoption of TikTok, RedNote, and DeepSeek.

Product Suite

Opera operates two main internet browsers - Opera One and Opera GX. Opera One, the flagship product, has seen limited success over the years and currently has 2.9% market penetration on global desktop devices, down from 5% or so in 2015. Opera One is not really growing, as that market share figure has remained more or less stagnant since 2020 - from my understanding, Opera One has many features that differentiate it from Chrome and others, but their market share has continued to erode thanks to hardware defaults (Edge) constantly badgering users to switch to them instead - though, antitrust laws particularly in the EU have shown impressive efforts to change this around.

Opera has historically been the innovator in the space, having been first-to-market with features like tabbed browsing, in-browser VPNs, adblockers, hardware controls, and more. It's just that because they lacked the hardware defaults or massive reputability of Edge, Safari, or Chrome, that the market share has remained stagnant, as these competitors end up essentially copying these features from Opera to prevent threats to their own market share.

The real growth story here is due to their quicker growing and more profitable GX browser, tailored specifically (and marketed very well) towards gamers - the Opera GX browser has attracted a devoted user base from this niche segment because it offers loads of features that Chrome and others don’t, and likely never will.

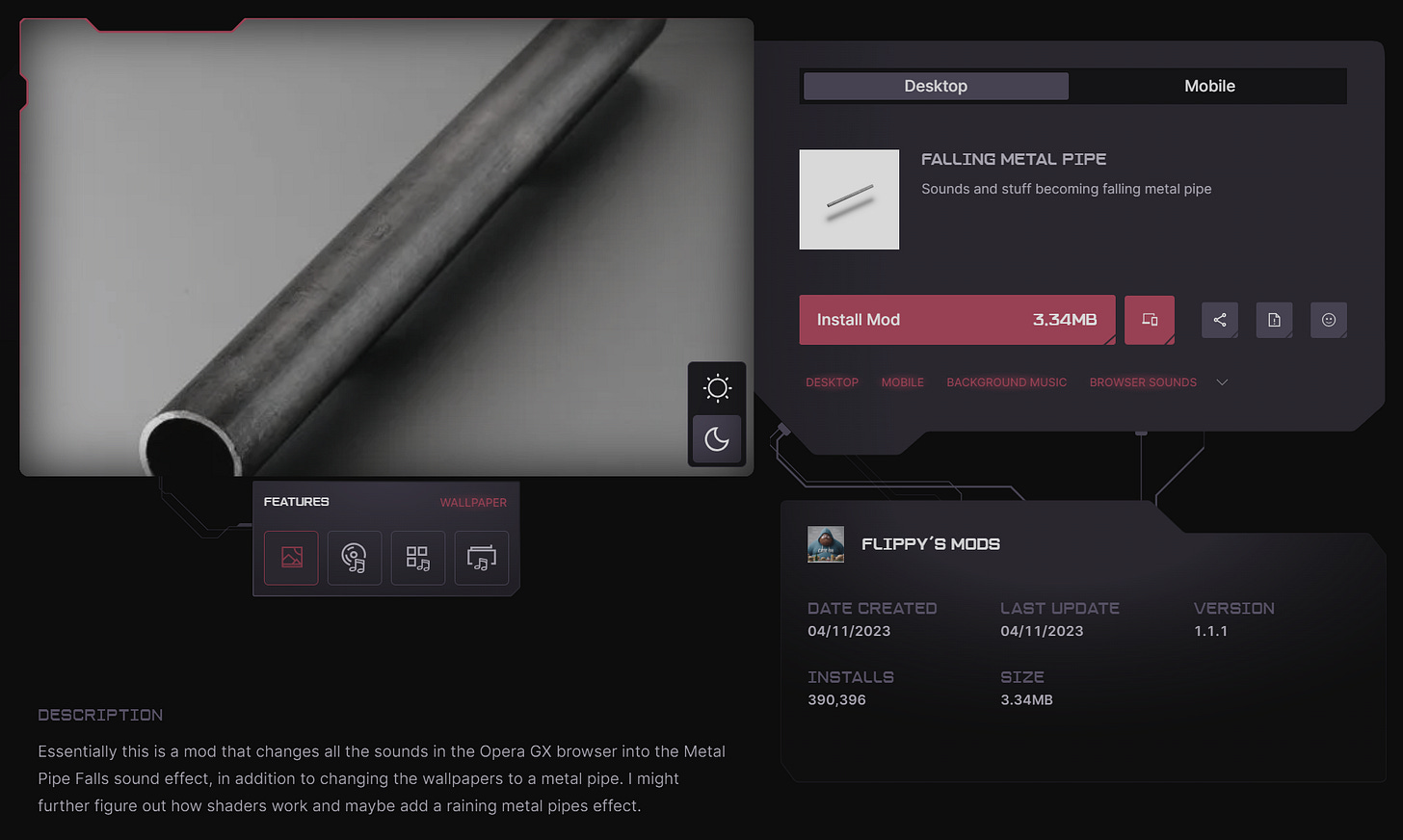

The GX browser is infinitely customizable. Due to a user-based content engine, any user can submit custom browser appearances (called mods) that other users can download to refresh the look and feel of the browser, but it goes beyond looks. Opera GX by default will add surprisingly satisfying keyboard clicking sound effects when users type into the search bar, a common feature found in many video games.

Mods can also include sound effects - if you wanted, you could download a mod that replaces keyboard typing sounds with something like “metal pipe falling sound effect,” or a sound effect of a guy screaming, or a sound effect related to a particular content creator (Opera promotes through content creators, and these creators usually have their own mods to drive higher user engagement). As you can imagine, the meme potential here is immense - both Gen-Z members and gamers alike love memes and content creators generally. There is also background music that can play automatically when opening the browser, and this is highly customizable as well.

As Opera GX is a “gaming browser”, many of its mods are related to specific games including Minecraft, Cyberpunk 2077, Doom Eternal, Elden Ring, Halo, and countless more. During my research for this section, I downloaded a user created mod for The Witcher 3, probably my favorite game ever made, and I feel right at home (The Witcher 3 has amazing and very soothing background music which was imported into the mod). That might be cheesy on my part, but it is a perfect example of Opera’s value proposition playing out in real time.

I’m certain that some of you reading this could find a browser like this very appealing for your home desktop computer - after examining the product, and given that I fall directly into GX’s target demographic, I can wholeheardlty say I understand why this browser has such a loyal fanbase, why it continues growing, and why it is likely to continue growing for a long while yet.

In addition to being extremely visually customizable, GX also allows users to manage their browser’s memory usage, which is one of the biggest pain points with Chrome and many other browsers - Chrome loves nothing more than to eat as much of your computer’s RAM as it possibly can, which can choke up and slow down other functions. I have seen a great many Chrome users complain about this and you probably have as well…

One of GX’s main selling points is the GX Control function that allows users to decide exactly how much RAM, network bandwidth, and CPU processing power the browser should use - they also offer a setting that can automatically kill specific tabs that use a large amount of a computer’s hardware resources. Another big selling point is the GX Cleaner function which can clear cookies, browser caches, downloads, and browsing history with the click of a few buttons. Both of these features are integrated into a neat and easily accessible sidebar:

Chrome has no functionality to limit its outrageous hardware usage despite this being such a significant pain point from their tech-savvy userbase. Google is a trillion dollar company and Search is one of their biggest revenue drivers, so you’d think they would spend some time innovating here, but no. Opera does not hesitate to mention these features in their marketing materials, to say the least.

The GX browser also includes features like password managers and built-in adblockers, even AI chatbots - this has everything you could want from a high-end browser, basically. It blows Chrome out of the water on every single function from the perspective of the target demographic. And after download, it’ll import all your saved passwords and extensions from Chrome, or whatever other browser you configure it to use.

GX also includes integrations with other gaming-related applications like Discord and the streaming app Twitch - suffice it to say, the browser does quite a bit to appeal to the target demographic.

I have multiple friends who use Opera because of these impressive features. Despite the fact that this product is basically just a Chrome search engine wrapper, it’s extensive personalization and enhanced performance tools give it a wholly separate feel. And don’t worry, Opera’s browsers still incorporate Google’s AI summaries when users submit search queries - Opera’s management has specifically mentioned they’re trying to create a browser that’s ideal for use with Agentic AI models, which could increase adoption enormously if they can pull it off.

Opera has no competition in the gaming browser niche and their brand presence is already quite solidified within the target demographic.

Business & Financials

Opera primarily makes money through advertising and search.

Search:

When users enter a query into Opera’s search bars, the traffic is directed through other search engines (mostly Google, but this is customizable by the user) - Opera’s browser is just a fancy wrapper around Google’s core search engine. Here’s what this relationship looks like, with a search I submitted for “kittens.” Opera and Google split the revenue generated by these searches.

Advertising:

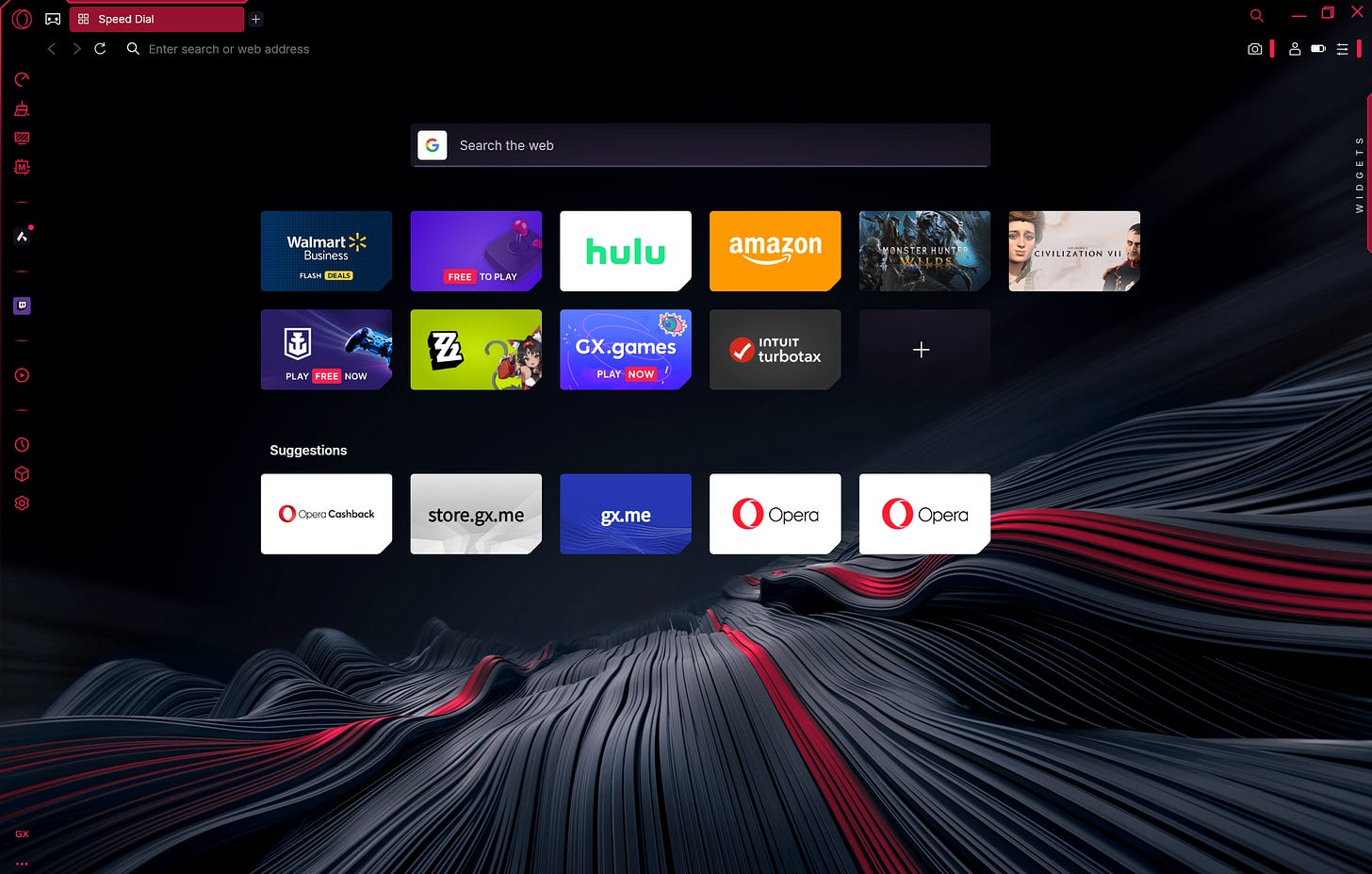

Here, Opera gets paid for driving internet traffic towards particular products or webpages. Their compensation can come in two forms, hosting fees or performance-based compensation when users successfully purchase a product. Internet traffic is driven to Opera’s advertising partners through their ‘Speed Dial’ menu seen below:

You can even see how they change these advertising partners around and rotate them out seasonally - it’s tax season here in the U.S., so TurboTax gets a home page listing for now. The same could be said for streaming services, online retailers, specific games, and many other potential companies that do the majority of their business online. Opera will also recommend offers or news stories that support various partner advertisers, shown below:

Of the two, advertising is expected to continue growing at a higher rate than search. Q4 search revenue was up 17% YoY, whereas Q4 advertising revenue was up 38% - their advertising revenue is growing much faster due to improvements in the company’s ad targeting model, enhanced with AI algorithms after the company purchased an AI data cluster early in 2024 ($20mm in CAPEX).

I believe that Opera’s products (mostly Opera GX, Opera One to a lesser extent) have those highly coveted three layers of growth:

Growth in addressable market - global internet users today represent ~68% of the human population, but that percentage has only increased over the years and is expected to continue increasing. The TAM for internet browsers is forecasted to grow at a 17% CAGR from 2024 through 2032.

Growth in market share - GX continues taking and retaining share with 600% MAU growth since 2020, from just 4.5 million MAU to 32 million today - and there is still ample opportunity to further penetrate the highly valued Western Gaming consumer demographic. Importantly, GX brings far higher ARPUs than the company’s other browser products

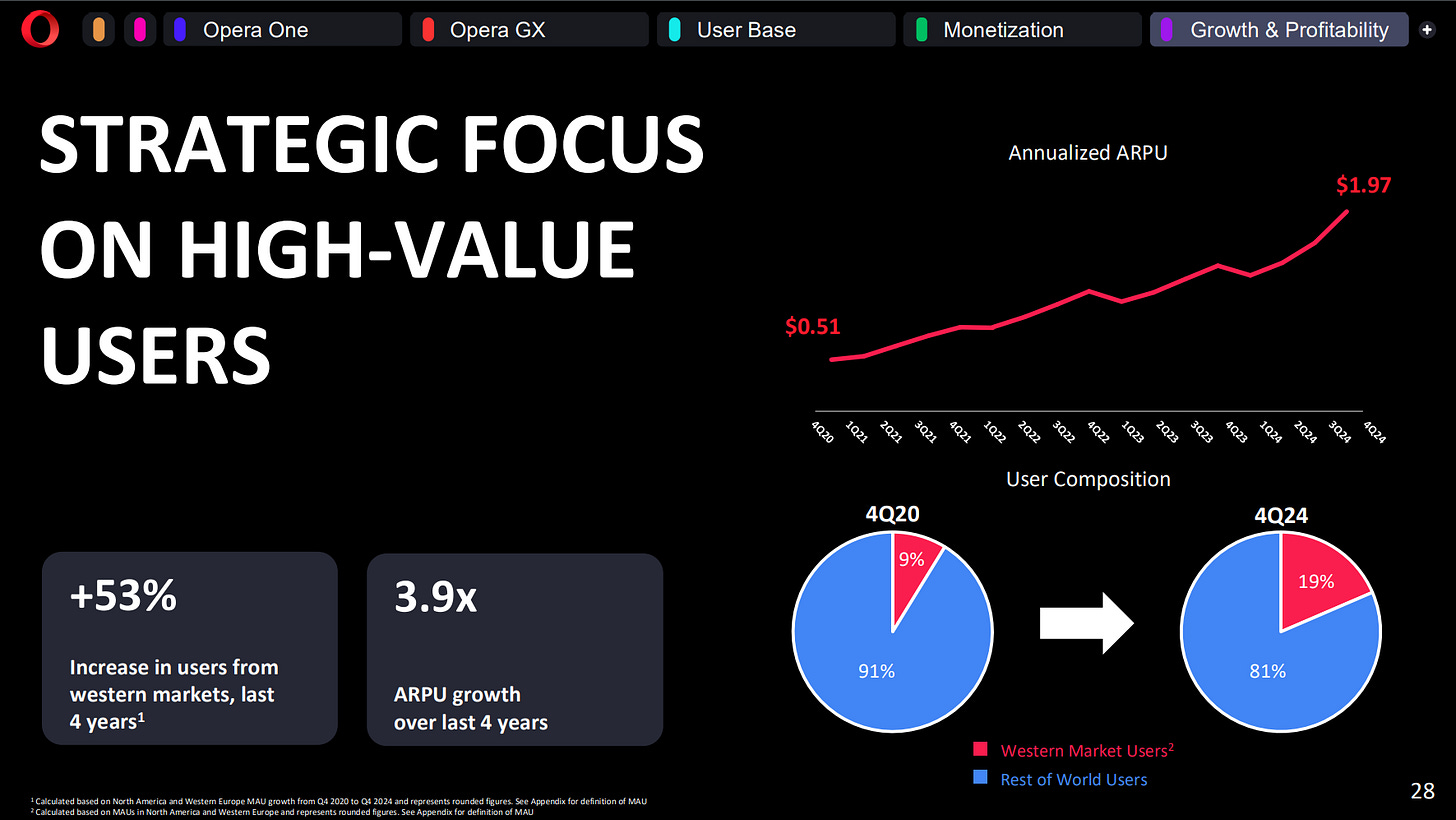

Growth in ARPU - annualized ARPU is up 4x in the past four years to $1.97 and growth shows no signs of slowing down - Opera has been developing increasingly better ad targeting algorithms to increase their advertising revenue, and the continuing shift towards the Western gaming demographic can continue to bring in higher-spending users. Opera’s browsers are all free, so ARPU expansion cannot come from any pricing power, but I believe it will still increase fairly reasonably over time. Also, if Opera’s advertising performance fees remain constant as a % of revenue split, and the companies advertising on Opera raise prices (streaming services mostly I imagine), that’s another way to continue increasing ARPU - so, ARPU increases may not be as “organic” as a company that simply has some pricing power, but they will still increase in my belief

Opera’s full year 2024 revenue rose 21% from 2023 carried by very impressive 29% growth in Q4.

Revenue grew substantially more this past Q4 due to a stabilization in total MAUs while GX MAUs continued the rapid growth (up 22% YoY) - Q4 is also seasonally higher due to holiday shopping trends. That, and the continued strength they are seeing in performance revenue from e-commerce/advertising. They have also been shifting focus toward Western markets, pulling back from markets in Asia and Africa, which leads to our increasing revenue despite declines in total MAU. Today, Western markets bring over half of revenue despite being just 19% of their userbase (up from 17% in Q3):

Opera has no long term debt, with $126mm in cash and $269mm in long-term investments (Opay stake) - a pretty clean balance sheet. Their ROE could actually double if they can get the balance sheet a little leaner - they’ve $919mm in TTM avg equity, and income of $80.7mm over the TTM for an ROE of 8.7% - nothing special. 41% of their equity is in cash ($126.8mm reported for Q4) and the company’s Opay stake (valued at $269mm). Factoring those out of equity, their ROE could jump to 19-21% assuming they put up $100-115mm of net income in 2025 (compared to $80mm in 2024) which I think is reasonably achievable, considering they’ve guided to 29% revenue growth in Q1 25, nearly double their revenue growth in Q1 24, and their bottom line margins holding steady. They’re guiding for 17% revenue growth in 2025 but in recent quarters they’ve pretty consistently been beating out guidance. I’ve heard rumors that Softbank might be looking to IPO Opay in the coming years if the app continues doing well, if not, it might be difficult to monetize the asset and that is definitely a risk, but they’ve commented that they would divest it if someone makes an offer.

On margins, Opera’s gross margins are a little hard to measure (most data providers give different numbers), given revenue sharing agreements within Search and cost of revenue (either owned or partner advertising inventories) within Advertising, and IFRS accounting standards which the company reports in - on the Q4 call, CFO Frode Jacobson mentioned that they expect FY25 costs of revenue to be 30% of revenue - a solid 70% gross margin, not bad.

The e-commerce advertising strategy they’ve been pursuing within Opera Ads has hit gross margins some and is expected to continue doing so, because the costs of revenue in advertising are higher and the faster-growing Advertising line is becoming a larger share of the revenue mix over time. Importantly though, this advertising spool-up is driving incremental dollars to the operating line at steady rates, those margins are holding steady. Eventually the revenue mix will stabilize some more, gross margins will stabilize further and we’ll have a clean slate.

Below you’ll find Opera’s adjusted income metrics and margins - net income margins are holding steady around 15%, whereas the adjusted numbers are pushing 19%. We don’t even need these income margins to grow for 20%+ annual earnings growth, as I see things.

Search is expected to put up a revenue CAGR at 17% or so from here, which is the same long-term growth rate expected for Google’s search revenue. Advertising revenue will be increasing significantly more, as in recent quarters, but that’s a little more difficult to accurately forecast as that business line hasn’t nearly matured just yet.

A few years down the line, I think this company could pretty reasonably fetch a 20 or 25x P/E multiple once the market realizes that the company is in a much better place now than it was even a few years ago - I think 14x 2025 earnings estimates is simply too cheap for this name. However, this pitch does not really need any multiple expansion to perform well as I see it - their earnings growth from here alone could generate 20-30% annual returns, but some P/E expansion would definitely be appreciated.

It’s interesting, you look at the rest of the U.S. listed small-cap software market, and this stock almost looks ridiculously cheap in comparison to many other names. But you also could argue that Opera’s products are pretty similar to Google’s, which consistently trades around 20x earnings, currently 16x forward according to FinViz. The relative cheapness of this company is likely up for interpretation depending on what your assumptions are, but I still think it can easily be considered pretty cheap at this point.

Opera’s core business (the browser functions alone, subtracting out cash and the Opay stake) would trade with an 3.8% operating cash flow yield - $105mm TTM operating cash flow to an “enterprise value” (minus cash and the Opay stake) of $2.75Bn. Now, I know capital expenditure (and thus, free cash flow) is important as well, but Opera is very CAPEX light generally. They acquired a GPU cluster in Q1 2024 for $20mm in CAPEX, but their CAPEX for the rest of the year amounted to $3.1mm. Say, a 10-11% “Opera core” EV/FCF yield excluding the one-time data cluster purchase, growing operating cash flow by 27.8% in 2024. The company’s financial records linked above can show you in more detail their operating to free cash flow metrics over time.

Obviously the Opay stake (and cash) are included in the market cap of the company today, so buyers do pay that full price. But a lot of value would immediately be created for shareholders if the company can divest Opay and return that capital to shareholders through special dividends or repurchases. We investors would be left with something of a cash flow machine, as I see it.

In the ideal scenario, the Opay stake is divested and the proceeds returned to shareholders through a special dividend, as well as the cash position. Either the current dividend will be raised, or they will pay a special dividend, or they repurchase shares. Then the company’s market cap would no longer include such a large cash position + the Opay stake, and we investors could be left with a small pile of cash + the remaining cash flow machine that is Opera’s core business.

The ideal scenario is probably not likely to occur just like that, though. Opera could have difficulties in monetizing the Opay stake for years and years (this is likely IMO), or they could make new investments with their cash, which might draw ire from shareholders (myself likely included). They also may never be able to repurchase shares given their large ownership stake by Kunlun and low-ish free float. All of these are risks, and if they present themselves, I will still be relying on Opera’s core business, growing well with solid margins, and relatively cheap at 14x forward earnings (all-in valuation) as I see things.

Via: FinChat

Capital Returns

Opera has a very impressive history of capital returns, having bought back 30% of shares outstanding since 2020 (17% in 2023 alone), and combined with their semiannual 40¢ dividend payments (4.3% forward yield) and various special dividends, they have returned 25% of today’s market cap to shareholders over the last 5 years - that’s really quite good compared to your average small cap software company.

In fact, when was the last time you saw a profitable (20%+ EBITDA margin) and quickly growing (20%+ revenue growth annually) software company with a clean balance sheet trading at a 4% dividend yield? I’m not sure I’ve ever seen such an opportunity listed anywhere in the U.S.

Their CFO Frode Jacobson is shareholder friendly in my opinion - he has remarked positively about share buybacks and dividend returns in general, so we can be well assured that Opera’s management will continue to return significant sums of capital to shareholders into the future. I would rather they buy back more, especially sitting on so much cash that’s been building up every quarter. The dividend will be the primary method of returning capital - the company is somewhat buyback-averse due to the size of their free float (30% or so), given their majority ownership by Kunlun. They bought out a pre-IPO shareholder a few years back and probably would be willing to buyout portions of shares from Kunlun, if offered. Kunlun selling some more shares over time could open the pathway to conducting further buybacks.

Opera’s products need very little investment to continue attracting new users. A good amount of marketing spend is necessary to grow quickly (30% of revenue-ish), but 78% of Opera’s downloads come from organic traffic, so paid promotion is not necessary to continue growth, and the business requires very minimal CAPEX overall. Opera can continue returning as much excess cash as it can generate to shareholders for years to come, as I see it.

That pretty much wraps up this report, I hope you all enjoyed this writeup! I’m interested to see where this company will end up trading a few years down the road and what kind of product innovations the team can come up with in that time. Goodbye for now, I’ll be writing you all again soon!