red violet, Inc. (RDVT) - Quick Writeup #2

This company probably knows where you live, why not get long?

Disclosure: This is not financial advice. If you like the idea, conduct extensive research and consult a financial advisor before making any investment decisions. All investments, including this one, carry the risk of financial loss. I own red violet stock, thus I am biased in favor of the company and one should view this article through that lens. This article comprises my personal beliefs and convictions around owning any securities mentioned, and is not intended to be used as a recommendation to buy or sell any securities. Please be careful everyone.

To start, I would like to say that this one just has that feel to it - I’m looking at the income statements, tilting my head up, and laughing. The story is just so good it’s almost absurd. This stock feels like IOT (up 60% from when I took interest), or WIRE at $175 (up 60% in 6 months before being bought out). This is either going to be a phenomenal investment, or the company is fraudulent, with no in-between - but I don’t think red violet is fraudulent. With that said, I suspect this is the kind of stock you need to buy and hold on to for dear life, much like IOT. It almost feels too good to be true, and if the chart is any indication, it’ll be quick to shake you out of a position, so be careful, friends.

Red Violet (stylized as red violet) is a data and intelligence gathering company (a data broker) that provides a variety of services such as ID verification, fraud prevention, compliance, background checks, and customer research to a variety of customers like banks, law enforcement agencies, realtor agencies, insurance companies, and collections and repossession agencies. As they put it, their technology “enable[s] the real-time identification and location of people, businesses, assets, and their interrelationships.”

red violet was founded as IDI in 2014, and listed on the NASDAQ in 2016 as cogint, Inc. cogint spun-off red violet in 2018 and later rebranded to Fluent (FLNT) - apparently, this spin-off was a terrible decision as Fluent is now a penny stock in terminal decline, worth just 11% of red violet’s current market cap.

red violet operates through two core products, IDI and FOREWARN. In Q1 2019, IDI and FOREWARN had 4,000 and 15,400 customers, respectively. Today those numbers are 8,700+ (up 20% YoY) and 263,000+ (up 80% YoY), respectively.

IDI is offered on a contractual use basis, and serves the following sectors: financial services companies, insurance companies, healthcare companies, law enforcement and government, identity verification platforms, collections, law firms, retail, telecommunication companies, corporate security, and investigative firms. This service accounted for 26% of revenue as of Q2, up 5 points YoY.

FOREWARN is an app-based subscription tailored to the real estate industry, with over 490 contracted realtor associations in the US (out of 1200+). FOREWARN essentially offers “instant knowledge” of customers and their history, to better prepare realtors for meeting with clients. This service is an annual subscription billed monthly (auto-renew on by default), and accounted for 74% of revenue in Q2, down 5 points YoY despite its immense growth, suggesting that IDI is priced much higher per use.

red violet’s FOREWARN product is so good, they’ve kept adding realtor customers while home sales (and realtors) have plummeted. red violet is headquartered in Boca Raton, FL, which might seem off, but Florida has the most realtors of any state. Makes loads of sense that they’d want their HQ to be there.

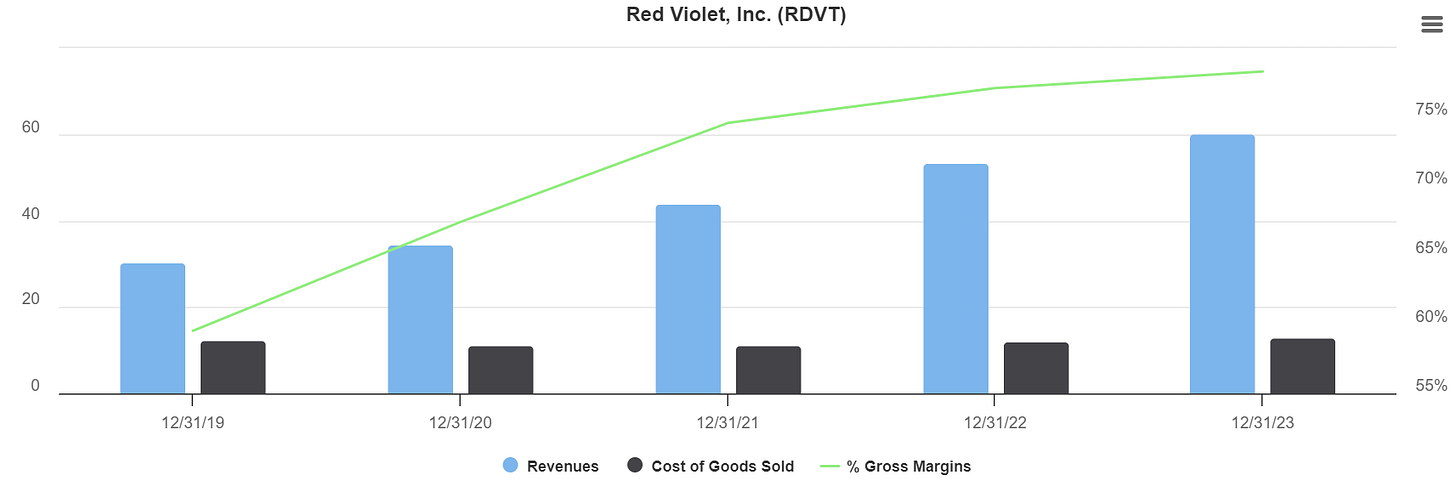

To power these products, red violet accesses and aggregates publicly available and proprietary datasets, paying a fixed fee to access the proprietary data, with unlimited usage agreements. This fee structure has allowed their COGS to remain close to flat since 2019, as revenues have doubled:

Financial Highlights

revenues on a 38% CAGR since 2017

Q2 saw 30% revenue growth YoY, LTM growth of 13% YoY

gross margins of 81%, up 20 points since 2019 - they’ve commented in the most recent 10-K that historically, when at scale, gross margin could fluctuate between 70-85%, but they do expect gross margin to keep rising in the coming years

first achieved positive operating income in 2022 at 0.7% margins, LTM op. margins are 8.8%, and Q2 24 op. margins were 16%

Q2 net income margins of 13.8%, up 4.3 points YoY

H1 24 EPS of 32¢ is up 68% from FULL YEAR 2023 EPS of 22¢. red violet saw a one-time $10.4mm tax benefit in Q3 23, which I have adjusted out for all figures

red violet trades at 75x TTM earnings, 35x my fwd earnings estimate with a $390mm marketcap. A steep price, but they’re likely to grow EPS in the triple digits this year

I think they put up 80¢ in EPS over the next 12 months, for 110% YoY est. EPS growth and a PEG of 0.67 - this EPS target is actually a little lower than the consensus analyst estimates right now, too

94% gross revenue retention in Q2 - considering 26% of their revenue is non-subscription, that’s really quite good

They have just 13.7 million shares outstanding, of which insiders own 24% or so, with some notable buying as recently as April. Interestingy, the 4/25 proxy states insider ownership at 9.5% and I can’t see any buying since then, but both Finviz and YahooFinance give me the 24% figure. Not sure which exactly to go with, but solid enough insider involvement either way

red violet has no long term debt and has 7.5% of the market cap in cash

Comps are LexisNexis (awful name, but private) and TransUnion (TRU), and a company owned by Thompson Reuters (TRI). Here’s how comps stack up:

TransUnion is a 19bn company, which adds merit to red violet’s large and growing TAM.

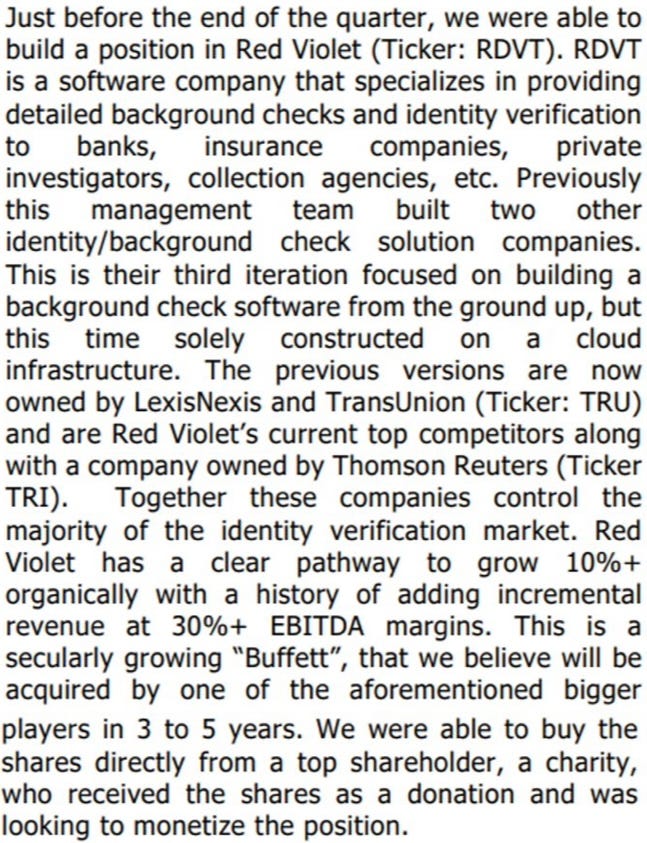

3 of red violet’s insiders, their CEO, president, and CFO used to be at TransUnion, and according to Cove St. Capital, built two of red violet’s competitors including TransUnion:

red violet offers the only cloud based solution for this space at the moment, and I see them taking much further market share down the road. The growth in their realtor customers alone is extremely promising to this end, but their other verticals like law enforcement and ID verification services should not be underestimated. They have also built some ML/AI capabilities into the platform to streamline the customer experience even further.

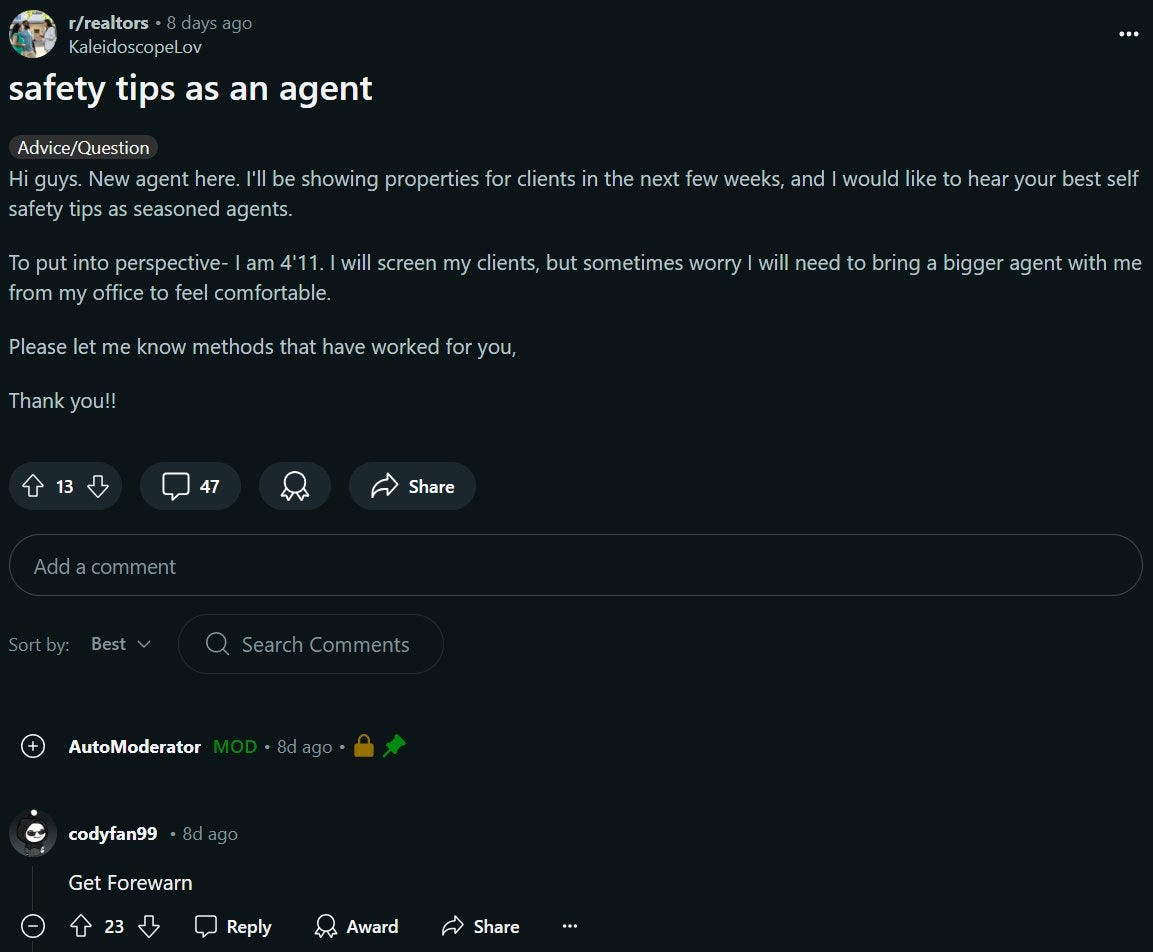

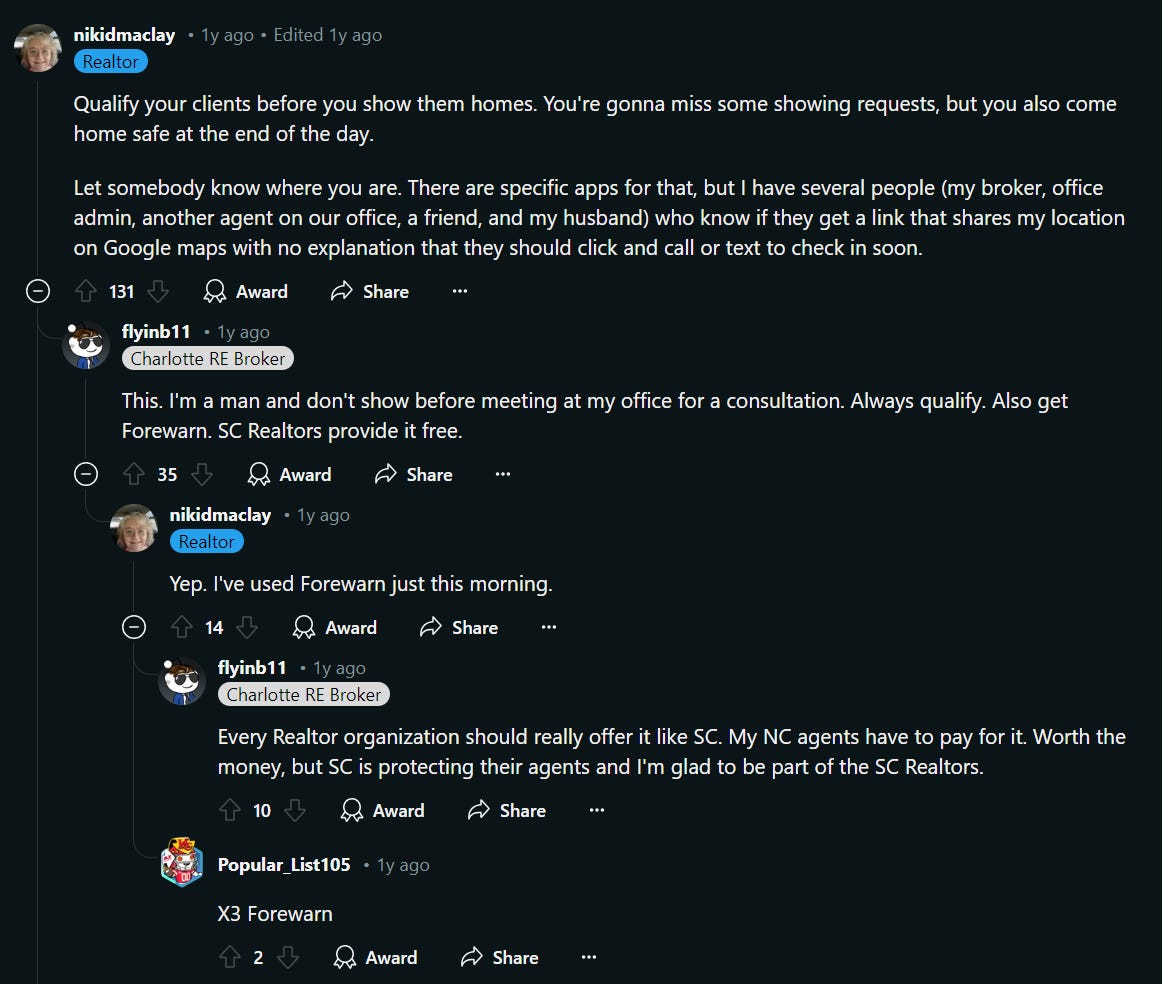

I found some interesting info on FOREWARN on r/realtors, it seems like a lot of the more seasoned realtors use FOREWARN often, and recommend it to others just so. A few examples below:

1:

2:

3:

The app also has great reviews on Apple’s app store, I looked at quite a few (sorted by most recent as usual). I should note though, it seems you need to learn how to effectively use FOREWARN before it provides real value. If you were to, say, enter a phone # to the platform, the database will provide information for all people ever associated with that #. You need to screen your results or refine your search queries a little further to effectively filter out negative info. Multiple comments said that the platform provides solid info for 80-90% of queries, but no database is perfect. I saw many comments that said FOREWARN is well worth the money if you learn how to use it and are actually showing a solid number of homes every year, plus many realtor associations just provide it for free to their agents.

On pricing, I doubt I’ll be able to find much on IDI, but an r/realtors comment from 3 years ago said FOREWARN is priced at $20/month. I would bet that price is closer to $30/month today, but it’s not too important. The key thing is that they can provide this service for a really modest fee, considering it has very likely saved lives and that many realtors get paid plenty enough to cover that fee.

On sentiment, red violet is 6.5% shorted overall, 12% at IBKR. Honestly, not the worst. Though, Twitter sentiment is actually pretty good according to IBKR. The stock gets a little more buzz than average with solidly positive sentiment, kinda a first for a company I’ve covered on this blog, hope I won’t come to regret that, but this stock is very far from what I’d consider a FinTwit darling. The stock also appears to be relatively under-covered by Wall St., as there was just one analyst on the line asking questions for the Q2 call. On the Q1 call, management sounded really excited to have some analysts to talk to, you could literally hear in the CEOs voice how proud he was of what the company has accomplished and their future plans for growing the company. It’s a shame not many people seem to know about this stock.

I have added red violet at 12.5% allocation. I expect this company to keep up the outsized growth through taking further market share, and I expect their operating and income margins to expand further, as gross margins might as well not have a ceiling for the time being, and they have plenty enough operating leverage to really juice those bottom line margins, as we’ve seen with their rapid operating margin expansion to date. My cost basis on shares is $28.25. I think this stock will at least revisit its 2021 all-time-highs in the low $40 range, which should be good for a 50% return from my cost basis. Unsure on timing, but I would be surprised if the stock doesn’t get there within a year or so considered their very rapid earnings growth and fairly reasonable valuation multiple.

Update 10/1:

Corrected the TTM P/E multiple from 25x to 74x. A big jump… rookie mistake on my part, I adjusted the Q3 ‘23 tax gain out of my EPS figures, but not the P/E figure. Last time I’ll make that mistake, don’t worry. However: I think this honestly makes much more sense. 25x really felt too good to be true, and at 35x fwd EPS, the company has a PEG of 0.67. I think they put up 80¢ over the next 12 months, based on some “napkin math” Excel modelling, or around 110% YoY growth in EPS. I’ll gladly pay 74x for that kind of EPS growth, especially considering how much I think this company can grow topline over time… a look at a few software peers like TRAK at a $336mm market cap, at 64x P/E with just 8.5% growth expected NTM, further allays my fears (thanks to JoeRetail2 on Twitter for this). I bet the stock still goes up, despite my stupid oversight here. I’ll be buying this name on weakness as well.