Red Violet Revisited (RDVT) - Deep Dive #9

Turning a commodity into a high margin, highly scalable cash flow stream | 38x EV/LTM FCF with FCF on a 50%+ 3-year CAGR

REQUIRED READING DISCLOSURE: This is not financial advice. I am not a financial advisor. If you like the idea, conduct extensive research and consult someone who is a financial advisor before making any investment decisions. All investments, including this one, carry the risk of financial loss.

I own Red Violet stock, thus I am biased in favor of the company and one should view this article through that lens. This article comprises my personal beliefs and convictions around owning any securities mentioned, and is not intended to be used as a recommendation to buy or sell any securities. This article may contain errors or incorrect information - you should verify all information presented here through your own research.

Quick Stats:

Ticker: RDVT 0.00%↑

Marketcap: $614mm

ADV: $3.8mm

EV / LTM FCF: 38x

Introduction

“If data is the new oil, data fusion is the process of refining it.” — The Hank Show, Mackenzie Funk

A few of you will have seen my previous work on Red Violet (RDVT) — a few tweets here and there, and a quick-n-dirty writeup I published here in September 2024. Shares are up 70%+ since that initial writeup, and I think RDVT still has plenty of gas in the tank longer-term.

This report aims to tell the company’s story (and more importantly, how investors can still make money here) in much greater detail. I’ve since unpublished my first report on the name as it’s lower quality, doesn’t go very in depth, and I got a key revenue assumption incorrect about the company, which we’ll get into.

Either way — I think this is a very unique opportunity supported by strong and embedded tailwinds. It checks all my boxes, and if I’m being frank, it’s probably my best long-term compounder idea right now. I think this company remains a damn good bet — one that has grown to occupy over 20% of my portfolio, at this price. So… let’s get into the analysis.

Table of Contents

Introduction

Table of Contents

Description & History

Thesis

Risks

Business Model & Services

Financials & Analysis

Description & History

RDVT is a data broker and identity intelligence company that serves a number of verticals, from corporate risk and fraud prevention, to law enforcement, collections, and real estate. The company’s IDI database product is powering numerous federal and state level agencies, thousands of corporate customers, and seven of the top ten identity verification companies today, with significantly more growth potential in these markets.

The company has demonstrated a very impressive ability to take market share from it’s larger competitors and open up new addressable markets, growing 20%+ and rapidly expanding margins, leading to huge earnings and cash flow growth. In fact, earnings per share are on a 115% 3-year CAGR (though from a small base), and this past Q1 they grew GAAP EPS by 90%+ YoY as they posted 25% revenue growth and their operating margin shifted up 9 points YoY. Cash flows are following suit, on a 59% 3-year CAGR through end 2024.

I think RDVT can keep putting up pretty similar earnings growth and could potentially see an upward re-rating as the stock crests the $1Bn marketcap threshold and sees more liquidity and analyst coverage. The rest of this article will explain my reasoning thoroughly. But first, we’re due for some background information.

The company was founded by a management team that built some of the core identity intelligence subsidiaries powering much larger competitors like LexisNexis (valued at $2.9Bn in 2021) and Transunion ($TRU, $19Bn mktcap). The story behind how this occurred is honestly insane… strap in, and hang onto your seats for a second here.

In order to discuss the history of the data intelligence industry, we need to discuss a man named Hank Asher, a brilliant madman and the pioneer of today’s data intelligence industry. He was born in 1951, he dropped out of high school at 16, before moving to Florida and starting his own painting business that did $10mm in sales by the time he was 21. Already pretty impressive, that.

After a brief cocaine smuggling stint between central and south America in 1982 (where Asher was known to celebrate successful drug runs with a signature barrel roll), Asher flipped informant and joined forces with the DEA to help curb drug smuggling activity, and he was never formally charged with any drug-related crimes — though he did get a glimpse into the workings of DEA computer systems, which would influence his later work with data intelligence. This drug smuggling activity was still known to the DEA and would go on to hang over Asher’s career like a black cloud in the decades to come.

In 1992, Asher started a business called Database Technologies (DBT) after operating as a freelance computer programmer for some time. His first contract was mining data from Florida motor vehicle records for a local insurance company. Asher was one of the first people to collect and aggregate data from various sources to serve public and private organizations, like insurance and law enforcement, which was a huge step forward at the time.

Back in the 90s, data wasn’t nearly as proliferated as it was today. Obviously car insurance companies could benefit massively from receiving data from motor vehicle records, and likewise many other companies and public organizations could benefit from receiving curated data from many other sources. The data was already there, but it wasn’t being proliferated. Asher was just one of the first entrepreneurs to become a middleman and aggregate data from many sources to provide curated information to these companies and organizations.

DBT went on to become quite successful, mining data from many different sources and connecting it into one large supercomputer system to spit out insights. DBT’s main product was AutoTrack, an early identity verification and tracking system that was quickly adopted by enterprise and law enforcement customers — customers rose tenfold to 10,000 between 1994 and 1997.

As the company grew, DBT raised $90mm in investment, even receiving private funding from George Soros and Stanley Druckenmiller before going public as DBT Online in 1996. Shares hit $41 on opening day trading, placing the company at a valuation just over $300mm.

Unfortunately, all was not ‘well and good’ at DBT. Asher’s instability made operations rather difficult. He was known to flip between extreme generosity, buying new cars for every employee at one point, and extreme hatred, often screaming at low-level employees over perceived wrongdoings. He grew increasingly paranoid, and at times despondent and absent, leaving DBT rudderless and without effective leadership.

Also, Asher’s drug smuggling past came back to bite him. DBT’s board of directors as well as the company’s investors were worried that Asher’s history might affect their ability to keep government and law enforcement contracts. Asher was voted out of the company and his shares were bought out — even his own brother on the BoD voted him off.

This culminated in Asher building a company called Seisint in 1999 — Seisint is essentially the first iteration of today’s Red Violet, and the core engine behind it is still used to this day by LexisNexis, who bought the company for $775mm in 2004. You probably haven’t heard of Seisint itself, but you might’ve heard of the company’s Accurint product, for Accurate Intelligence.

Seisint was a key player in enabling the Multistate Anti-Terrorism Information Exchange (MATRIX), a US government operation to track down the perpetrators of the 9/11 attacks. Per Florida’s Attorney General Bob Butterworth, a criminal investigation that would previously have taken weeks was shortened to a few moments using Asher’s technology.

After Seisint was bought out, Asher founded another company called TLO, standing for ‘The Last One’ — what a name. This company primarily offered services for free to law enforcement and government agencies to track down missing and exploited children, as non-competes from the Seisint acquisition had yet to expire and the company couldn’t legally offer paid services. To this day, no fewer than 13,000 child predators have been arrested thanks to iterations of Asher’s technology, and he is among the highest single donors to the National Center for Missing and Exploited Children to this day. What a guy, seriously.

After leading this insane life, Hank Asher died unexpectedly of natural causes at age 61, in January 2013. TLO wasn’t quite at commercial scale at the time, offering their services for free to law enforcement, and was primarily funded by Asher. Without his funding, TLO was insolvent by May 2013 and was bought by TransUnion (TRU) in a bankruptcy auction the same year for ~$150mm. Interestingly, this sale was disputed by LexisNexis who would have offered $180mm for the company, but they were a day too late with their proposal.

Side note: if you want to learn more about Hank Asher and the foundations that built today’s data intelligence industry, I highly recommend reading The Hank Show by journalist Mackenzie Funk. It’s highly informative and provides a lot of great background on the industry as a whole, and it’s been my go-to source in compiling this writeup.

Anyways, this is where Red Violet finally enters the story… essentially, Red Violet’s current executives held positions at these previous two companies, Seisint and TLO, working with Asher to build these products up before they were eventually sold.

Red Violet’s Chairman and CEO Derek Dubner was General Counsel at Seisint and TLO. The company’s President, James Reilly, was also an executive at TLO, and the company’s CIO Jeff Dell was also CIO at both Seisint and TLO. The company’s CFO, Dan MacLachlan, was CFO at TLO and at TransUnion after it acquired TLO.

Essentially, minus Hank Asher, Red Violet’s executive team are the very same people that worked to build the previous two companies founded by Asher, now owned by Red Violet’s competitors.

The key thing here is, Red Violet is the third iteration of this same sort of database company. Red Violet’s management team took the learnings and the shortcomings from building these previous two companies and used them to make Red Violet superior to these previous iterations in many ways.

Red Violet’s core data asset platform, called IDI for Identity Intelligence, was built on the cloud from day one, incorporating early machine learning and AI algorithms to enhance the quality of its data assets. These competing subsidiaries, Seisint and TLO, were built in the late 90s and 2000s, before the cloud was really a big deal. They’re not as scalable — they’re really just large data rooms filled with servers, not a scalable cloud-native API-accessible application like Red Violet’s IDI.

Thesis

I think Red Violet simply has a better product in a sticky-revenue business with high at-scale margins and a high degree of operating leverage.

I think it’s cheap because it’s thinly traded and institutions can’t easily buy much of it, as well as the fact that the company is based in Boca Raton, a historical hotspot for scams. This factor alone wards off a lot of would-be investors, leading to (in my opinion) a decent discount on the shares when compared to larger US software companies that are demonstrating this kind of cash flow growth.

RDVT has perfectly valid reasons for being based in Boca — Hank Asher himself as well as the previous two companies, Seisint and TLO, were based out of Boca as well.

Superior product: this management team helped build the core data asset products for two of their main competitors, and a few of them have worked at these competitors to boot — Red Violet’s IDI is the third iteration of a database product like this, and management have used their lessons and iterations from the first two versions to improve IDI with higher scalability, more features, niche and new use cases, and better data accuracy and throughput.

Fixed cost model: because data costs don’t increase in-line with revenue, each additional dollar of revenue RDVT can bring in over the same data assets comes at nearly 100% contribution margin, flowing nicely down the income statement and generating high gross margins, supplementing operating leverage.

RDVT has already demonstrated meaningful scalability, having accelerated growth while increasing margins over the past few years, despite meaningful data asset and human capital investment.

RDVT’s business is largely countercyclical — as they serve verticals like collections and repossession, fraud prevention, debt recovery, and corporate risk, they’ll see more business from some verticals when others decline due to macroeconomic factors.

RDVT’s business is a sticky one, as identity solutions are very necessary for transactions involving risk, law enforcement, credit reporting, collections, and some marketing solutions. You can see some evidence of this with their promising 96% gross revenue retention, which is generally considered best-in-class for software. These data products end up getting integrated deeply into customer workflows, and it’s difficult to replace you once you’re in that workflow, especially if your product has advantages on pricing and data quality, which IDI does in many cases.

Red Violet is a proper small cap, valued just shy of $620mm by the market here. Because the outstanding shares are largely held by long-term investors and shares are thinly traded, institutional investors can’t really buy much of the stock, and illiquidity generally brings with it lower valuation multiples.

There are also only two sell-side analysts covering RDVT, and I have reasons to believe the first analyst from B-Riley is undershooting EPS estimates going forward, which makes the forward multiple people see in screeners seem artificially high. As RDVT continues growing its market cap, liquidity in the stock will increase and they’ll catch more sell-side interest as well, which I think may allow for a re-rating higher.

Side note: As I’ve been working on this article, the second analyst from Lake Street, a smaller investment bank, has initiated coverage of RDVT with a $60 price target. Nice to see — more institutional coverage, more eyes, more earnings estimates and more liquidity should help the stock price a good bit.

It might sound crazy to say this could re-rate higher given the company is trading at over 70x LTM earnings, but in the lands of mid and large cap software, I do see higher earnings multiples for worse financial performance. This is a company that can grow cash flows at 25%+ pretty sustainably with a strong business model, trading today at 38x EV / LTM FCF. I think it can pretty easily be considered cheap relative to many software comps — they’ve got those attractive software margins, recurring revenue, high growth, strong cash flow generation under a capital-light fixed cost model, and perhaps most importantly, they are not heavy dilutors and have very reasonable capital allocation.

There is a pretty good chance that RDVT gets bought out by one of the larger players in this space. TRU specifically is a serial acquirer at this point and they make $500mm in annual FCF, almost RDVT’s entire market cap today. It’s not a huge stretch to see RDVT getting acquired by a firm like TRU somewhere down the line — many of the other large players in the data intelligence space are notable acquirers as well.

This industry has pretty significant barriers to entry. Any new entrants to the scene who want to play against RDVT will need to accomplish the following:

1: Convince the large US credit bureaus (TRU, Equifax, Experian) that you can safely and securely disseminate personal information on millions of Americans to selected interested parties. Obviously there are massive compliance, cybersecurity, and InfoSec regulations in place here, and the credit bureaus aren’t giving this data out willy-nilly. RDVT takes security extremely seriously — for many new customer adds they’ll literally send a 3rd party to would-be clients HQs for a site visit to verify that they do indeed want a client relationship with RDVT, and that they can securely and safely handle the kind of information that RVDT sells.

2: It takes a while to build one of these companies from the ground up. RDVT had to invest about $50mm over 5 years during development before their IDI product could even reach commercial scale and begin generating some real revenue, and even then it took a few more years for them to reach GAAP profitability. What would-be competitor wants to sink $50mm into a project that’ll be 5 years away from revenue, especially against a team of people that have already done this successfully 3 times?

Also, I’d like to mention here that this trade is a little more immediately actionable than my usual writeup. RDVT reports earnings tomorrow after hours, and I have a strong feeling that they will beat numbers. The stock has come down a good bit from its last earnings pop and it’s sitting right on a long-term support trendline, just above the 200 day moving average. This technical support factor along with an earnings beat and potential for data asset contract resolution (mentioned below) could cause shares to see a decent pop if they do beat estimates.

Risks

Data licensing: Per their 10-K, RDVT gets 44% of its data assets from one source (probably credit header data from Equifax). I see this as a pretty small risk. These data assets are under long-term fixed cost contracts, and this big contract has a term of 5 years and is up for renewal within 12 months or so. RDVT has had a very long-term relationship with this company through it’s previous iterations (Seisint, TLO) and they have began renewal negotiations early, expecting to renew flat on price — their last contract renewal with this vendor was flat on price.

It may sound crazy that this vendor isn’t increasing price on a high-growth client like RDVT, but data is fundamentally a commodity. If this vendor raises price too high on RDVT, the company has multiple tier 2 and tier 3 sources that they can aggregate and move up to a tier 1 source to replace the data from this one vendor. This vendor knows that RDVT doesn’t strictly need their data, but instead they’re just earning a bit of extra revenue from RDVT on this data that they wouldn’t use for the same purposes anyway; it’s a win-win relationship.

The fundamental thing here is that data is everywhere, it’s a commodity. As RDVT’s management team likes to say, “Data is carrots and onions off the shelf. IDI is our proprietary carrot and onion soup.” This is why I said in the tagline of this report that RDVT is essentially turning a commodity (data) into highly scalable, high-margin cash flow streams.

Either way, RDVT’s management have stated that they hope to update us on the renewal status of this contract with their next earnings report on August 6th, so, tomorrow by the time this writeup hits your inbox.

Consumer backlash potential: RDVT operates in something of an interesting industry — most people don’t know this company exists, and frankly speaking, probably shouldn’t. Obviously everything the company and it’s competitors do is fully legal and highly regulated, but still, a lot of people understandably aren’t thrilled about having their personal information brokered and sold to interested parties.

This has led to some legislation, stating that in specific states, the company and its competitors must remove all personal data on an individual if said individual contacts them to request so — they’ve even got a data removal request portal on their website.

There are even new startups like Incogni that will mass-request data brokers to remove users personal data, though these companies are still young, and I imagine the amount of people who use or even know about these products is scarcely few. Still, this is a risk — a database is only has good as the data it’s aggregating. If too many people request data removal from RDVT and its competitors, the industry could struggle.

I don’t think there’s any risk of federal regulation here, necessarily. Versions of Seisint and some other key database products are still used by agencies like the CIA to hunt domestic terrorists. These systems are deeply imbedded into federal agencies like the CIA, FBI, and law enforcement agencies at the state, local, and federal level. These systems aren’t going anywhere, especially under this Trump administration, in my opinion.

Products & Services

RDVT’s core product offering is the IDI platform, which has numerous sub-applications tailored for certain industries. IDI is the core data fusion engine that powers all of RDVT’s identity solutions.

IDI is essentially an “identity graph” that uses vast quantities of data to build a 360-degree view of every adult consumer in the US. If you’re over 18 and you’re reading this from the US, there’s something like a 99% chance they know quite a few things about you.

The data that IDI inputs can come from many different sources; these include publicly available datasets like obituaries and death records, bankruptcies, liens, judgements, business and asset ownership history, and more.

Other datasets are licensed to RDVT by other data brokers, typically under generous unlimited usage agreements, like credit header data. RDVT signs long-term data licensing contracts and is allowed to use these datasets as much as they want to provide identity solutions to clients. These datasets may include things like IP and location records, metadata from data collection vehicles like mobile devices or websites, or tax and income metrics, credit data from larger credit reporting agencies like Equifax and TransUnion.

The last source of data assets is proprietary and learned data. If RDVT can find new connections between disparate datapoints in licensed or publicly available datasets, they get to keep the learnings generated, even if the license expires and they have to return that dataset to it’s original owner. All in all, the IDI platform incorporates many thousands of different data sources to form a view of every adult consumer in the US.

Probably the most basic of data sources is credit header data, anything that appears at the top section of a credit report from the likes of Experian or Equifax. The data these headers include is any names and aliases, addresses, SSNs, and they are highly vetted and constantly updated to be accurate. These are like the most basic, most distributed data sources from which other datapoints are connected to generate insights.

In aggregating this much data, IDI is able to provide insights on US consumers with a high degree of accuracy, across many different verticals and use cases. Let’s run through some examples:

Say you’re a collections agency working to recover bad debts sold to you by a bank or another financial institution. When banks have these batches of bad debts and unrecoverable loans, oftentimes they’ll sell these debts in batches to collections agencies to clean up their balance sheet and make some money off the sale if they can’t collect on the loans.

These debt collectors will then come to IDI and run a batch process, essentially uploading this dataset of thousands of bad loans into IDI at the same time. They need to see; where these debtors are, what assets they have, and more importantly, whether or not these debtors have declared personal bankruptcy — there are heavy fines as high as $10,000 per account imposed if debt collectors contact individuals who have declared bankruptcy, so IDI helps debt collectors screen out bankrupt accounts, and it aids in the recovery and identification of other assets that may assist in debt recovery.

RDVT initially got started selling this technology to small and mid-market collections firms, and the collections vertical remains a large contributor to total revenue today (around 20%).

Another use case could be for marketing or identification, specifically in the real estate industry. If you’re in the real estate industry and need to know who owns certain plots of land, IDI can help you find and name any individuals who do.

It also allows for more in-depth scans of the larger US consumer base, such as: “Find me all individuals over 65 years of age with significant home equity,” if you’re in real estate and looking to market or buy homes from these folks.

For law enforcement and investigations, the potential here is obviously immense. Using IDI, law enforcement agencies can quite literally type a name, phone number, or license plate into the database and pull up a full dossier containing all relevant information on the selected individual. This sort of data searching is how the US Government tracked down the individuals responsible for the 9/11 attacks, and how they locate and profile criminals and other bad actors on US soil.

There is also your basic potential for corporate risk and identity verification. If you’re a company that needs to verify identities for transactions to weed out fraud or reduce risk, IDI and the competing solutions like it can help you do that with the push of a few buttons. Running a basic ID verification query through IDI might only cost a few dollars per click, whereas a fraudster or scammer targeting your company and successfully exploiting your resources could cost many thousands of dollars.

There are a few main ways that customers can tap into the IDI database, including batch processing (mentioned in the collections example above), or API connections that can query the database once or twice automatically on a programmatic basis. IDI also has mobile application solutions, such as the ones included in their law enforcement and FOREWARN offerings.

RDVT has developed an app that allows law enforcement officers to input data such as a partial license plate, various demographics, and a general location into the app, and the database can drop pins that correspond to the locations of individuals who fit the criteria. This supplemental app has seen great reception from law enforcement agencies that have tried it out, and today Red Violet is barely penetrated into the 15,000 law enforcement agencies between federal, state, and local levels, leaving plenty of contracts yet to win and plenty of sticky public sector growth yet to come.

Unlike it’s larger competing products, IDI is virtually infinitely scalable through API connections and a cloud-native architecture. The database is dynamic and can scale or descale queries in sync with customer usage — customers don’t need to pay for too much data they don’t need, or too little data, as is sometimes the case with other solutions in this space. Instead, customers can dynamically access the data they need, when they need it, in whatever quantity they need it.

IDI also has advantages in its data quality thanks to its AI and machine learning driven foundations. Using machine learning, IDI can connect disparate datapoints together to find new insights that wouldn’t immediately appear when you’re just scanning a vast dataset full of random datapoints.

Here’s a recent snippet of IDI being demonstrated to potential law enforcement clients that I found on LinkedIn:

Though the image is rather blurry, if you zoom in on the IDI display you can glean some interesting information into how the product is built and how it may be used by law enforcement agencies.

Here is also a product demo of IDI being shown to private investigator clients as a sponsor of the YouTube channel PI Education — this video contains some great information on IDI and its advantages from one of the company’s database engineers, and I highly recommend giving it a watch.

“My C-level executives are sitting here every day, wanting and continuing to build the best database, continuing to evolve this product.” — Neil Cadell, IDI database engineer

RDVT’s second main product line is FOREWARN, a safety and know-your-customer app tailored to realtors and the real estate industry. This is essentially just a version of the IDI database that runs on a mobile app, but it uses the same core technology that powers IDI and all of RDVT’s other identity solutions.

When realtors get a call to show houses to any individual, they are basically going to meet a near-stranger who might have any number of past criminal charges. It’s relatively rare, but there have been a few tragic cases of kidnappings and murders of realtors when they go to show homes.

FOREWARN is rapidly penetrating the realtor associations market and is essentially a monopoly product as a preventative solution. There are competing products like panic buttons, but those typically are activated after an adverse event has occurred, whereas FOREWARN is a preventative solution that filters out potential adverse events before they occur. If FOREWARN keeps growing like it is, it could penetrate the remainder of the market within a few years.

I’ve heard testimony from multiple sources connected with realtors that FOREWARN is somewhat essential and some subreddit searches confirm this to be true as well.

This testimony includes “My aunt is a realtor, she said FOREWARN is essentially mandatory,” and “All my real estate buddies swear by forewarn,” from folks I know on Twitter.

No database is perfect, but FOREWARN is pretty good at what it does. Beyond an 80% hit rate, experienced users will filter for multiple potential key phrases to get a better idea of who they might be showing a home to. One search might not be perfect, but a few searches of a few keywords should do the trick.

There are around 900,000-1,000,000 active realtors in the US, so if growth continues as it has with the products market awareness increasing, FOREWARN may fully penetrate the market or reach peak adoption within 3-4 years. I think they may have some pricing power, especially as a monopoly at peak saturation, raising prices should be fairly simple which may allow for moderate annual revenue increases, but that’s less certain.

Fortunately, management has identified a few potential new verticals for FOREWARN, such as screening matches on dating apps for abusive or criminal histories. Would you pay $5/month to avoid being catfished, scammed, or worse when meeting a near-stranger for a date? There is definitely potential for a product like this one if they can get the regulatory approval for it, which may not be certain. Really, FOREWARN is just a mini-background check in the palm of your hand — there are a lot of potential applications there.

RDVT’s engineers are also working on a potential new product that aggregates signals from various verticals they serve, like default and collections activity, to warn other firms of potential warning signals in their target markets. Essentially like a consumer and credit risk analytics product, which does sound really promising given the amount of data and insights that flow through the IDI platform on a daily basis. Management has a multi-year product road map in place, and they are pretty long-term in their thinking around product improvement and continued innovation.

Business and Financials

“Buy data once, and a broker can sell it a dozen times, a hundred times, a thousand times. It’s a business without any ceiling.” — The Hank Show, McKenzie Funk

IDI generally generates revenue on a per-click basis, where a single query through the database might cost $1-2, though the company has minimum usage agreements in place with most customers to ensure that revenue is relatively linear. These contracts are subscription-like on a 12 month basis, with autorenew on by default. FOREWARN generated revenue on a purely subscription basis.

I really like RDVT’s financials, and I like their capital allocation. Here are some highlights before we dive in a bit deeper:

Revenue is on a 36% CAGR since 2017, growing 25% in 2024 with potential to accelerate near-term growth over the next couple of years through increased adoption of FOREWARN as well as IDI law enforcement contract wins.

RDVT sports an impressive 96% gross revenue retention, with a demonstrated ability to land and expand as customers integrate IDI’s solutions into more and more of their daily workflows. The company’s reported number of customers bringing over $100K in annual revenue has increased meaningfully as they shift up-market, from 96 in Q4 to over 105 in Q1.

Gross margins exceed 80% and could potentially scale to 90% pending data acquisition costs — the biggest cost of goods sold here is data, which RDVT either owns outright (costs nothing) or licenses from other data brokers under generous long-term fixed cost contracts. This means that each incremental dollar or revenue RDVT can bring in from the same data assets comes in at nearly 100% contribution margin (contribution margin = revenue - variable expenses, essentially measuring how well revenue can cover fixed costs as a business scales. A 100% contribution margin is very high and a rare setup, even for software).

So essentially you have a highly scalable business with low fixed costs, which leads to a fantastic margin structure. Gross margins already exceed 80% which is generally great for software, and RDVT’s 2024 FCF margin (including capitalized data costs) was just over 19%, and rapidly scaling up from 10% in 2023. Much like RDVT’s income statement, these capitalized data costs don’t really increase much as revenue scales, meaning FCF margin should continue to increase in kind as revenue continues scaling.

Taking that FCF margin and the company’s rapid revenue growth, we can derive a ‘Rule of 40’ score of 44, which shows healthy growth and strong profitability working together to drive significant shareholder returns. I see that Rule of 40 score increasing in the coming years as RDVT maintains strong revenue growth (20-30%) and FCF margin increases closer to 30%-40% over the long term.

I really like the fixed cost model and the long term margin profile of the business. This truly is a fixed cost business; all you are paying for is data under fixed pricing, and some employees in data engineering, infrastructure, and administration. The company has hired more employees in recent years (up from 170 employees in Q1 23 to 216 in Q1 25), mostly in sales and marketing functions, though their operating margin has expanded meaningfully (8 points in Q1 YoY) despite this additional investment into growth.

RDVT’s revenue isn’t strictly SaaS, but it is 74% contractual with minimum usage agreements in place. Revenue isn’t recurring, but still re-occurring which leads to that typical high software revenue predictability that the market pays a premium for.

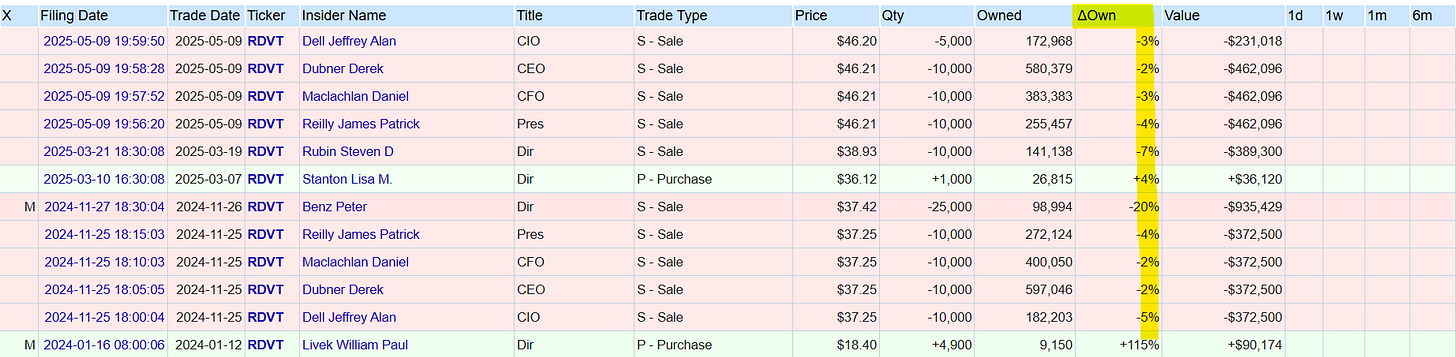

RDVT is debt-free and has a clean capital stack, with only one share class outstanding. Common shareholders are right in line next to management with stock ownership; management owns 9% or so and they rarely sell shares, and in small size when they do, which is encouraging.

Management and insider ownership:

Very small insider sales, likely for tax purposes:

The company paid a 30¢ special dividend in February of this year, which opens up the path for further capital returns past the company’s share repurchase program. I took this as a really nice sign that management is considering stronger capital returns at some point in the future once the company has scaled significantly more; at the very least, they are thinking about and open to returning more capital which the market should appreciate. Many small and mid-cap software companies don’t return capital through a dividend like this.

One thing that I think really sets RDVT apart from other software in both small and mid cap, is that they are not heavy dilutors. In 2024 SBC was under 8% of revenue which is generally ideal, and most quarters the company will buy back shares to counteract this issuance. Total shares outstanding have increased by less than 6% since 2022. You can contrast this to a lot of other software across the size spectrum where SBC is over 10%, even 15% of revenue, and dilution is much higher.

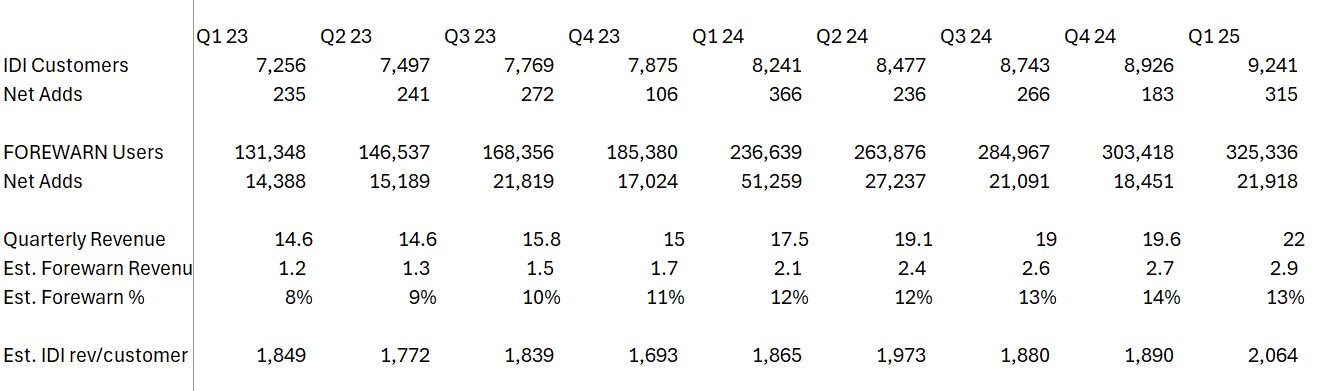

Now, let’s approximate some segment-level growth numbers:

Management says that if an individual realtor calls them up to use FOREWARN, they’ll charge $20/month. Whereas for the MLS and realtor agencies FOREWARN serves that can bring in thousands of realtor users under one contract, FOREWARN is priced “significantly lower” than $20/month per individual user.

FOREWARN ended Q1 25 with ~325,000 realtor users (the vast majority being bundled into contracts with realtors associations) — I estimate an average price per user of $3/month, which would have produced $2.9mm in Q1 25 revenue, roughly 13% of RDVT’s quarterly revenue. This was the big thing that I got wrong about the company at first — I assumed their reported ‘contractual revenue’ was referring to FOREWARN being a subscription service, instead of referring to IDI. RDVT doesn’t disclose exact revenue breakdowns between product lines or customer verticals, so I didn’t have much to go off, so I assumed 75% contractual revenue meant 75% of revenue was from FOREWARN. But this commentary from management around FOREWARN’s pricing cements the fact that FOREWARN is likely between 13-18% of revenue — 13% at $3/month/user, 18% at $4/month/user.

Thus, we know the remaining quarterly revenue (roughly, these are estimates) is coming from IDI with its 9,064 ending quarterly customers and significantly higher ARPU. That puts IDI at around ~$2,000 in revenue per customer per quarter.

Now, IDI quarterly customer adds haven’t seen that same hockey-stick growth like FOREWARN has, but based on the above assumptions, my Excel napkin-math shows it’s likely that IDI’s revenue/customer is increasing a good bit, consistent with the company’s move upmarket.

An important note here is that a lot of the larger enterprise customers and public agencies IDI is now targeting have longer sales cycles than the smaller, mid-market firms they started targeting, but as my napkin math shows, it’s likely that these customers bring larger accounts and higher average revenue per customer.

IDI is adding customers at a 17% 6-year CAGR, and assuming FOREWARN is priced at an average of $3/user, my napkin math shows IDI revenue on a 16% 3-year CAGR.

FOREWARN users are increasing at a 61% 6-year CAGR, which is why I think they will quickly penetrate the remainder of the market with a monopoly position as there are no competing proactive solutions and it would be difficult to create one without RDVT’s data engine.

The TAM here is really large, and RDVT still has plenty of customers and contracts left to win. IDI has just under 10,000 customers, whereas LexiNexis and TransUnion have hundreds of thousands of customers between them.

This target-rich TAM as well as the company’s strong growth and fixed cost model have led to some fantastic earnings growth:

One thing to note on the chart above is that RDVT saw a large $9.7mm tax benefit in 2023 which boosted non-operating earnings significantly. Excluding this one-time benefit, their earnings growth over each year looks much more attractive and normalized. The operating margin % supplemented above demonstrates significant and continuing margin expansion.

All this to say, I think RDVT simply has strong compounder potential and has plenty of room to grow revenues while expanding margins, leading to nice shareholder returns. I think the capital structure is clean, I think management know what they are doing, and I think the company will see more interest from institutions and other investors once it crosses the $1Bn market cap threshold and the shares see more liquidity. I’m long at 26% allocation at an average price of $43.69. Welfare out, I’ll be writing you all again sometime soon.

hi, thanks for your deep dive. could you share which earning calls/conference the management said FOREWARN is priced significantly lower for MLS and agencies?