Disclosure: This is not financial advice. If you like the idea, conduct extensive research and consult a financial advisor before making any investment decisions. All investments, including this one, carry the risk of financial loss. I own Rocket Lab stock, thus I am biased in favor of the company and one should view this article through that lens. This article comprises my personal beliefs and convictions around owning any securities mentioned, and is not intended to be used as a recommendation to buy or sell any securities. Please be careful everyone.

Alright, ladies and gentlemen. Prepare for liftoff, because we have a lot to cover this update. The past quarter has been a momentous one, to say the least - RKLB is now up around 150% from the release my August Deep Dive - an absolutely insane run that I wasn’t remotely expecting. I’m going to try my best to remain objective in this article, given how much the stock has run up since the first one. I just find it best to keep expectations tempered if at all possible, especially given overall market and sentiment conditions at the moment. I can’t promise any of you the Moon here, but I can recap this amazing quarter… so without further ado, let’s get into it.

Table of Contents

Quarter Highlights

Neutron Updates

Financial Highlights

Space Services Developments

Quarter Highlights

Since we last spoke, RKLB has launched Electron mission #53 for Kineis (a French IoT company) and #54 for a confidential commercial customer. Both launches went off without a hitch, bringing my adjusted launch success rate to 94.4% - 51 successes and 3 failures.

RKLB announced the first Neutron bookings, from a confidential constellation operator! I’ll speak more on that point in the Neutron Updates section.

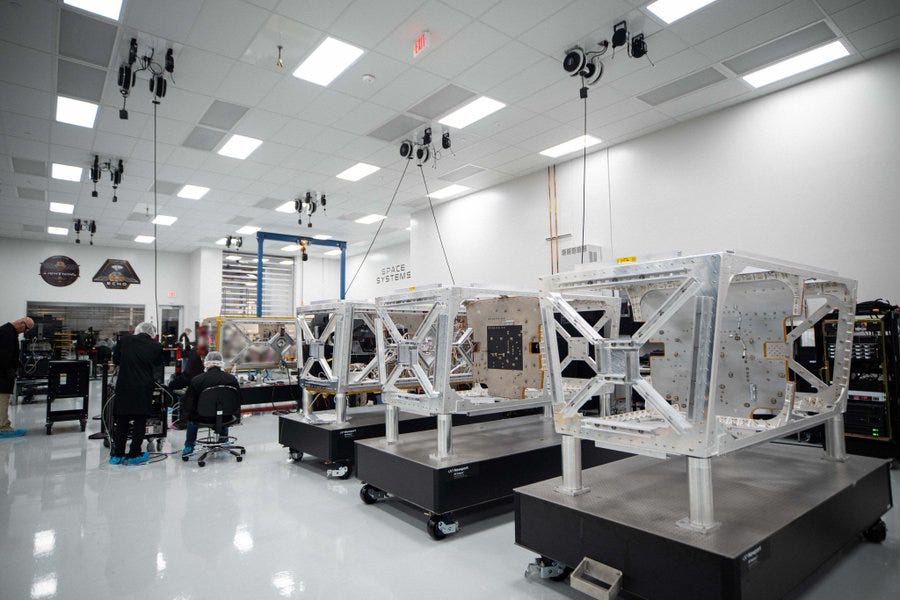

On the Space Systems side, RKLB completed their second spacecraft for Varda Space, another factory-pod that will be used to grow pharmaceutical crystals in Earth orbit. RKLB has also ramped up production lines for their constellation class Lightning spacecraft at the company’s Long Beach HQ:

Synspective, a longtime Electron customer, just finished building their 3rd SAR satellite factory and will probably be booking launches at a higher rate in the future. You’ll read a little more on them later on in Space Services Developments.

Other quarter updates:

RKLB is currently hiring for 300+ positions across engineering, propulsion, testing, design, vehicle assembly, GNC, communications, finance, logistics, mission operations, and more. CEO Peter Beck said in a promotional video, “Don’t expect a 9-5. But do expect to have an actual, meaningful impact on the world.”

Launch 54, 12th launch of 2024, went from contract signing to launch in under 10 weeks - an extremely impressive turnaround that only RKLB is capable of in small launch.

The long-awaited Europa Clipper launched in October aboard a Falcon Heavy, carrying solar panels supplied by SolAero, now a subsidiary of RKLB

ESCAPADE launch postponed due to delivery timeline issues of Blue Origin’s New Glenn vehicle (I suspected this would be the case back in August). There is a timeline where Neutron ends up launching the ESCAPADE orbiters to Mars, and I really wish we were living in it

RKLB’s in-space flight software, offered through subsidiary Advanced Solutions, has now racked up a cumulative 242+ years in space

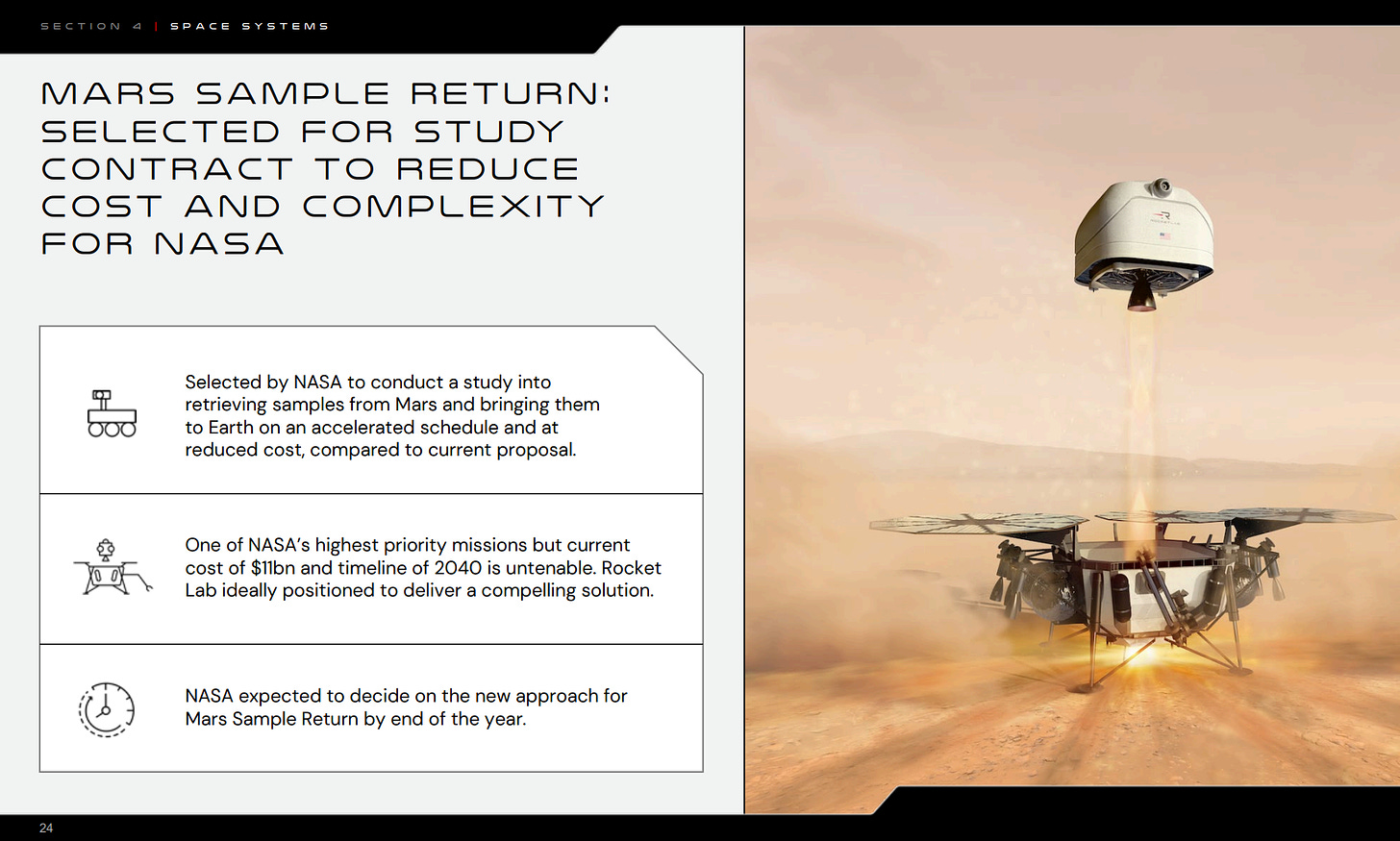

RKLB was awarded a $500,000 NASA research contract to explore the possibility of building a Mars Sample Return system

They currently have builds underway for a backlog of over 40 spacecraft

Electron’s average price/launch is now up 60% from first launch in 2017 to $8.4mm

CEO Peter Beck believes that the recent presidential election is a tailwind for the company, saying on CNBC that “The administration has a very strong focus on space and national defense, and when space does well, Rocket Lab does well." He went on further to say, “There’s an even stronger focus on highly efficient contracting and outcomes for taxpayer’s dollars in the space domain, and that’s where Rocket Lab excels as well. If you look at our historical government missions, they’ve always been at price points and timelines that I think this administration will find very attractive.” To get a little more color on the implications of this election on broader space policy, I’d really recommend Scott Manley’s summary on YouTube

RKLB is in a strong position to be awarded satellite contracts for SDA’s upcoming Tranche 3 layer, requiring 200 satellites - RKLB was previously awarded $515mm to build 18 satellites - if they can snag more contracts this time, they could snag much more than $515mm

Neutron Updates

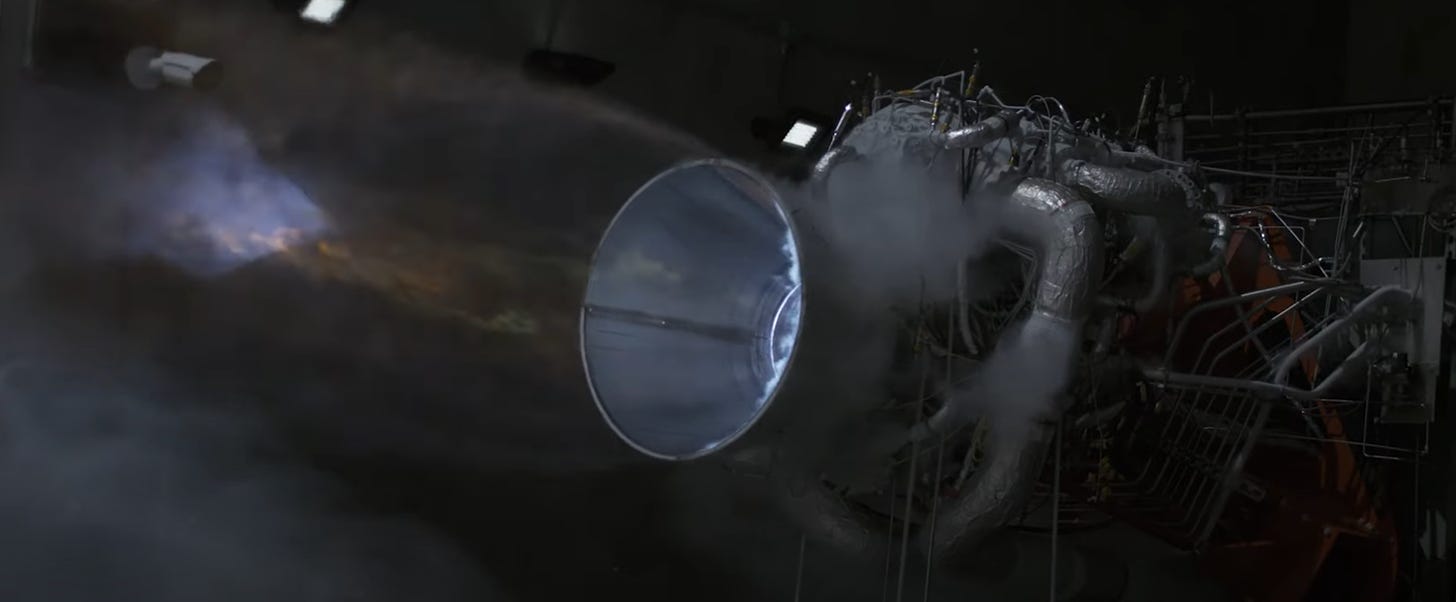

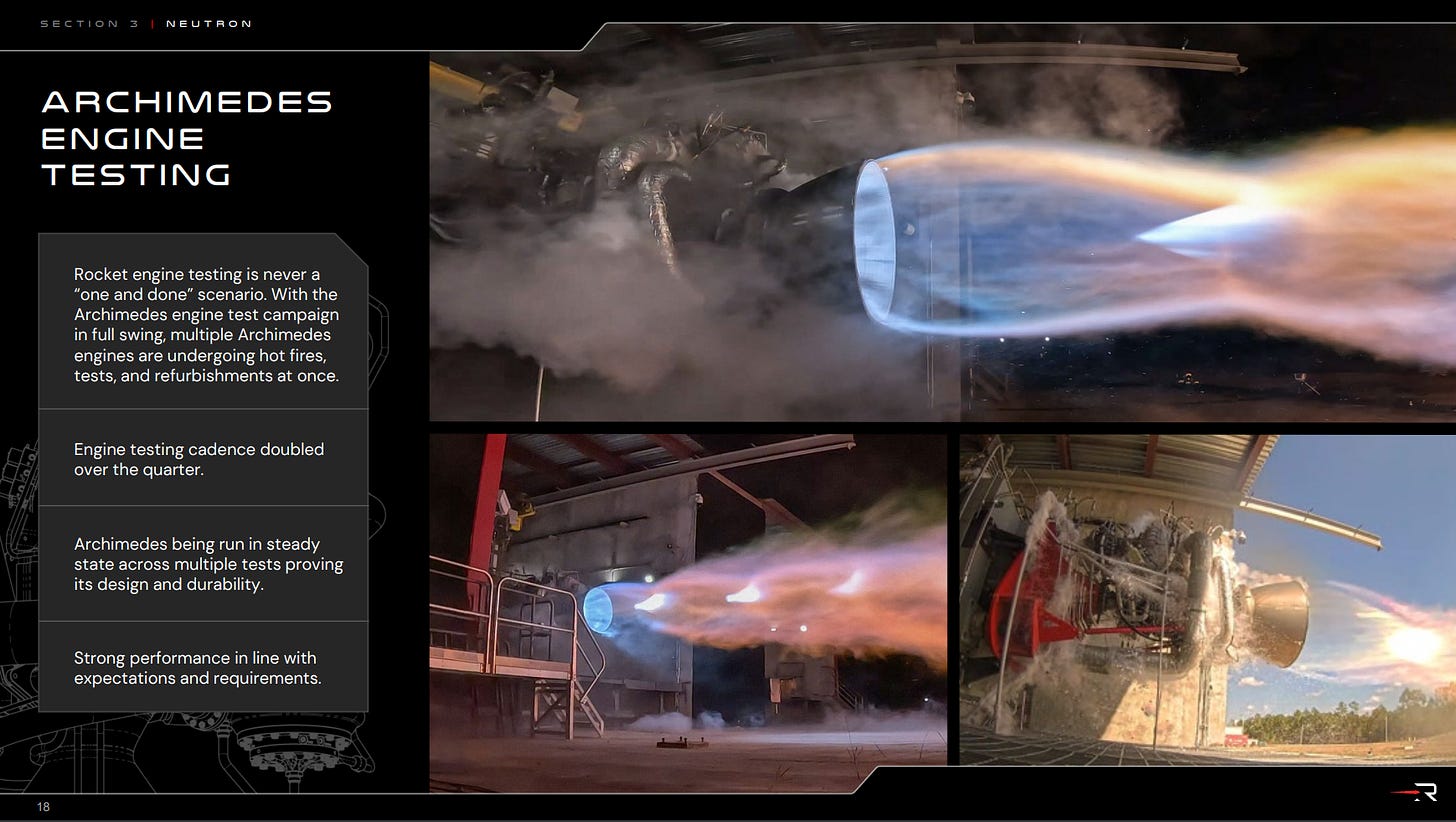

The biggest Neutron development update during this quarter was the Archimedes hot fire video release. To cover some ‘drama’, Rocket Lab was under scrutiny about the timeline of Archimedes engine development. A few allegations were lobbied against the company, including an allegation that an Archimedes engine exploded on the test stand and was not hot-fire ready.

Shortly afterwards, RKLB released a video showing multiple Archimedes hot fire segments, including one 30 second full firing towards the end of the video.

I have a few notes about this release. One, the timing is definitely interesting. The company could have been sitting on these clips for at least a few weeks before releasing the video just as rumors began to circulate. But I’m not going to dip my toes into any of the “burn the shorts” reasoning that’s been suggested for this release, I’ll just say the timing was interesting, is all. CEO Peter Beck had this to say:

Two, I immediately noted that the 30 second full hot fire at the end of the video is rather short. A full duration hot fire is typically two minutes, or thereabouts. That’s not to say that Archimedes couldn’t handle a longer fire, it’s just a little strange they didn’t release one, if I’m being honest.

Three, the obvious green flashes. CEO Peter Beck has clarified, the earlier green flashes were from TEA-TEB (rocket engine starter fluid) burning up, but later on they were caused by a slight instance of an “engine rich” fuel cycle - copper burns green, so typically seeing green exhaust means the engine is tearing itself apart. Beck did clarify that the green flashes seen in these tests were due to a slight copper erosion within the engine, and that engine Serial Number (SN) 3 has a tweak for this issue.

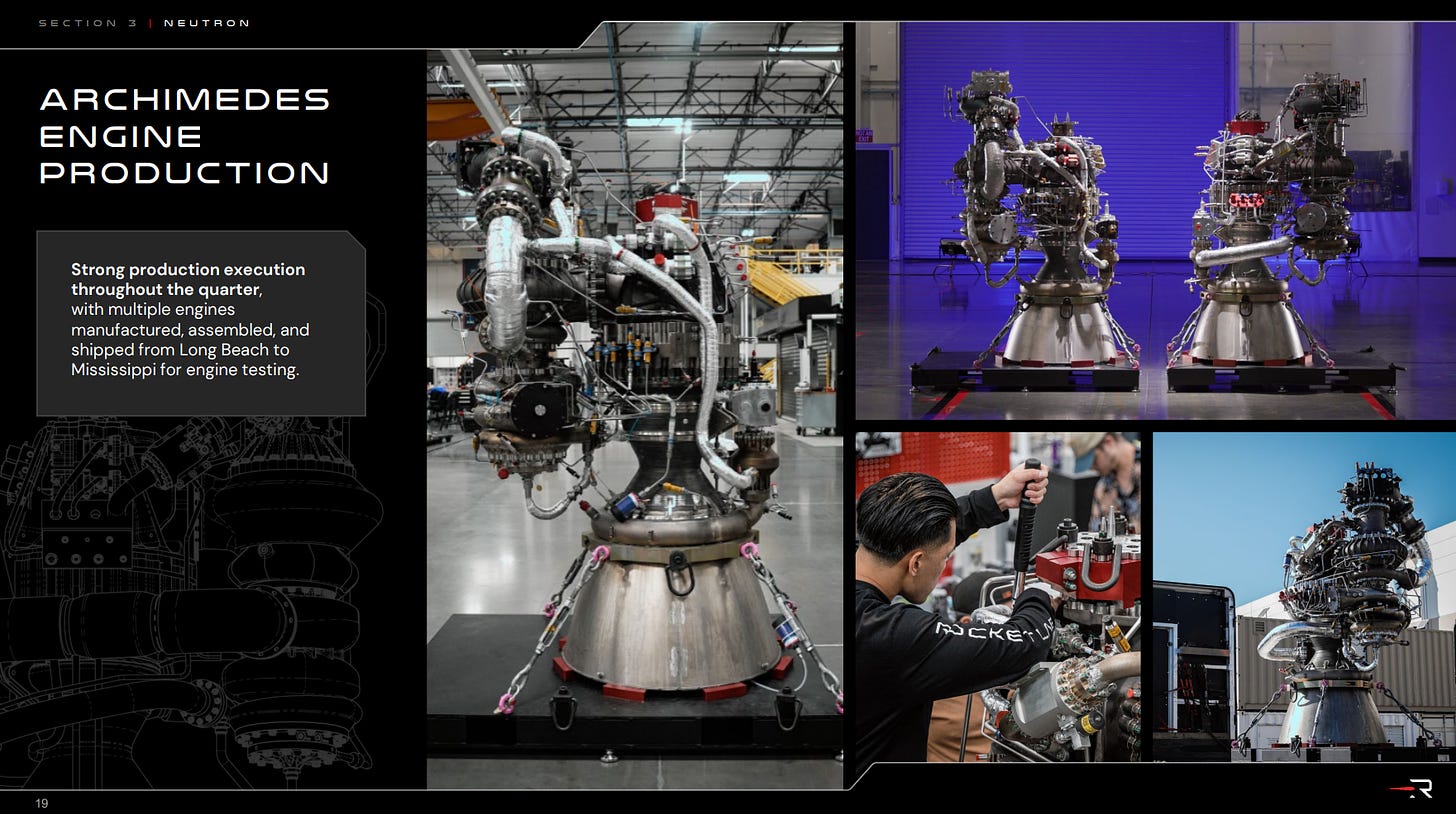

It is believed that RKLB has produced four Archimedes engines to date, of the nine that Neutron will require (though ideally, they produce a few more before the first flight in case of any mishaps).

Remember, 90% of the mass of an Archimedes engine is 3D-printed by the company in-house, which should drastically speed up the overall production process. Given the current pace of production, I would say that RKLB should be able to produce the nine engines required for Neutron’s first flight.

Remember, RKLB is fast-tracking the whole engine development process with Archimedes, using what they’ve learned from the ~500 Ruthorford engines they’ve launched. Archimedes assembly lines have been built out since the first few engines were produced, and if you recall the Deep Dive, some members of SpaceX’s Raptor engine team have come to work on Archimedes.

We have also been treated with a video tour of Neutron’s launch pad, LC-3 at NASA Wallops, from Markets with Madison on YouTube. In addition to the water tower installed earlier this year, RKLB has installed two 90,000 gallon liquid oxygen (LOX) tanks near the pad, and will be installing more as the program scales. They will also be installing two 90,000 gallon LNG (methane) tanks opposite the LOX tanks.

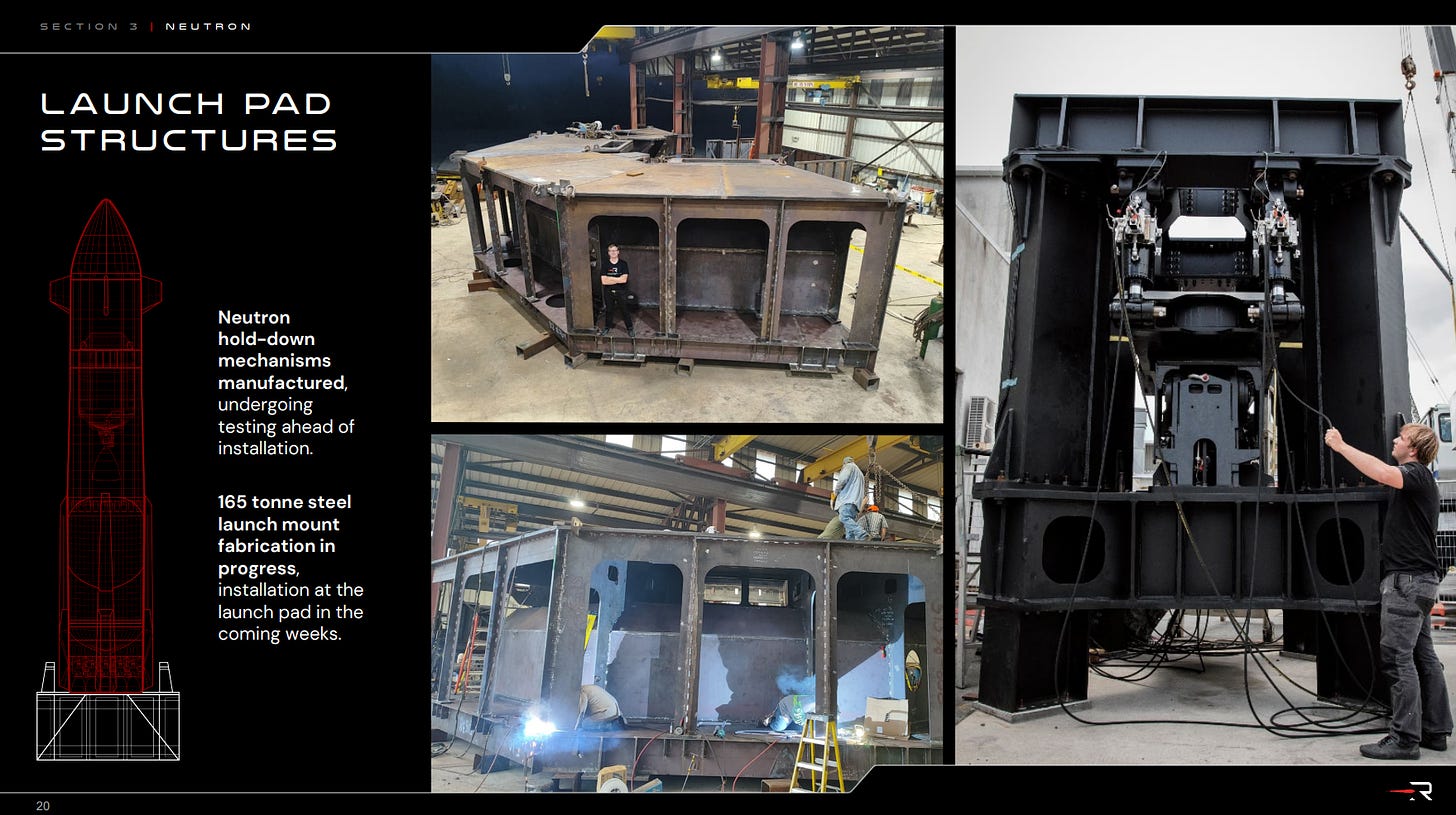

RKLB has also begun constructing the foundation for Neutron’s launch pad, which is currently naught more than a hole with some concrete poured over it, around the size of an “Olympic-sized swimming pool.” Though, this is the most time consuming part of building a launch pad, and now that the foundations are laid and launch stand anchor points are drilled in, RKLB will begin assembling the launch ring, atop which a Neutron rocket will eventually sit. They have already begun fabricating the remaining structural components for the launch ring. Aaron Kuipers, Director of Test and Launch at RKLB, explained that these components will be on the way shortly, and from there RKLB will begin assembling the launch mount. After that, a whole load of plumbing work will need to be done to hook the fuel stores up to the completed launch mount, and other critical systems like fire suppression systems will need to be implemented. There is still a load of work yet to be done to complete the pad before Neutron’s first launch, but Kuipers sounded confident that the work will be competed in time for a mid 2025 launch.

RKLB has completed a wet dress rehearsal (flight simulation fuel and pressure testing) for Neutron’s second stage. The next step will be a static fire of that stage with its single vacuum-optimized Archimedes engine.

First stage tanks are undergoing assembly now as well, ahead of a wet dress rehearsal similar to Neutron’s second stage:

They have also made impressive progress on Neutron’s fairing:

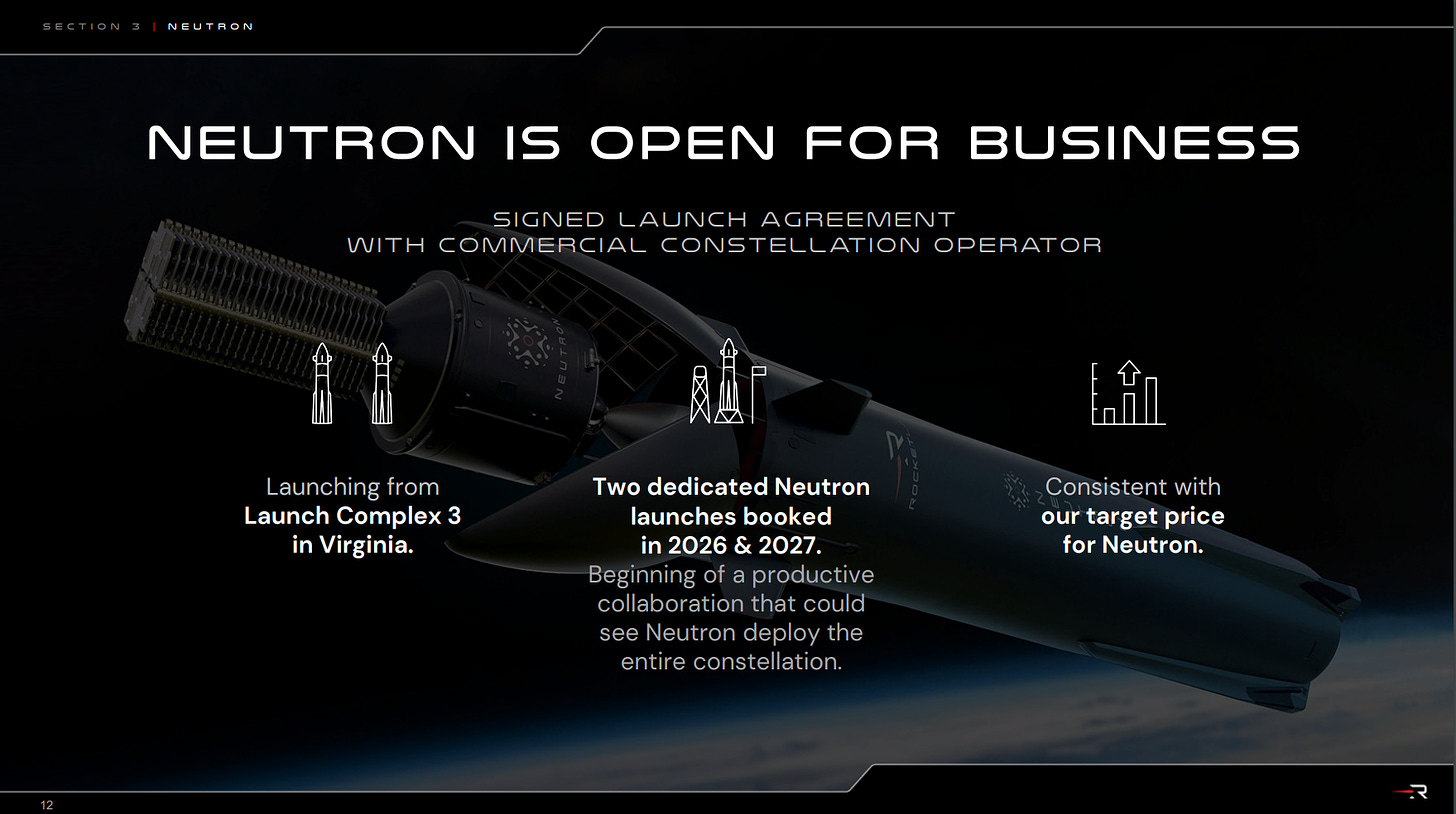

We have also finally seen the first Neutron launch bookings! A confidential constellation operator has booked two launches, one in 2026 and the other in 2027 - CEO Peter Beck stated that this could be the beginning of a fruitful partnership. I’ve seen a number of names tossed around as for who this mystery customer could be, including BlackSky (BKSY), ASTS, and Astrantis. Unfortunately, my crystal ball hasn’t been working for a while, so I have no good idea who this customer actually is, though, RKLB called the launch deal “the beginning of a productive collaboration that could see Neutron deploy the entire constellation.” Sounds pretty promising to me.

Financial Highlights

Here, you’ll learn what I mean when I say I’d like to temper expectations a bit.

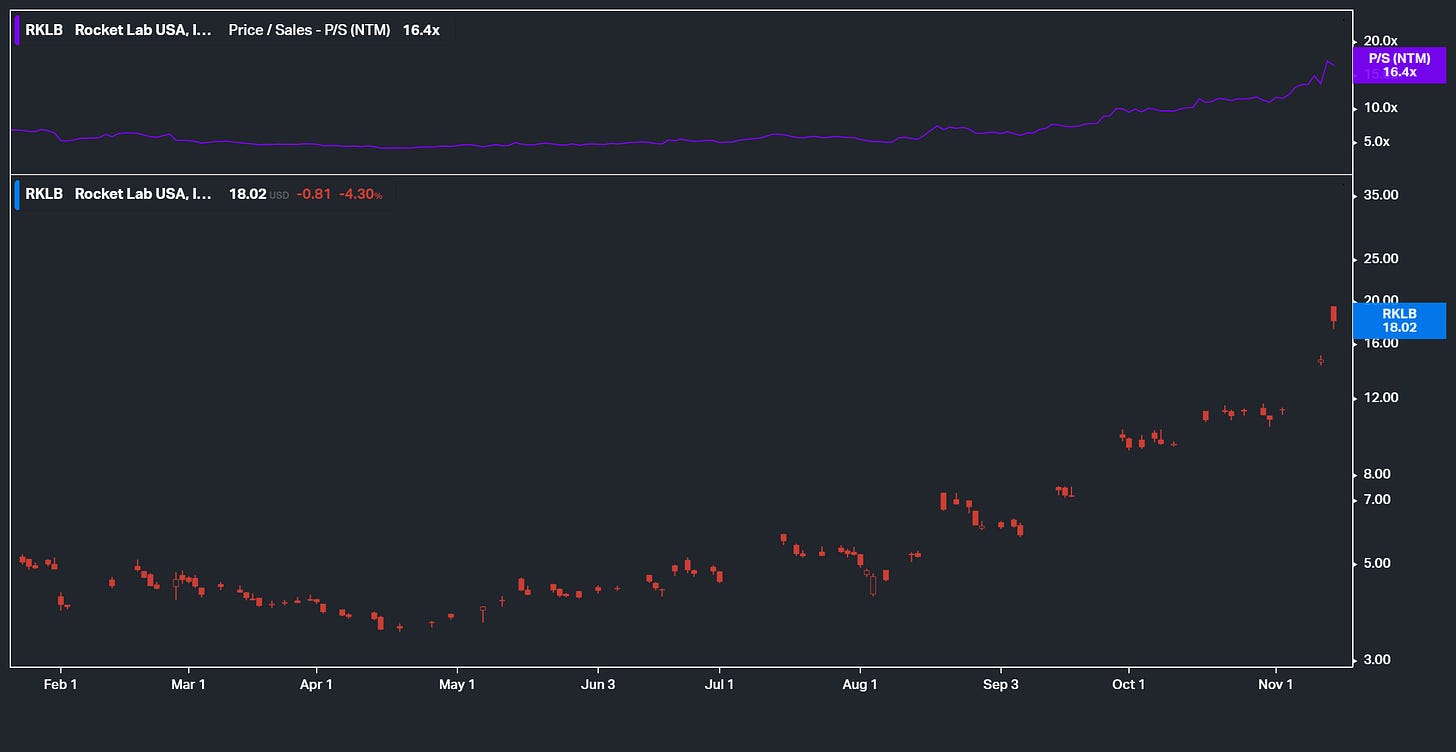

After the Q4 report, RKLB shares are trading around $18 - I think it’s likely that a good amount of the earnings move and associated massive volume spike was due to short covering. RKLB shortable shares are around 60% utilized at IBKR, so the actual short interest number is probably closer to 20-30%, though I imagine that’s dipped by a decent amount now.

I am generally very selective when it comes to the companies I’ll invest in. RKLB is a very neat company, but it’s actually rather far from the typical sort of opportunity I look out for. I prefer to avoid asset and capital intensive businesses, simply because their long-term returns are generally lower than those of asset-light businesses (hence, all the software and financials exposure in my portfolio). Asset intensive businesses are also generally lower margin and are not as scalable as something like a software company. Obviously, rocket development is very, very capital and asset intensive, even if RKLB can do it faster and cheaper than anyone else.

I decided to ignore these selection criteria when it came to buying RKLB. Really, I just love space travel and I’m proud to be investing in the sector. I also have reasons to believe that RKLB’s margin structure will be generally better than your typical "industrials” company. If you recall the Deep Dive, I modeled 2030 gross margins of 41%, and we know that management is targeting net income margins in the low 20s - if those income margins are actually realizable down the road, I’ll have no issues there. Not to mention, any space services business lines the company develops in the coming years will generate recurring revenue at much higher margins.

However: the valuation at these prices worries me a little.

I know the company is likely to grow revenues by upwards of 70% this year, but still, a 16x sales multiple on such a capital/asset heavy business worries me, instinctively. If you recall the same model from my Deep Dive, I expected RKLB shares could return around 25%/year through to 2030 (excluding any Space Services business lines), for a price target of $30. I really wasn’t expecting shares to return 100% within a few months - so we’re now already halfway to my 2030 price target, within a mere few months. Sheesh, guys - I’m impressed, I really am. Still, I’d like to remain as objective as possible and highlight the remaining risks and potential downside that RKLB shares might face. Remember, there are no earnings to create a price floor just yet, and there likely won’t be for over a year. A broad market decline could easily knock the wind out of this rally, regardless of how cool or interesting we all think RKLB is as a company. Not to mention, there is significant risk around the Neutron program. Technically speaking, a mid 2025 launch is possible, but as CEO Peter Beck often says, “it is a rocket program, anything could go wrong.” To blindly dismiss these risks simply because the stock is up would be foolish.

If you recall the Deep Dive, the first line of my thesis reads, “I believe Rocket Lab’s current share price is not accurately reflective of the company’s future prospects and the high probability that it achieves those prospects.” At this time, hovering around $18/share, I think the price is much less attractive for entry positions in the medium term. As I see it, the blistering run we’ve seen over the past few months has come as the market has recognized the impressive potential this company has going for it. Though, nothing of great importance is the case now that wasn’t the case back in August. From a financials and fundamentals standpoint, the picture is more or less unchanged - people are just putting more weight on the company’s future prospects now, as I wrote in the thesis.

Because of this condition, I believe further upside needs to be dependent on one of two things: continued strong topline growth, and improved overall gross margins, leading to enough gross profit to outweigh operating expenses and achieve better profitability, OR Neutron complete success, the sooner the better. Ideally, both will occur. But I never want to rely purely on multiple expansion to justify near term or medium term share price increases. Better financial performance from a company is the best and most solid catalyst for increased upside, in my opinion.

I think it’s important that we all keep our expectations limited going forward. RKLB will be a much bigger deal one day - but that’s half the game with investing, you need to be patient and set realistic expectations of returns. These things take time. With that out of the way, let’s launch into the quarterly financial highlights:

Q3 revenue of $105mm, up 55% YoY

GAAP gross profit of $28mm at 26.7% GM

Backlog at $1.05Bn, up 80% YoY and unchanged QoQ - 50% to be recognized within 12 months, 50% beyond 12 months

net loss of 10¢/share, $32mm in SG&A expenses and $48mm in RnD expenses

$42mm operating cash flow loss - between RnD and Capex, Neutron cost $44mm in Q3 as per CFO Adam Spice on the earnings call

So it would seem, on a net income basis, RKLB is hovering close-ish to profitability if we exclude any Neutron spending. The company guided quite well for Q4, forecasting revenues of ~$130mm, which would be a 110% YoY increase from Q4 2023 - though, there is a particularly high amount of launch revenue expected in Q4, with anywhere from 4-6 launches expected, compared to the 3 in this quarter. They also guided GAAP gross margins to ~27%, a notable step-up and closer to management’s target of 30%, and for GAAP operating expenses of $85mm - consistent with a ramp-up in Neutron spending as we head into the launch window target. What I’m getting from this is the the extra launch revenue next quarter is likely at higher gross margins than space systems revenue - we know that 24 Electron launches/year should be profitable, and 17 launches or so might just be close enough to that to raise the gross margin a point or so.

I’ve decided to eschew the modelling updates for this quarter, partly because I’m lazy, but mostly because I don’t think it really matters. Models have a very limited amount of predictive power in my experience - my last one certainly failed to predict a 150% increase in the share price within 2 months. Also, it wasn’t a great model to begin with but I digress - onto the next section.

General Market Developments

The general space markets have heated up substantially since August, much like RKLB shares. AST SpaceMobile (ASTS) declined nearly 50% after a massive run, for one, and SpaceX shares owned through closed-end fund DXYZ were ripping as well after Trump’s presidential victory. It’s also worth noting that Redwire (RDW - a satellite components maker) has seen it’s own impressive returns. So far, the only other company matching RKLB’s pace is Intuitive Machines (LUNR):

Specifically honing in on ASTS here. The stock ran all the way up to $38 in mid August, then down to the low $20s over the 2 1/2 months since. Shares were down around 8% after the election due to, as far as I can tell, increased scrutiny around launch availability. Investors seem to be worried that ASTS won’t have access to launch if SpaceX presses their control over the medium launch market at the moment, especially with Elon Musk now heading up a government task force. Until Neutron is launching at a reasonable cadence, which is likely 3-4 years out, a SpaceX Falcon 9 remains the only reasonable choice to launch ASTS’ BlueBird communications satellites, and shares seem to have been depressed as a result.

I really just think this speaks to the importance of Neutron as an upcoming medium-launch class vehicle. Constellation operators like ASTS and AMZN’s Project Kuiper would be uncomfortable relying solely on SpaceX to launch their constellations, given how prolific Starlink is. Blue Origin’s New Glenn should help in this sense, but that vehicle is also unproven as of yet, and as we all know, rocket development timelines are famously unreliable - they’ve already delayed it once and pushed back the ESCAPADE launch (which makes me more angry than it probably should - I want to see more RKLB logos on and around Mars). I’ve seen some speculation that ASTS is the confidential customer that booked two Neutron flights, or that it could BlackSky with a few more SAR satellites - either way, it’s clear that the launch market is heating up, and that a lack of demand will not affect Neutron’s launch cadence in the slightest.

Space Services Developments

In this section, I’d like to shine some light on the already-impressive developments that RKLB and other launch providers are enabling for the budding Space Services markets. Specifically, I’ll be highlighting four RKLB customer constellation operators: two providing SAR imaging and two providing other services. I think SAR imaging specifically will be one of the most important technological revolutions of the coming decade, but I see very few people talking about it today.

But first, what is SAR imaging? Synthetic Aperture Radar (SAR) is a technique in which a radio wave is swept back and forth along a dish in such a way that repeated scans can generate a “synthetic aperture”, allowing one to compile these radio scans into a single, cohesive image. If you put these scanners on satellites, it becomes trivial to image any location on Earth, where before this technology was generally flown on airplanes and accessibility was dependent on weather or location. If you want a much better idea of how SAR works, I’d highly recommend this primer from Scott Manley.

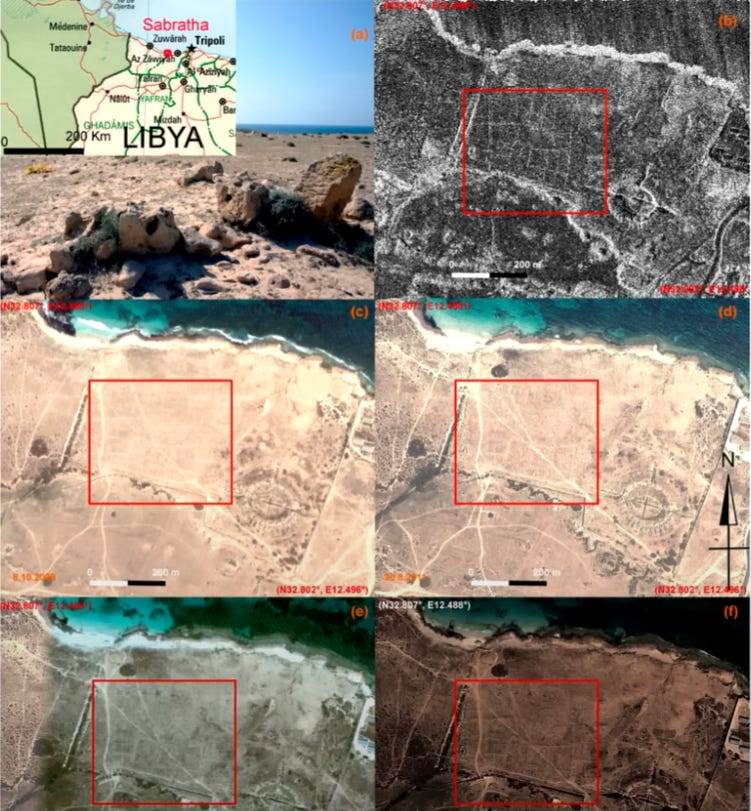

The main difference between SAR and optical imaging is that radar can penetrate clouds and “see in the dark”, so to speak. So, you can generate images of any location on Earth, no matter the weather and no matter the local time. Radar isn’t great at penetrating surfaces like the ground, buildings, or containers, but optical imaging can’t penetrate these mediums at all - which is how scientists used SAR to penetrate Venus’ cloud layer and generate scans of its entire surface. Archaeologists have also used radar ground-reflections to find ancient cities:

SAR imaging can be used to scan farms and plantations, and when combined with algorithms that can determine crop yields and density, one could get a much better picture of global agricultural production. SAR can be used to scan oil refineries and storage sites across the globe, using the radar resistance of specific containers to estimate the amount of oil stored:

If you can observe and scrutinize literally every detail of the Earth’s surface in real time, around the clock, the implications will be massive. Economic actors could generate a cohesive model of global shipping patterns, global transit and air travel, global commodities stores, human movement and parking patterns, and so much more.

Imagine the implications for disaster response! Cloud cover from hurricanes could be a thing of the past - disaster response teams will be able to peer straight through storms to get a much better picture of the situation on the ground, from a bird’s eye perspective. Naturally, there are also loads of military implications with this sort of technology - the US Military, for one, has had access to this stuff for years, but now that it’s becoming commercially viable, I think the usage of this tech is going to explode in popularity. With enough constellation operators and enough satellites, any economic actor could commission SAR scans of any location on the planet, within minutes, for a fraction of what these scans cost today. This will be a much bigger deal 10 years down the line, but RKLB is helping to shape the early stages of this market, and getting paid to do so, today.

Synspective:

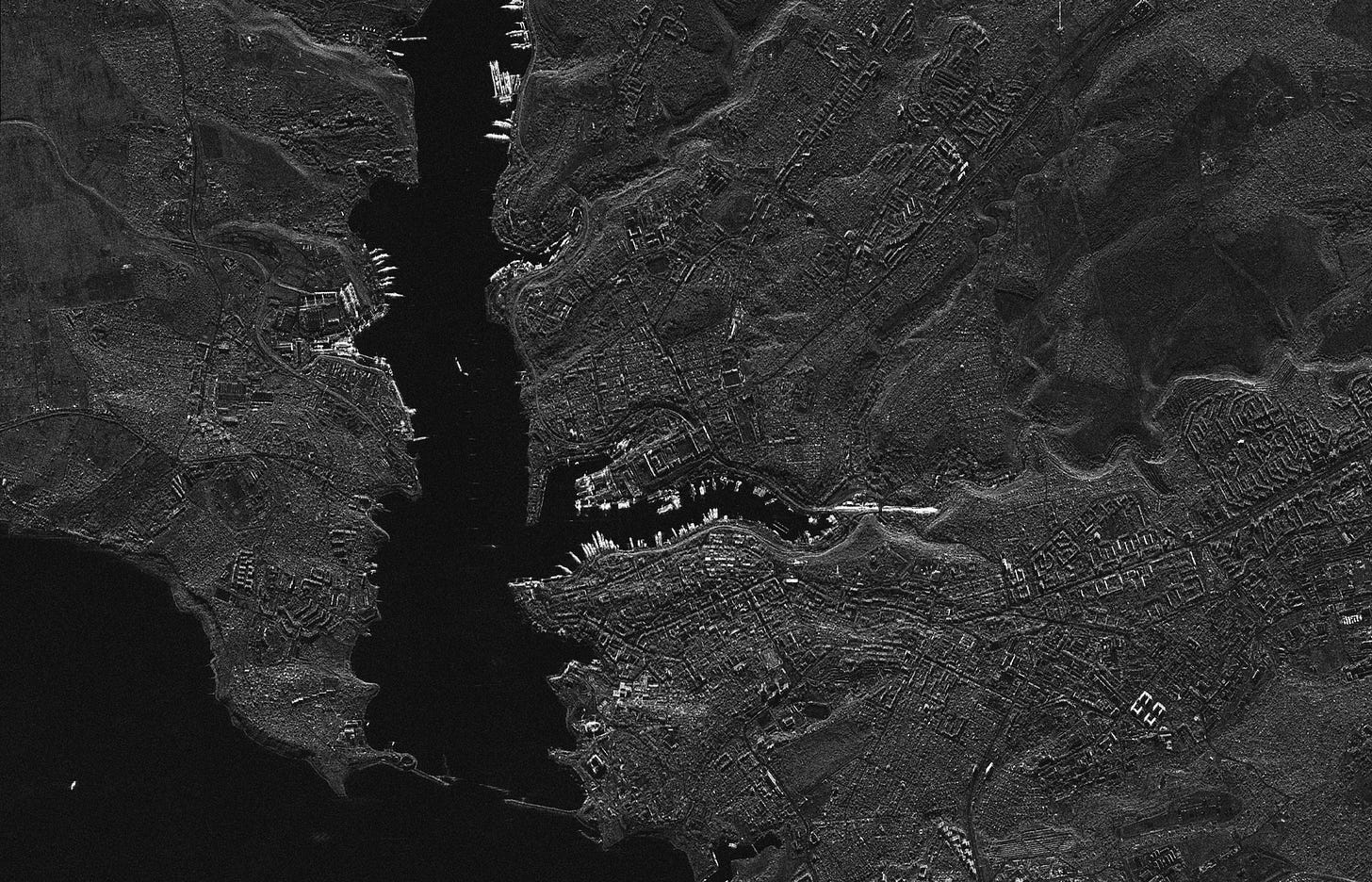

Synspective operates a constellation of 5 orbital imaging smallsats, all launched by RKLB. Synspective’s smallsats are around 1/10 the size of larger, conventional SAR satellites. Despite this size difference, these smallsats can generate images comparable to the quality of much larger SAR satellites thanks to continual improvements in the technology:

Here’s another image, demonstrating how trivial it could be to one day track global shipping, illegal fishing, or maritime accidents and hazards:

Synspective is aiming to have 6 SAR smallsats in orbit by the end of this year, enabling the once-a-day imaging of any location on Earth. By the end of the decade, they’re aiming for a full constellation of 30 satellites deployed, which would enable imaging of any location on Earth within 60 minutes, no matter how remote or what the local time is.

Capella Space:

Capella Space is another SAR provider, having booked 5 launches with RKLB since 2020. The mission titles for these are especially good - the first was entitled “I Can’t Believe it’s Not Optical,” and the most recent was “A Sky Full of SARs.” Here are some scans from their SAR constellation:

Another RKLB launch customer, HawkEye 360, is building out a constellation of RF analytics satellites that will analyze radio frequencies emitted by maritime vessels to help government agencies detect and track smuggling, illegal fishing, or maritime border violations. This sort of technology could be used as a “finder” for SAR sats, by grouping together hotspots of radio activity into specific groups of ships, being government fleets, commercial fleets, smugglers, or illegal fishers, before governments decide to queue a SAR scan over that zone.

The fourth operator I’ll highlight here is Kineis, a French company using satellite based IoT technology to monitor maritime tracking, law enforcement, and efficiency. Their constellation of 25 nanosatellites “guarantees precise connectivity and location tracking of any object anywhere on the planet.”

This is what Ashlee Vance meant when he wrote “[These] satellites will watch and analyze the Earth in previously unfathomable ways.” And right now, RKLB presents a great way to get long this coming technological revolution, selling not just launch to these constellation operators, but spacecraft systems and components as well. Not to mention RKLB’s own goals of acquiring space services technology such as SAR imaging systems - if they do so, they could undercut every other player on price while generating higher margins because they own their own launch vehicle and spacecraft components. This is what makes RKLB such a compelling play.

For those wondering, there is one publicly traded company that I know of that does SAR imaging - BlackSky, ticker BKSY - I’ve done almost zero research on the company, but they have 70% gross margins, though the bottom line margins look rough at the moment. If you ask me, we’re still a good ways out from SAR becoming a widely used technology, but when it does, this company will likely be one to watch - in addition to RKLB, of course.

That’s all I’ll be covering for now. I’ll see you all again in early December for Samsara (IOT)’s Q3 Earnings, and again in February for RKLB’s Q4 report. Until then, take care everyone!

Update 11/18: This is not material, but I would like to make everyone aware that there was at one time a titanium copy of the Half-Life 2 gnome floating in LEO thanks to an early RKLB launch. It is unclear whether or not it has de-orbited yet, but it was attached to a Photon kick stage and placed in a 200km orbit. If anyone can do the math on that, please let me know!