Sable Offshore Corp (SOC) - Deep Dive #5

A unique (and risky) oil asset play with 100% downside and multibagger upside

REQUIRED READING DISCLOSURE: This is not financial advice. I am not a financial advisor. If you like the idea, conduct extensive research and consult someone who is a financial advisor before making any investment decisions. All investments, including this one, carry the risk of financial loss.

Sable Offshore Corp. specifically is a sort of “special situation” where you are likely lose the entirety of your investment if the thesis doesn’t play out - use extreme caution and conduct extremely thorough diligence (on your own) before taking any position in this company.

I own Sable Offshore Corp. stock, thus I am biased in favor of the company and one should view this article through that lens. This article comprises my personal beliefs and convictions around owning any securities mentioned, and is not intended to be used as a recommendation to buy or sell any securities. Please be careful everyone.

Introduction

Hello ladies and gentlemen, it’s nice to be writing you all again! To start, I’d like to mention the reasons why I’ve chosen Sable Offshore Corp. for my portfolio. Previously I’ve spoken on Twitter about my natural aversion to owing oil companies, or really any commodity company for that matter.

I’m not nearly specialized enough in something like oil & gas to outperform sector specialists, and in general, I prefer to avoid making any investment where the company’s product has been commoditized - it’s just not my process, and in general the returns are lower than other opportunities I’ve found in companies with “unique, in-demand products or services” - essentially, a big part of my investment mandate. Sable Offshore, however, presents a completely different picture. Due to the (potential) tremendous undervaluation of Sable’s shares, at investment at this point would be quite worthwhile IF, big IF, the company’s bet pays off. This is a sort of “special situation,” or a “deep value opportunity,” - I’ve seen it called both by others who have published their work on the company - with immense asymmetric upside if things go right from here.

Additionally, Sable offshore is a means of hedging myself against economic weakness that I believe may be caused by the Trump administration. I believe that if fully implemented, Trump’s stated aims of 1) deporting a significant number of the migrant workforce, 2) implementing significant tariffs with most (if not all) of our trading partners, and 3) massive reductions in government spending may bode poorly for the economy going forward, and obviously a downturn, or even a tariff-related inflation scare, would more than likely hurt the share prices of many of the companies I own.

However, Trump is famously pro-oil and pro-business. He has specifically commented that he’d like to override the exact regulatory agency that is currently halting Sable’s progress. He has also declared a national energy emergency, which may enable his administration to use extraordinary federal powers to enable as much oil production as possible, overriding traditional regulatory barriers. Obviously, all of these are fantastic potential catalysts for Sable Offshore - so, I bought some.

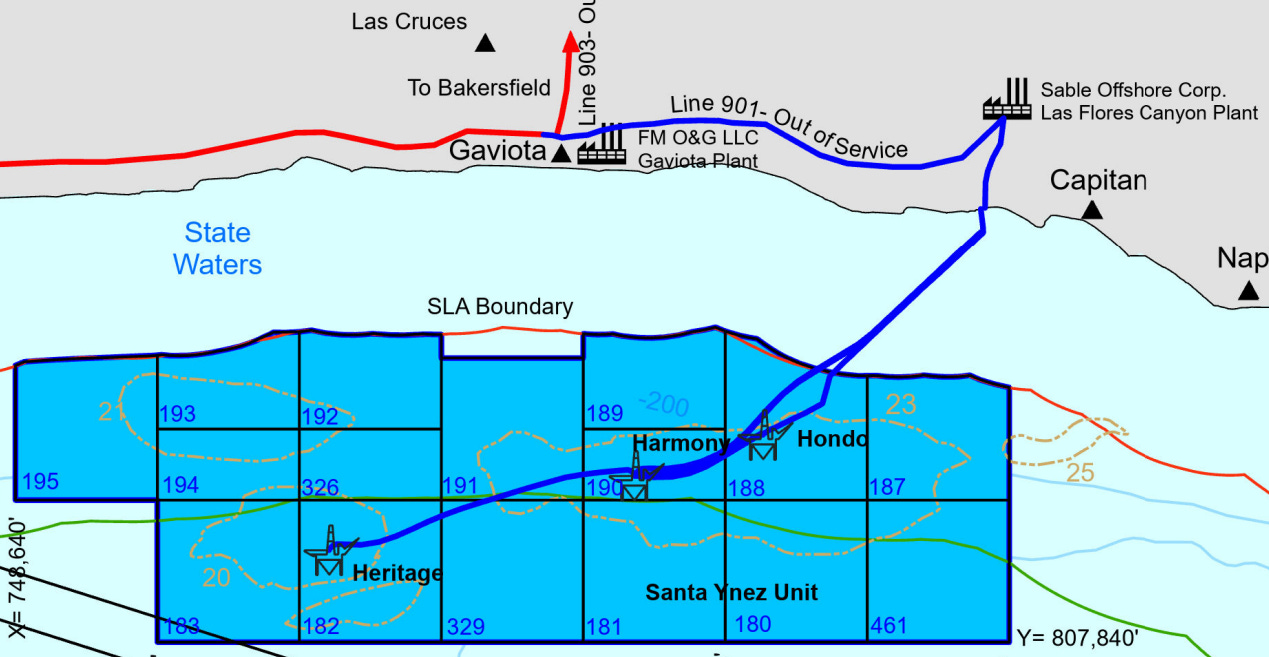

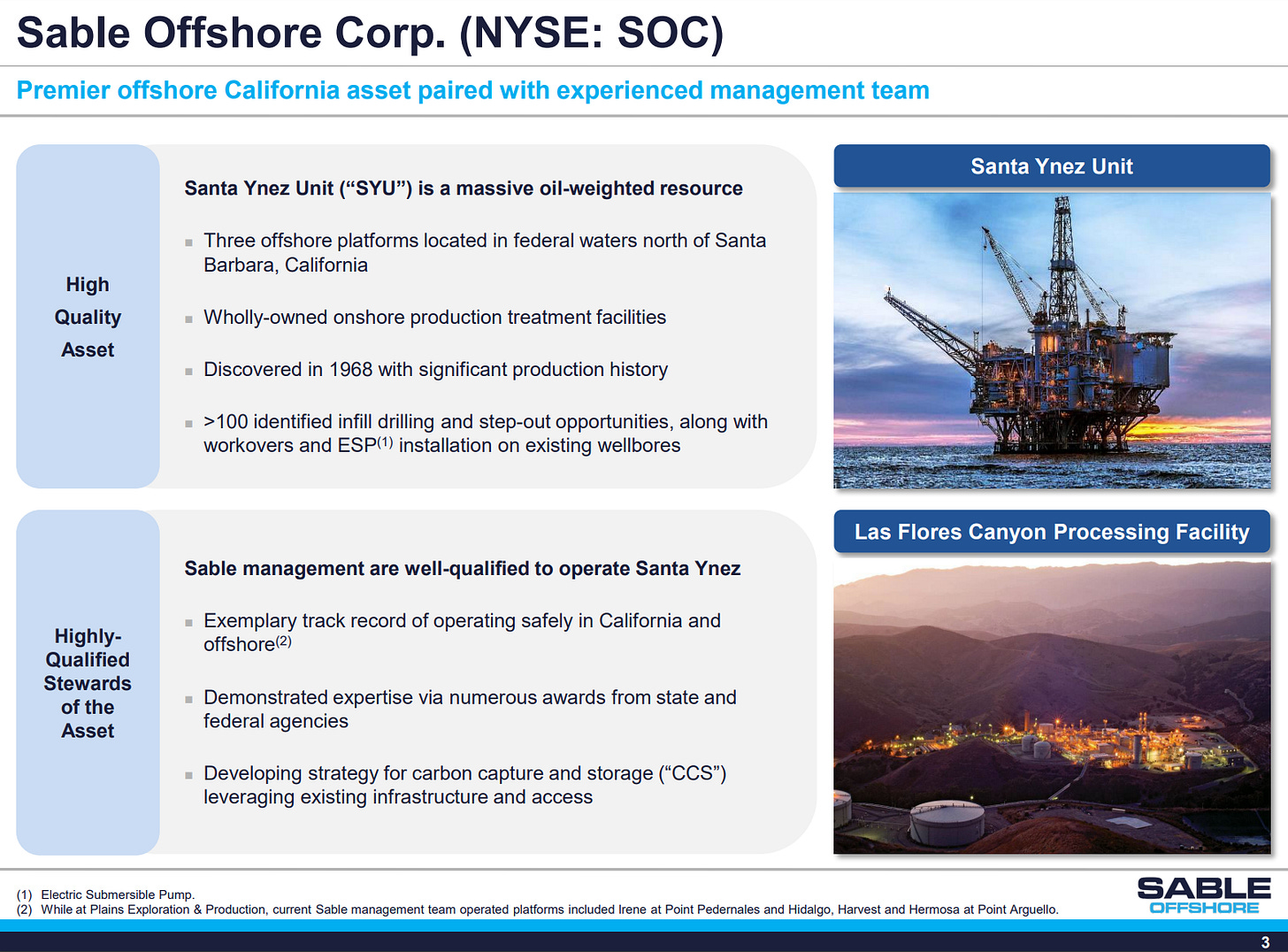

Sable Offshore Corporation ($SOC) is in a unique position as they own a collection of oil assets in federal waters off the California coast, called the Santa Ynez Unit (SYU). With these assets, Sable owns three offshore oil rigs - Hondo, Heritage, and Harmony. They also own undersea pipelines that will transport oil from these rigs to their wholly-owned onshore processing facility, the Las Flores Canyon Plant.

The SYU offshore oil platforms have historically yielded a significant amount of oil, producing over 671 MMboe (million barrels of oil equivalent) from 1981 to 2014. It is estimated by the company (and others) that the SYU likely has at least 650 MMboe left in reserves, with significant additional drilling opportunities remaining. These assets were previously owned and operated by ExxonMobile before a pipeline rupture in 2015 resulted in the spill of 3,400 barrels of oil, causing California regulators to essentially cease all oil production from the SYU by shuttering the pipelines that it relies on to transport produced oil to refineries. After the closure, Exxon placed the SYU into a “preserved state” with regular inspections, spending ~$80mm in annual maintenance CAPEX to keep the assets in workable condition.

Now, here’s where Sable Offshore comes in - these guys essentially created a SPAC to raise capital and purchase ExxonMobil’s frozen SYU assets for pennies on the dollar, including the three offshore oil rigs and the onshore processing facility, under the condition that Sable must get production restarted by January 1, 2026 - or Exxon gets to take the entire collection of assets back and Sable will be left with nothing - in theory.

The crux of this bet is that Sable’s oil assets will be enormously profitable if, big if, they can get production restarted. Since closing the deal, Sable has dealt with a regulatory minefield that has halted progress and bogged down the operation, resulting in a massive value discrepancy between Sable and it’s peers. Judging by average peer valuations, Sable’s shares are trading at ~20% of their mature value if oil production can indeed be restarted. Past this, these assets could generate $400-700mm in annual cash flow under moderate to low assumptions, equating to a 20-30% cash flow yield based on a current share price in the mid $20s. The math and assumptions behind all of these figures will be explained further in the Thesis section.

I’d also like to say that this report would not have been possible in large part without the work of Lake Cornelia Research Management (@CorneliaLake on Twitter, now deactivated) and Jason Strom (@JasonStrom84409 on Twitter). Jason’s page has excellent commentary on much of the legal process specifically, including detailed breakdowns on the potential for federal intervention now that Trump has invoked a national energy emergency. Lake Cornelia’s page includes some really informative Twitter spaces (many featuring Jason) and a lot of great posts about the company, though the page is now locked to new followers, unfortunately. I would highly recommend following both accounts and reading their work if you can - Lord knows I’ve relied quite a bit on pointers from these two in constructing this report.

Table of Contents

Introduction

Thesis

Risks

Timeline

Litigation & Regulatory Challenges

Conclusion & Appendix

Thesis

The crux of this thesis is that Sable’s shares will be tremendously undervalued if production can indeed re-start at the SYU, and that the legal case blocking the restart is rather flimsy (see Litigation & Regulatory Challenges), with plenty of opportunity for the company to litigate towards a production restart.

If restarted, Sable’s assets could prove to be veritable cash-printing machines, and Sable is ready and willing to aggressively return cash to shareholders if their production restart plan works out. They project ~50,000 Boe / day production by 2028 - at $70 (currently $76) Brent Crude oil prices (minus the company’s 16.4% royalty burden) and a $20 cost of production / barrel, that’s roughly $700mm in annual EBITDA. Subtract interest and taxes, you’re looking at $475mm-ish (emphasis on ish) annual profit, ignoring depreciation (non-cash and addressed by annual maintinence CAPEX). Minus 2028+ projected annual CAPEX of $150mm, that’s $325 million in annual FCF, or a 15% annual cash flow yield from today’s $2.2Bn market cap - very roughly speaking, this is napkin math. The cash flow figures can get much better if oil prices improve largely down the line, too. To complete the deal with ExxonMobile, Sable took out $625mm of debt at 10% PIK interest so there will be a good amount of paydown required, but they could complete that paydown pretty easily with a few years worth of cash flows. As of Q3, the company had $814mm in debt and $288mm in cash.

Sable’s shares could re-rate significantly higher if production resumes. Currently, Sable’s SYU assets are sitting on an estimated $10Bn+ in contingent reserves, an oil-industry term that indicates oil reserves that exist but are not currently producing. If Sable can restart production, these contingent reserves instantly become proved reserves - oil reserves that can actually be harvested and sold. Proved reserves are valued significantly higher by the market than contingent reserves. Sable’s current market cap of $2.2Bn suggest 4x upside if the company’s $10Bn of contingent reserves can be realized. Additionally, there is some potential for the company to sue various regulatory bodies for the equivalent amount of contingent reserves ($10Bn) under a constitutional takings suit.

Sable’s oil assets likely have plenty of gas left in the tank, so to speak. Management has identified over 100 additional drilling opportunities located within their leases that could potentially be tapped.

California is an “energy island” - of their ~1.7 million barrels of oil consumed daily, California produces only ~250,000 - the rest is imported from places including Canada, Brazil, and Saudi Arabia. Sable projects that if restarted in 2025, the SYU could pump out 28,000 barrels per day, scaling up to 50,000 by 2028-29. This would immediately lower prices statewide, and likely emit less carbon than continuing to import oil, as tankers must burn fuel of their own to really get anywhere. Not only does this condition (in my opinion) strengthen Sable’s case for a production restart, it also means that Sable’s oil operations will have significantly better economics than many. California prices oil off of Brent Crude, which is usually a little more expensive than West Texas Intermediate Crude, used by much of the rest of the country. California is also “one of the few places on Earth where natural gas is actually worth something,” - Sable’s operations will produce a smaller amount of natural gas, so a small profitability boost on both oil and gas only sweetens the deal.

The recent and incredibly tragic LA fires only exacerbate California’s need for energy - at least 10,000 structures have been destroyed. Based on some probably pointless estimates, we could expect that rebuilding all structures would require ~3 million barrels of oil at least. Considering California consumes ~1.7 MMboe / day, that’d be around 1.75 day’s worth of extra annual consumption. That’s not a lot considering how much the whole state uses, but producing ~28,000 more barrels / day domestically (Sable’s target SYU daily production for 2025) would certainly help increase supply and result in significant cost savings to reconstruction projects - assumptions and sources used in this estimate calculation are laid out in the Appendix section.

Sable’s management team have previously won numerous awards pertaining to the safe and sustainable operation of oil assets:

There is evidence to suggest that Exxon never planned on taking the SYU assets back, as they would be unable to operate them anyway due to California’s stringent regulatory criteria. For one, California law stipulates that any oil companies operating in California are required to apply California’s environmental and safety regulations to the entirety of their global operations. ExxonMobil and many larger oil companies like them could never comply with this. This first criteria enforces the second, which is that California law also stipulates that offshore oil platforms must be removed at the expense of the operator upon retirement - if Exxon has to keep these assets, and can’t operate them anyway under California law, they’d have to immediately decommission and remove all three platforms at their own expense. Simply selling these assets to Sable instead is a win-win for both parties, which is part of the reason I believe Exxon doesn’t present a threat to the company.

Back in October 2023, Sable’s CEO Jim Flores sold his private jet to the company in exchange for 600,000 shares, notably well before the company could emerge from the regulatory approval process. It might sound silly, but this is a big part of my conviction around this stock - I’m assuming that Jim Flores isn’t stupid, and it would be a stupid thing to do to trade your private jet in exchange for shares in a company you think might completely fail. Jim has a storied career in oil & gas, naturally. He’s operated multiple other offshore oil platforms located off the California Coast, with a great track record for environmental and safety compliance. Including shares and warrants, Jim and his family own around 20% of Sable Offshore.

I own shares of Sable Offshore Corp. at a 15% allocation, near the maximum risk I’m allowing myself to take on with this position. My cost basis on shares is $27.54 - as usual, this writeup will be going out as I’m down 10% on my own position. Now, if the production re-start doesn’t work out, a 15% loss would absolutely hurt my portfolio. Only a month into 2025, I’m not sure about how the rest of the portfolio is likely to perform, save for a few specific names, maybe. There is a good chance that this bet cripples my performance for 2025 if the worst comes to fruition, but I believe the asymmetric upside it provides more than makes up for the potential of a complete loss.

At a 15% allocation, if my thesis plays out, my portfolio would make 60%, plus any future dividends the company might pay out, say a further 5% (portfolio wise) annual dividend return from my cost basis. The upside potential here is so extreme that the expected value of this bet remains positive even if we only assign a 33% chance of Sable successfully restarting production - I think the actual chances of a restart are closer to, if not at least, 50%. So, yeah, it’s a gamble for me. But hey - I’m a pretty young guy and my portfolio is definitely on the smaller side - I can afford to take (potentially stupid) risks like these. If you can’t afford to take on similar risk, it is probably best not to consider an investment in Sable Offshore, but as always, use your own discretion.

Risks

Pipeline Infrastructure Risk: Pipelines 901 and 903 are essential in allowing Sable to restart production at the SYU - they are the only means of transporting any oil produced. In causing the 2015 Refugio oil spill, pipeline 901 (then operated by Plains All American Pipeline) failed at just 56% of its maximum operating pressure due to severe corrosion issues - an investigation carried out by PHMSA and 3rd party pipeline contractors revealed numerous instances of extreme corrosion, including sections where 89% of the pipe wall thickness had been worn away. Pipelines 901 and 903 are both over 30 years old and have been severely corroded in the past. However, Sable has been conducting extensive repair work on this pipeline through subsidiary Pacific Pipeline Corporation (PPC). According to the company, PPC has over 30 pipeline repair crews working to repair sections of the pipeline in accordance with the 2020 Consent Decree, utilizing modern and accurate pipeline monitoring technology to repair both pipelines to “as new” condition. Sable has also agreed to numerous precautionary measures suggested by regulators, including the addition of a pipeline control station located in California (Plains All American’s Texas-based control station contributed to the 2015 failure). Currently, numerous state agencies have essentially OK’d a pipeline restart, including the Fire Marshall - the only large remaining regulatory obstacle is the California Coastal Commission (CCC). The CCC has temporarily halted all repair work on sections of the pipeline that fall within their coastal jurisdiction, but Sable has continued repairs to non-coastal sections of the pipeline. This brings us nicely to the next risk factor,

Ongoing Regulatory & Legal Threats: The CCC and numerous other regulatory agencies have been fighting tooth-and-nail to prevent the SYU from restarting production, ever since the initial 2015 spill that halted production. See Legal & Regulatory Challenges for a complete breakdown of every agency with oversight on Sable’s operations and their current enforcement actions against the company. Due to the extreme amount of regulatory clearance required before and after a production restart at the SYU, there is NO guarantee that Sable will be able to restart or continue production. If state agencies are able, they could likely draw things out for some time yet, potentially another year or longer. While I am not concerned about Exxon taking the oil assets back in 2026 if the process is drawn out further, the prospect that Sable will never clear this regulatory minefield remains very real and is in my opinion the biggest risk factor facing the company today. This is also where the majority of bearish sentiment stems from - the idea that it is simply not possible at all for the company to navigate the regulatory minefield. I do believe it is possible, if things go right from here - but obviously, one guy’s opinion on his silly investment research blog is no guarantee whatsoever that Sable can indeed escape regulatory hell. This stock would not be trading at such a sizable discount if a path through the regulatory process was guaranteed - there is no sure margin of safety with this investment whatsoever.

I would also like to mention specifically that if the regulatory process is delayed for years and years and Exxon doesn’t end up wanting the SYU assets back, that $625mm in debt with 10% PIK interest could become a ticking time bomb of sorts over a few years, so watch out for that.

Capital raises - Sable Offshore is not yet generating any revenue from oil sales, with $288mm in cash on the balance sheet as of their Q3 report, and the company may need to raise additional capital before their oil assets can be restarted. In their 2021 SPAC IPO, Sable raised $287mm. They further raised $150mm from a September 2024 PIPE offering, as well as the redemption of public warrant proceeds of $184mm in November 2024. Given that the company is engaged in repairs of very capital intensive assets (three oil platforms and two pipelines, all at least 30 years old), as well as a potentially lengthy litigation process, there is a solid chance that the company may need to raise even more capital to complete the restart of their oil assets.

Nepotism - I’m not sure how much my readers might care about something like this, but Sable CEO James Flores hired his son, J. Caldwell Flores, to act as the company’s president. J. Caldwell has held leadership positions at multiple other companies run by James Flores, so I’d hope he at least has some experience here… he does have a BBA from the University of Houston (Texas’ energy hub), but c’mon… we all know it’s not very difficult at all to get a bachelor’s degree and go work for your parents company. In general, I’m regarding this risk as (hopefully) mostly harmless. I’m sure J. Caldwell Flores has been coached by his dad for roles like this for a solid amount of time. I’m not necessarily concerned about this, but I wanted to include it in my interest of mentioning literally every detail about a company that I can possibly get away with in these Deep Dive reports. Not to mention, the Flores family owns some ~20% of Sable Offshore, so we can be reassured that management is incentivized to act in shareholder’s best interest. They contributed $33mm of their own capital to the initial SPAC raise, if I remember correctly.

Risks associated with all oil companies: obviously, oil companies are subject to risks around the price of oil, as well as any drilling related incidents, damage to assets, or environmental safety infringements. If you’d like a worst-case-scenario view of what this could look like, YouTube has all sorts of documentaries about the Deepwater Horizon oil platform catastrophe (to be fair, it is highly unlikely that Sable suffers a similar fate here given that underwater drilling safety measures have come a long way, and Sable’s team has a good track record of operating safely).

Timeline

After discovery in 1986, Exxon consolidated over a dozen offshore federal oil leases into one single unit, the Santa Ynes Unit (SYU). Come 1976, they began construction on the first of three offshore rigs, platform Hondo, which began producing in 1981. Following Hondo, platforms Harmony and Heritage both came online in 1994. All three rigs continued to produce until their 2015 closure due to a pipeline-failure related oil spill - the failure was due to corrosion in pipeline 901, which transports oil from the Las Flores Canyon plant towards the Gaviota plant and pipeline 903. At the time of the spill, 2015, the pipelines were some 28 years old, and owned/operated by Plains All American Pipeline (PAA). These pipelines were constructed in the late 1980s, hydrotested in 1990, and begun service in 1992 (line 901) and 1991 (line 903).

The 2015 spill, called the Refugio oil spill, led to the leakage of 3,400 barrels of oil from pipeline 901, equivalent to over 100,000 gallons - the resulting environmental cleanup operation cost PAA an estimated ~$100mm. Including legal damages, PAA estimated in an earnings call that the spill would cost $257mm - net of insurance proceeds, the company ended up paying out ~$60mm according to a few sources.

It’s important to note that PAA were less than ideal stewards of this pipeline, given that they hadn’t installed an automatic shut-off valve. They checked the pipeline for corrosion in 2012, and found evidence of it occurring, but it appears that nothing in particular was done by the company to mitigate a potential leak. Evidence from federal agencies and pipeline inspection contractors also revealed that PAA had completely failed to detect some instances of pipeline corrosion.

In a 2016 report, the Pipeline and Hazardous Materials Safety Administration (PHMSA) identified three causes of pipeline 901’s failure, finding:

“The contributory causes can be grouped into three categories: 1) ineffective protection against external corrosion of the pipeline; 2) failure by Plains to detect and mitigate the corrosion;, and 3) lack of timely detection of the rupture.” - 2016 PHMSA Failure Investigation Report

They found that, due to significant corrosion issues, pipeline 901 failed at just 56% of it’s maximum operating pressure (MOP) after a pump on line 903 was unintentionally shut down. Because oil was flowing through line 901 to 903, this resulted in the oil pressure within line 901 to increase (as the pump further up the line was shut down, so any newly pumped oil through line 901 would have nowhere to go and simply increase pressure in the pipeline). Pressure at the line 901 discharge station (at the Las Flores Canyon processing facility, basically feeding oil into line 901) increased up to 696 psig (pounds / square inch gauge). Shortly after the unplanned shut-off of the pump on line 903, the controller at the Las Flores station feeding into line 901 shut down pumping, and discharge pressure in line 901 remained at 677 psig. This would have all been well and good, except that…

“Approximately four minutes later, the pump at Las Flores Station was restarted.” This was probably what the industry would call a very bad move. The resulting resuming of pumping at the line 901 discharge station led to a rapid increase in line 901 pressure, up to 721 psig, followed by a sudden drop in pressure to 199 psig. This sudden drop in pressure means that the oil within line 901 had gone somewhere else, i.e., leaked out of the line.

The PHMSA report stated that although this sudden sequence of multiple pump shut-offs and restarts was unusual, it should not have led to a complete rupture of line 901. The 721 psig pressure which ended up rupturing the pipeline was just 56% of the pipelines maximum operating pressure (MOP), 1,341 psig as reported by PAA in the PHMSA’s 2016 investigation. Only due to corrosion and weakening of the steel pipeline itself did such a low amount of pressure cause the pipeline to fail.

The pipeline is 24 inches in diameter, made of steel. This steel was covered with a urethane coal tar coating applied directly to the bare pipe, further covered by thermal foam insulation with an overlying Polyken tape wrap. The corrosion in question is external corrosion of the steel itself, meaning that water had found a way through the pipe’s insulation system and made direct contact with the steel, allowing corrosion to occur. Corrosion in this case is also affected by seasonal heating and cooling of water within the pipeline’s coating as temperatures fluctuate during any given year.

Originally, after the pipeline’s failure and subsequent shuttering, ExxonMobil petitioned Santa Barbara County to grant them permits to truck oil to the Gaviota station while the pipeline could be repaired, but they were continually denied on environmental and safety grounds.

On top of this, in August 2017 Plains All American petitioned to completely replace lines 901 and 903 but they were also continuously denied on environmental grounds.

Essentially, California regulators wanted to prevent the SYU from restarting at all costs - they didn’t allow Exxon to use trucks to transport oil, they didn’t even allow for a complete repair of the corroded pipeline which would have significantly mitigated the chance of another spill - they simply never wanted these assets to be restarted at all - keep this condition in mind for the rest of this report.

Fast forwarding a few years here…

2020: Federal Consent Decree issued, outlining all steps that must be taken to ensure environmental safety and compliance if pipelines 901 and 903 are to be restarted. This was signed off on by numerous state and local agencies, including the Fire Marshall, the PHMSA, the State Lands Commission, Bureau of Safety and Environmental Enforcement, and a few others - every agency that could possibly oversee Sable’s operations, minus two local water quality control boards.

March 2021: Flame Acquisition Corp. (Sable’s SPAC) closes $287.5mm IPO

October 2022: Exxon buys pipelines 901 and 903 from Plains All American

June 2023: Sable Offshore seeks to install 16 check valves (automatic shutoff valves) along the length of pipelines 901 and 903, but they are blocked from action by Santa Barbara county after a tied 2-2 vote

January 2024: Exxon takes $2.5Bn write-down on SYU properties before sale to Sable

August 2024: Sable sues the county of Santa Barbara arguing that they do not have jurisdiction to prevent the installation of check valves. Santa Barbara county backs down, admitting that they do not have jurisdiction and allowing the install of the necessary check valves

February 2024: Flame Acquisition Corp. merges with Sable Offshore, Sable Offshore closes on purchase of SYU assets from Exxon

May 2024: A settlement worth $70 million was reached between Sable Offshore and landowners along the pipelines involved in the 2015 Refugio oil spill - one landowner suit remains, the Zaca Preserve suit (see Legal and Regulatory Challenges).

By the end of Q1 2024, all the SYU assets, processing facilities, and associated pipelines (901 and 903) and pump stations are under Sable’s ownership. After this, pipelines 901 and 903 undergo repairs targeting their most likely failure zones - Sable was working on repairs both inside and outside the coastal zone, until…

November 11, 2024: The Coastal Commission issued a cease-and-desist order towards Sable about pipeline repair work within the coastal zone that they saw as development, which they do have jurisdiction over - however, since pipeline repair and maintenance work would more than likely fall under “maintenance”, the Coastal Commission does not have jurisdiction. The ongoing cease-and-desist order remains in effect through to February 11th. After this expires, the CCC demands that Sable fill out a coastal development permit to continue “development”, as well as to cover the “development” that they had already done. These coastal development permits (CDPs) can take up to 300 days before the CCC makes a decision to issue or deny a permit. It is unclear weather or not Sable will actually have to apply for a permit, given that their work is really just repairs and maintenance, not really development.

Sable has continued pipeline repairs and maintenance outside the coastal zone - the section inside the coastal zone is where the biggest hangups currently lie, with the Coastal Commission.

After Sable is fully cleared to begin operations, there will still be some work to do. For one, Sable will need to hydrotest lines 901 and 903, likely in their entirety - this process could take weeks. A hydrotest is a simulation where a pipeline is filled with water to 125% of its regular operating pressure for 8 hours, to test the pipeline for leaks and ensure that pressure is holding. Following a successful hydrotest, it will take Sable around a month to spool up it’s oil processing facility and finally begin generating revenue.

It is also worth noting that Sable’s platforms have seen plenty of activity in recent days, from both supply and passenger ships. Would they be doing all this work if their master plan was about to fail spectacularly? Maybe, but I doubt it.

Now that we’re mostly caught up to recent events, let’s examine the regulatory challenges that Sable will have to navigate before any oil can be produced.

Litigation & Regulatory Challenges

“Dating from the 1970s, the California Coastal Commission is an unelected body of regulatory zealots that overrides dozens of elected city and county governments on land use and environmental issues. The appointed commissioners managed to combine Stalinist regulation with mafia-style corruption. For example, Commissioner Mark Nathanson, appointed by Assembly Speaker Willie Brown in the 1980s, served prison time for extorting bribes from Hollywood celebrities and others seeking coastal building permits.” - Lloyd Billingsley, Blaze Media

Sable Offshore has essentially been stopped up by the California Coastal Commission (CCC), which could be called “the single most powerful land-use authority in the US,” given that it has ultimate control over California’s entire coastline and all its incredibly pricey real estate. The commission is comprised of 12 voting members, 6 chosen from the general public and 6 appointed by elected officials. These unelected commissioners have no term limits - the guy who originally spearheaded the commission back in the 70s held his seat for 27 years.

The CCC has been criticized in the past given that they are unelected, hold extreme power over some of the priciest real estate in the country, and that they oftentimes fully overreach their power and block development projects that would benefit the public for no discernable reason whatsoever.

Despite all of this, the CCC is not immune - they have been beaten before, and there is a credible path towards beating them again.

Notably, SpaceX won a lawsuit against the CCC after the commission tried blocking a step-up in SpaceX’s Falcon 9 launch cadence out of Vandenburg Air Force Base - from what I’ve found, the commission’s reasoning for blocking additional launches was that Elon Musk had begun inserting himself into the government with donations to Trump’s campaign. Whether any of us agree with Elon’s involvement in government or not, the CCC obviously wouldn’t have jurisdiction or any real authority over this, so they lost.

If Sable is forced to pursue a Coastal Development Permit, that could add another 300 days to the expected production restart as the commission would very likely drag it’s feet and take the maximum amount of time to either approve or deny Sable’s permit. If denied, Sable can appeal the ruling in state and federal appellate courts - the CCC has lost appeals like this in the past, though not to any oil companies that I’m aware of.

Technically, Sable’s pipelines do already have existing Coastal Development Permits dating back from when they were built - Sable has been contesting the CCC’s cease-and-desists by saying that the pipeline maintenance they’ve been doing is permitted as maintenance under their existing permits, which I think has a good chance of holding up in court if it comes to that, but we’ll see.

There are a few more California agencies that must be satisfied before oil pumping can resume, though. This document I pulled out of an LLM includes every agency with oversight and any enforcement actions that are currently underway. I’ve included select excerpts below that I believe are the most consequential, but I’d recommend giving the whole document a read on your own.

CENTRAL COAST AND CENTRAL VALLEY REGIONAL WATER QUALITY CONTROL BOARDS

ACTIONS UNDERWAY:

On December 13, 2024, following an inspection, the Central Coast Regional Water Quality Board issued violation and non-compliance notices for unauthorized waste discharge into Santa Barbara County waterways, as well as a directive to seek permit coverage. Sable must take corrective action, submit a waste discharge report, and apply for appropriate permits.

CALIFORNIA DEPARTMENT OF FISH AND WILDLIFE/CDFW OFFICE OF SPILL PREVENTION AND RESPONSE

ACTIONS UNDERWAY:

In October 2024, CDFW-OSPR certified that Sable had the financial resources to cover the costs of a reasonable worst-case scenario oil spill.

On November 22, 2024, CDFW-OSPR sent a second notice to Sable sharing that its offshore contingency plan (C-Plan #CA-00-7239) was deficient.

On December 20, 2024, Sable submitted corrections to its plan. CDFW-OSPR is reviewing these corrections and must respond by January 19, 2025.

On December 17, 2024, CDFW-OSPR sent a third notice to Sable sharing that its onshore contingency plan (C-Plan #CA-00-7217) was deficient. On January 9, 2025, Sable submitted corrections to its plan. CDFW-OSPR is reviewing these corrections and must respond by February 9, 2025.

On December 17, 2024, CDFW also issued a notice of violation for Fish and Game Code violations. This notice requests that Sable discontinue any work on CDFW properties and contact CDFW to discuss remedial measures and other actions to address impacts.

CALIFORNIA DEPARTMENT OF CONSERVATION: GEOLOGIC ENERGY MANAGEMENT DIVISION

ACTIONS UNDERWAY:

On December 17, 2024, the Department of Conservation sent a letter to Sable notifying them of the need for an additional inspection of facilities, and production and bonding requirements.

CALIFORNIA COASTAL COMMISSION

ACTIONS UNDERWAY:

Commission staff is coordinating with Sable (and Santa Barbara County, which shares the permitting jurisdiction) to determine what permits are needed and the appropriate permitting process. Commission enforcement staff are in the process of investigating multiple potential violations.

On September 27, 2024, Commission staff issued a Notice of Violation and cease and desist letter to Sable due to then recent and ongoing development activities that were occurring on and around the pipeline within the Coastal Zone without any Coastal Act authorization.

On October 4, 2024, Commission staff issued a Notice of Intent to issue an Executive Director Cease and Desist Order and requested confirmation that all work on the pipeline had ceased and that Sable would apply for a Coastal Development Permit for the work that had already occurred.

On November 11, 2024, the Commission’s Executive Director issued a Cease and Desist Order to Sable, directing Sable, among other things, to submit an application for a Coastal Development Permit “for any proposed future work to be undertaken along the Pipelines, as well as for after-the-fact (‘ATF’) authorization for unpermitted development that has already occurred.”

Currently: Coastal Commission staff are coordinating with Sable and the federal government to determine the scope of required federal consistency review. Federal agency approvals would only occur after the Commission acts on the federal consistency review.

There is also one remaining landowner with an ongoing suit against Sable, the Zaca Preserve - Sable’s pipeline 903 runs through this property.

“In order to avoid further damage to Zaca, Sable needs to either negotiate a new easement from Zaca and construct a new pipeline on Zaca’s property … or abandon the pipeline and remove the pipeline from Zaca’s property entirely, and reroute the pipeline through other properties in the area,” the suit reads (excerpt from article linked above).

If Sable loses the suit and isn’t able to reconstruct the pipeline in this zone, the only other option according to the suit would be to acquire the entire property at the market rate, estimated to be at least $40mm.

Now, keep in mind: Sable likely has an army of lawyers and reported $288mm in cash with their Q3 report. Not to mention, the company’s market cap of $2.4Bn (with a greatly increasing stock price over the past year) leaves potential for further dilution if necessary. They could likely litigate all of this for years, dilution or no dilution, and the bet could still remain quite profitable given how discounted the company’s shares are today - you know, assuming Exxon doesn’t want the assets back, and I do believe that they don’t.

It’s also worth noting that Trump has invoked a national energy emergency, demanding increases in oil & gas production - he has also specifically commented that he wants to overrule the California Coastal Commission. If Sable ends up filing suit against the CCC or another regulatory body, and it’s taken to federal court under a Trump administration, you can see how the odds might start to play into the company’s favor. If appealed to the federal level, this potential case would be litigated in the 9th Circuit Federal Appeals Court, which is located in San Francisco - obviously, judges based in San Francisco probably aren’t all that excited about oil & gas activity, but I wouldn’t underestimate the Trump administration in it’s tenacity. They have already fired numerous federal officials (even FBI higher-ups) who oversaw investigations into and prosecutions of January 6th perpetrators, among other sweeping changes and a flurry of executive orders. I really do not think they would be above stooping to whatever level necessary to pressure local courts into compliance with their federal level decrees if they really wanted to - this Trump admin plays dirty, and that’s a good thing for Sable Offshore.

Conclusion & Appendix

California fires increased oil demand calculations:

Assuming each of the 10,000+ destroyed structures require an excavator, a dump truck, and a cement mixer truck all operating 20% of the time across one month (28 days) to be rebuilt:

Caterpillar 320 DL Excavator: assuming 100% duty cycle across operating hours, estimated hourly fuel consumption is 8.7 gallons diesel / hour (estimate sourced from Quora)

10 cubic yard capacity cement mixer truck: assuming 20 mile average travel time from cement loading station to build site, average consumption 3 gallons diesel / hour (estimated)

Caterpillar 770 dump truck: average consumption of 15 gallons diesel / hour (estimate by FinModelsLab)

Assuming each vehicle operates for 134 hours across the 28-day rebuild period (20% uptime), each structure could require as many as ~3,577 gallons of diesel to repair; assuming one barrel of oil can produce 12 gallons of diesel fuel (estimate by energybot), each structure could require ~298 barrels of oil to be rebuilt. Times 10,000 destroyed/rebuilt structures, that’s an additional 2.98 million barrels of oil that will be consumed, before accounting for the plastic components used in construction of structures like houses or commercial buildings which would likely further increase oil demand.

Another thing I’d like to mention in the appendix is that there have been a few short reports published on Sable Offshore - one is available here from Hunterbrook Capital. While they do bring some important risk factors to light, Sable has already crossed through many of the regulatory barriers mentioned in this April 2024 report. When mentioning the past “failures” of companies run by CEO James Flores, they mentioned that Sable Permian Resources, one of the CEOs previous ventures, declared bankruptcy after “a drop in oil prices.” What they neglected to mention in this section is that the so-called “drop in oil prices” was caused by the onset of the COVID crash, when WTI Crude went into the $10-20 range for a few months straight:

Obviously, the largest oil companies managed to survive this nightmare scenario, but Sable Permian was a small operation, and not very well funded from my understanding. Read the whole short report if you’d like to learn more, you might as well.

Anyways, in closing - Sable Offshore presents a very interesting situation. Really, I can’t say whether or not the company’s plan will end up working out. I just think that currently the market is underestimating the chances that it will. If you’re a degenerate risk taker like me, maybe you think the same, maybe not - we’ll find out eventually, and personally I’m very excited to see what ends up happening with this company.

That’s all for now folks, Welfare Capital signing off.

Thank you for the input. Really appreciate it

Great post. I'm currently long SOC myself. Are you only long equities, or do you suggest call options too? I realize that adds more risk (and reward).