Shift4 Payments (FOUR) - Deep Dive #8, a Broad Overview of the Bull Case

The cleanest dirty shirt of the payments/FinTech space? Featuring: a killer acquisition framework and an executive team that actually knows how to invest capital

REQUIRED READING DISCLOSURE: This is not financial advice. I am not a financial advisor. If you like the idea, conduct extensive research and consult someone who is a financial advisor before making any investment decisions. All investments, including this one, carry the risk of financial loss.

This article comprises my personal beliefs and convictions around any securities mentioned, and is not intended to be used as a recommendation to buy or sell any securities. This article may contain errors or incorrect information - you should verify all information presented here through your own research.

Introduction

Shift4 Payments (FOUR) is a payments provider serving the restaurant, hospitality, sports & entertainment, and e-commerce verticals in the U.S. and across the globe. Since their 2020 IPO the company has made a number of transformative acquisitions that have allowed them to expand their market share and conquer new segments of the payments ecosystem, driving significant growth; over the past 3 years they have grown revenue at a 29% CAGR and operating cash flow at a 34% CAGR, managing to handily outperform most competitors in the payments space as well as the NASDAQ itself. They grew operating income at a staggering 115% last year, after 20+ years in business.

As you can see in the chart above, FOUR shares have suffered a pretty steep decline in 2025 (down 19% YTD), given the recent announcement of the largest acquisition in their history (1/3 of the current market cap) and the departure of their 26-year founder and CEO, as well as the remaining tariff-related macro uncertainty… clearly the market seems a little freaked out about all of this.

In my humble opinion this price could make an opportune time to enter a position (depending on your macro forecast and timeframe, I guess) - I think the market doesn’t realize how quickly FOUR can continue displaying it’s M&A magic and I think any concerns over the acquisition and the departure of their CEO are unfounded, for reasons I’ll get into further on in this report. Macro does worry me some, but more importantly, I still think FOUR shares have a decent shot at outperforming broad indices should we end up with a recession and during the eventual recovery.

Generally, the payments space is low margin and kinda commoditized. See the others on that chart above (LSPD, TOST, PYPL, XYZ) that have performed rather poorly. Payments is very competitive and it is difficult for payments providers to develop a real insulating moat that protects their pricing and keeps their customers from being picked off by others.

Having said that, what makes FOUR so different from others in the payments/fintech space? Of all the payments processing companies shown in the chart above (TOST, XYZ, LSPD, PYPL), why is FOUR the only one that has produced any meaningful shareholder returns over the past 5 years?

The only answer to this question is that FOUR’s executives actually know what they are doing when it comes to investing capital. They’ve developed a tried and tested acquisition strategy, cheaply buying companies with complimentary systems and lots of captive customers to cross-sell their payments network to, with fantastic results; they’ve been able to grow their number of customers and payments volume massively, at as low as 1/5 the cost of customer acquisition for competitors like Toast (TOST).

“We are passionate about identifying critical but often overlooked businesses that have incredible merchants who benefit immensely from a single comprehensive payment platform. We aim to deliver these merchants what they would have otherwise sourced from 5 or 6 different companies, and in turn, deliver more value and convenience.” - FOUR CEO David Lauber, Q4 2024 earnings call

During 2024 they saw payment volume growth of 319% to $165Bn, and after their most recent acquisition, the company now has access to $1.4 trillion in payments cross-sell opportunity that they are very advantaged to win. There is a load of growth already baked into this company today, even if management were to ‘sit on their hands’ and stop doing M&A transactions altogether.

I see FOUR continuing to outperform the payments space at large and I think there’s a really good chance it outperforms the broader market as well over the coming years. Today, the company is trading at around 18x forward earnings. For that, you’re getting a company with a good chance of doubling it’s free cash flow over the next 3 years given their massive cross-sell opportunity that is baked into the company today, as well as realizations of coming M&A transactions.

From this company I’m expecting a good amount of growth, a pinch of margin expansion, and quite possibly some multiple expansion depending on how the macro shakes out.

Table of Contents

Introduction

Thesis

Risks

What does Shift4 do?

Products, Services, & Customers

Switching Costs

Broad-Level Financials

M&A Strategy

Leadership & Governance

Conclusion

Thesis

I think FOUR shares today are pretty cheap at 14x forward earnings, considering the amount of growth that’s baked into the company today. FOUR could ‘sit on their hands’ and completely stop M&A, and even then the company has over 8x their current payment volume in cross-sell opportunity to existing customers with a payment volume TAM in the multi-trillions.

M&A put this company where it is today, but their organic growth is still quite strong with numerous organic customer wins in Q4, including 18 ski resorts, 19 non-profits, 4 retail customers, 10 entertainment venues, and expansions/further penetration of sports stadium customers. They could stop all M&A activity tomorrow, still grow fantastically, deleverage over a few quarters or a year, and return a good amount of capital to shareholders just by ‘sitting on their hands.’ I find the embedded growth potential with this company pretty attractive - 2024’s organic gross revenue less network fees (GRLNF) growth was >20%.

I really like FOUR’s management team on capital allocation, product strategy, and high ownership. I think they are smart, diligent, very knowledgeable about their own company, and most importantly, quite good at investing capital - see M&A Strategy. This company’s executives have executed very well over the past 5 years and have delivered on every promise they made to investors at their 2020 IPO and more. They are realistic, they are pretty honest, and they are generally very transparent with shareholders around products, operations, and the acquisition strategy. Founder Jared Isaacman has more or less outlined their entire acquisition strategy for investors many times in shareholder letters - he owns over 20% of the company today. For even more color on management, see Leadership & Governance.

I know people generally dislike the FinTech space, but this is genuinely a good business if you ask me. The executives are incredibly clever on product and investment. I think this company deserves and will see a higher multiple than today’s 14x forward earnings. The outgoing CEO Jared Isaacman rejected multiple buyout offers last year because the price was too low, and having studied the business, I agree with him in that regard.

Payments is very competitive - some investors would call it commoditized, I disagree to an extent. The commoditization of payments may have been the case for payments providers a decade ago, but today, many major providers including FOUR have a lot of differentiation built in with much stickier product offerings, as well as specific niches that providers like FOUR target and do well at - FOUR’s best verticals today are hotels and sports & entertainment venues, compared TOST which does best in restaurants.

We’re talking niche software and analytics integrations for merchants like hotels, sports stadiums, theme parks, restaurants, plus customer service and support, hardware advantages, and more. We’re talking acquired resellers with decades-long relationships with merchants and local areas. Not to mention, FOUR can and often does raise take rates with some merchant customers, every year in some cases (obviously up to a firm ceiling, but still). It’s not so easy for any customer to go and change up their whole payments system these days given all the services offered and all the involved integrations that need to work flawlessly.

It’s also not like any payments provider can immediately go after FOUR’s customers just by lowering their prices - they’re taking share rapidly in verticals like hotels and stadiums because they simply offer a better, more tailored solution to these merchants.

“There’s a reason why we’re the category leader in sports and entertainment and theme parks, every one of them is using our mobile solution for ordering a burger and a beer to your seat, they’re using us for ticketing, they’re using us for concession stands, VIP suites… are the Baltimore Ravens or the Yankees gonna throw away all that technology to save a few pennies but give a worse experience to patrons?” - FOUR Founder Jared Isaacman

I should mention, I’m not currently long FOUR myself. I might be soon for a trade, we’ll see. I did have a smaller position here earlier in the year, but I sold it to maintain my cash buffer and focus on other opportunities. You can decide if that was the right or the wrong decision, haha. Really I’m writing this report because I think this fintech space is interesting enough to explore, with all it’s unique positives and drawbacks, and I wanted to provide my personal view on the bull case for the company going forward, while mentioning the drawbacks and potential negatives for a company like this (seen below). Payments isn’t the greatest business to be in but I generally think these guys will still do well.

Risks

1) The biggest risk here in my opinion is recession. As FOUR’s revenue is ~90% dependent on payments volume, the company is pretty sensitive to changes in consumer spending. If we end up in a recession soon, FOUR’s revenue growth could slow dramatically or even reverse into negative territory. During unfortunate macroeconomic conditions, people are probably not going to completely stop spending at restaurants, hotels, and sports stadiums, but they will pull that spending back substantially. It really depends on what sort of recession we get, if any. I will say, FOUR has grown all major KPIs at 20%+ annually basically every single year since their 1999 founding, even through the 2008 and 2020 (COVID) downturns. They can handle a good bit of same-store-sales compression just by growing payment volumes (organic and acquired) by a good bit, like the 49% YoY volume growth in Q4. I think a recession will certainly slow down volume growth but they could likely still continue growing.

Also, serial acquirers like FOUR (though technically FOUR’s management disputes the serial acquirer term) can have a sort of ‘natural hedge’ baked in, if equity multiples decline across the board in a downturn, FOUR could invest capital in cheaper companies as a result and create more value out of those dollars for shareholders - assuming they’re sufficiently deleveraged and have the cash + cash flow for it, which is not a given.

“For those who are kind of worried about the restaurant health or the consumer health, we had a global pandemic 4 years ago [when we] were 99% restaurants and hotels and we did pretty damn well through that. We grew payment volume 20% YoY in the third quarter of that pandemic, so you know, a little bit of same store sales compression doesn’t change our view that we gotta find a hell of a lot more customers every year to continue to grow.” Incoming FOUR CEO Taylor Lauber

Something notable about the quote above, FOUR’s business is much bigger and likely more exposed to macro volatility today. Will they be able to grow fast enough to escape consumer spending compression? Really, I don’t know. Maybe now is a bad time to buy if you’re expecting a recession - as always, it’s up to you, the reader. Might be a good idea to keep this article handy to refresh yourself on the company later on, after a spending contraction if we end up getting one.

2) Investors in this company are largely dependent on the M&A strategy. It is absolutely crucial for continued outsized growth as I see things. While the company is not likely to stop M&A anytime soon, if management lapses with their M&A strategy and ends up investing in something they shouldn’t, bad things will probably happen to the stock price. This is a small risk if you ask me, but still present, as it would be with the capital allocation strategy at any company.

3) FOUR’s CEO and founder, Jared Isaacman, is set to leave the company and run NASA after a nomination by president Trump. There should be some risk here but I feel like the stock price reflects that already, and I do think incoming CEO Tayler Lauber is more than qualified to continue leading the company - see Leadership & Governance. The short version is, he’s been with the business for 6 years in it’s current form, he knows the acquisition strategy very well, he knows the company and the broader payments space well, and Jared will remain the largest shareholder of the company going forward (>20% ownership). If he feels safe leaving over a billion of his dollars in Taylor’s hands after 26 years of running this business, I don’t see why other investors ought to be too worried.

4) There is always competition risk with payments. I might think there’s less risk here than with a few others but the risk is still present. If FOUR can’t hang onto its existing customers in its best verticals (sports, hospitality, theme parks) then the stock will more than likely suffer as a result. Maybe other payments providers think they can serve these customers better and try to undercut FOUR’s pricing to take share. I don’t think this is a huge risk, but again, still present.

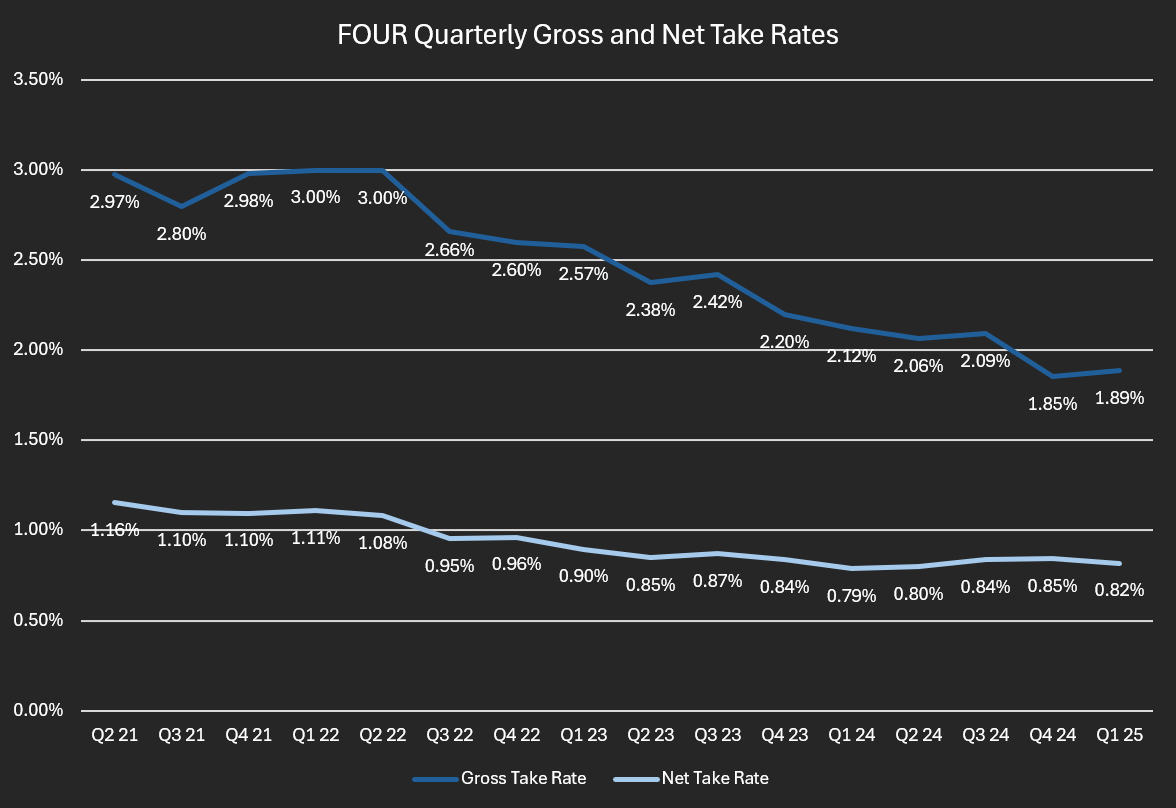

5) Lack of pricing power (inherent in payments): Gross volume take rates are declining at this company, though net take rates (net of network fees paid to other payments ecosystem operators) are holding steady, at around 0.8% of volume. I don’t honestly care too much about gross rates declining because they’re still able to drive incremental dollars to the bottom line at great rates, but it’s certainly not ideal. As long as net take rates remain constant or decline only slightly, we should be fine given the company’s immense volume growth, but this can be a risk as well. We should hope to avoid seeing net take rates decline too far if they decline from here at all. Maybe one day down the line, gross takes rates will decline to a point that they drive net rates down too — that would be really bad. Fortunately, gross take rates have flattened out their decline this past quarter — if these start trending up in a meaningful way, amazing things could happen for the stock price. They’ve been lowering rates in many cases to take share, but once they’re well cemented within their best verticals, we could see take rate increases or at least, a bottom for gross rates.

For a more apt comparison, competitor TOST charges somewhere around a 2.6% gross take rate + 10-30¢ per transaction. So, FOUR has lower gross take rates but around the same net rates from what I’ve seen estimated online.

6) Up-C corporate structure: FOUR is 22% owned by Rook, an entity solely controlled by the outgoing CEO Jared Isaacman (his >20% ownership stake). When FOUR IPO’d, they did so with an Up-C structure, meaning a public holding company (Shift4 Payments Inc) was created with it’s sole asset being a portion of ownership interests in the actual operating company (Shift4 Payments LLC) - the remaining ownership interests were kept by FOUR’s pre-IPO shareholders (Isaacman) through Rook, a separate entity. Why do companies do this? Tax purposes, naturally. So - on the income statement, we see some accounting income reductions due to minority interest, from Rook’s ownership stake in the public company. There is also a TRA (tax receivable agreemeny) liability charge on the income statement, which essentially means FOUR will pay 85% of its future realized income tax reductions back to its pre-IPO shareholders, over a period of many years as is usually the case with these agreements. The tax reductions are generated by becoming a public company essentially, changing their tax basis. This liability charge is non-cash, so we should simply expect FOUR to realize less tax benefits than some other public companies going forward, but it won’t really affect cash flows besides reductions to net income via, paying equivalently slightly higher taxes. This Up-C structure with a TRA agreement isn’t ideal but it’s fairly common for recent IPOs.

7) Previous shareholder lawsuits - FOUR was sued by two groups of shareholders a few years back, over alleged accounting discrepancies related to the counting/timing of certain cash flows - these suits ended up combining, but the resulting suit was dropped by courts. It’s worth noting these lawsuits came around the same time as a 2023 short report published by Blue Orca that saw shares fall by 12%. I don’t think this should be a risk factor going forward, assuming the company maintains the same accounting practices it does today.

What does Shift4 Do?

The payments space initially seems complicated and opaque, but it’s really not so bad once you get familiar with it and all it’s different actors and moving parts. With that said, what does it mean to be a payments processor?

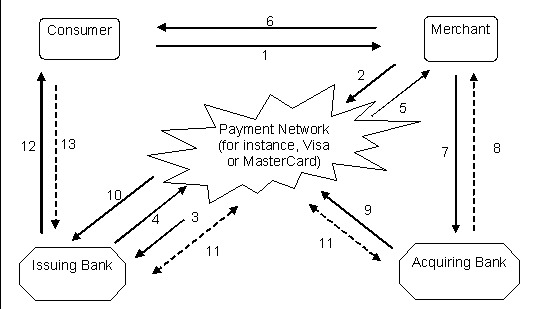

FOUR operates as an intermediary between customers who purchase goods or services either in-person or digitally, businesses (called merchants) like restaurants who offer those goods, credit card networks like Visa or Mastercard that facilitate transactions, and the banks who actually hold and move money on behalf of both the customers and merchants. The act of swiping your card at a POS terminal is simple as a customer, but there’s quite a bit happening digitally to complete any transaction. So what does this process actually look like?

After a customer swipes, taps, or inserts a card, a chip or card reader within the POS terminal reads the card’s details and sends it along to a piece of POS software, running either within the POS terminal itself (in-person transactions) or in the cloud (online transactions).

The POS software encrypts the card and transaction data and transmits it to the payment gateway, another bit of software that’s usually running in the cloud. The gateway forwards this data to the payments processor (in this case, FOUR), who then routes the transaction through card networks like Visa or Mastercard, who in turn ping the cardholder’s bank (called the issuing bank) for authorization - authorization in this case can mean both fraud prevention and confirming the availability of funds in the customer’s account.

After the transaction is approved by said bank, the POS screen flashes “Approved” and the customer can collect whatever item they purchased and go about their day. All in, this entire approval process usually takes no more than 5 seconds. But getting the transaction approved isn’t where the story ends.

Following this, there’s a settlement period where the merchant collects batches of authorized transactions and submits them (usually at the end of the day) to their bank (called the merchant acquirer). The merchant acquirer works with the payments processor and card network to request the transaction funds from the issuing bank. During this process, fees are taken off the gross transaction amount by various actors including the banks, card networks, and payment processors, before the net transaction proceeds are finally deposited into the merchant’s bank account, usually within 1-3 days.

What do these fees look like; who gets how much, and why?

The largest fees are interchange fees, charged by issuing banks. These can range from 1.5-2% of the transaction amount, the largest share taken by any these facilitators. These issuing banks are allowed the largest share here because they provide and maintain payment cards (credit or debit) and take on the cost of managing consumer credit or debit accounts (think, customer service). They also take on credit risk when consumers use credit cards, as there is always a risk that any consumer might not pay their credit card obligations - a higher share of the fees here insulates them from this risk.

After these fees, there are the card network fees charged by networks like Visa (V) and Mastercard (MA) - these can range from 0.1%-0.3% of the transaction amount. V and MA can take the lower spectrum of the fees charged by the parties here while retaining their very high gross margins (V has 80% gross margins, for example) because it costs them almost nothing to process payments once their infrastructure is already built out. There’s no customer facing hardware to build and ship around the globe, and no customer support costs.

Some fees are also paid to the merchant acquirer (though FOUR does offer merchant acquiring services as well) with the remaining amount kept by the payments processor. FOUR justifies it’s share of fees by providing (and often subsidizing the cost of) POS hardware to it’s merchant customers, operating as a payments processor coordinating the entire transaction between all involved parties, and by providing customer support, transaction analytics, and a lot of industry-specific software to its merchant customers.

Here’s a rough diagram to show how this whole process can look using credit cards:

Let’s take a look at FOUR’s 2024 results to determine how they fit into this network at a basic level:

During 2024, the company processed $165Bn in payment volume - the gross revenue they took from this volume was $3.3Bn, with a 2.3% average quarterly gross take rate. Past that, the company paid network fees to others within the payments ecosystem equal to ~$2Bn, arriving at gross revenue less network fees (GRLNF) of $1.3Bn (this metric grew 44% during 2024). Average quarterly take rate after network fees for 2024 was 0.82% of total volume.

Past this, other cost-of-revenue items like hardware expenses are subtracted, giving us $973mm in payments gross profits, at 30% gross margin. The company also has a smaller amount of SaaS and other revenue (10% of total) coming in at much higher gross margins (assuming near 70-80%, typical for software) and growing much quicker than payments at +90% YoY.

Now you might be wondering, why not just buy V or MA with their 80% gross margins and 50%+ operating margins? You could also do that just as easily, but they are fundamentally different companies at different valuations. Today FOUR is trading at around 14x forward earnings, compared to 28x for Visa. That, and I think Shift4 can continue to grow faster over time thanks to it’s acquisition strategy - Visa grew EBIT 12.4% last year compared to FOUR’s 115% growth. FOUR has outperformed both V and MA since their 2020 IPO and I fully expect the company to continue doing so, at least for a while. One can argue that payment networks like V or MA are sturdier businesses with more competitive insulation, but these are the same companies that have been sued by the DOJ on monopoly grounds with allegations of anti-competitive and exclusionary practices. So, pick your poison I guess — I suspect the competitive moats around networks like V and MA might not be as untouchable as many people say, but that’s just me.

Products, Services, & Customers

Keep reading with a 7-day free trial

Subscribe to Welfare Capital Research to keep reading this post and get 7 days of free access to the full post archives.