Welfare Weekly - Edition #2

Market talk, trade ideas, portfolio updates, weekly equity basket performance + earnings updates soon!

Please see the not financial advice disclosure at the bottom of this article.

I thought this particular tweet was pretty funny, in summing up this past April:

Just don’t mind the 20% drawdown along the way, haha!

Trade ideas:

I still think Starbucks is a ripe short, largely on qualitative factors. They printed -6% AH Tuesday after a nasty earnings report - same store sales declined 4% in the US, operating margin compressed by 6.4%. This Q1 was their 5th straight quarter of declining volumes while increasing prices - a bad combo given the macro I’m expecting at this point, if we do end up seeing anything nasty. They cut their guidance (can’t necessarily blame them for that) and stopped reporting the number of U.S. rewards members for the first time in many years.

Why do I think there’s a lot of juice left here? This is still trading at 27x TTM earnings (and you know their 2025 earnings will be worse at this point) and the people who bought this company assuming people would just keep paying increasingly higher rates for lower quality and more sugar-filled coffee ever year are pitching it as a “turnaround play.”

I disagree. I do not think you turn this ship around, much like Nike which I also suggested as a short in the Q1 update. I think Starbucks has lost its magic touch, I think it’s another coffee company like any other - but not even a good coffee company.

They should trade at whatever the mature multiple of a breakfast restaurant chain is - significantly lower than 27x TTM earnings, if you ask me. I think they continue to see fierce competition in coffee, from others Dutch Bros, but also from local ‘indie’ coffee shops. I don’t think people, specifically the Gen-Z consumer, will want what is essentially corporate slop coffee forever given the many alternatives available in most cities.

I know there are concepts of a bull case like longer term growth in ROW, and the aforementioned turnaround potential, but still. If the macro scares continue I don’t think this does well. As a reminder, I’m not short anything, I just really don’t like Starbucks here or in general.

Another interesting trade idea is ASTS - I’ve done a lot of work on this name recently and I still cannot figure out what to do with it. It’s a retail cult classic name, massive volatility (literally up 18% on Friday as I write this), the stock basically acts like levered beta absent any major news.

It’s a pre-revenue space-based telecom play. So, already sounds like a long shot, you’d think. I know a lot of investors completely brush off space stocks as more or less ‘lighting your money on fire,’ but I actually do believe in the sector long term (massive space nerd here). Still, there are a lot of assumptions one has to get comfy with in order to own ASTS, if you ask me…

If you assume management is right about the capabilities of their technology, and the competitive picture from Starlink and others doesn’t change too much, you genuinely might be looking at some massive earnings and cash flow potential towards the end of this decade. Here’s what the modeling for that looks like:

The revenue/satellite estimate here is shamelessly stolen from TheKookReport, his estimate used pricing/gigabyte and data transmission throughput, which I felt was moderate-conservative. I have refined these opex, interest expense, and dilution estimates after more research. The launch timing estimates are more conservative than most, but I think they’re really just realistic. I assume each New Glenn vehicle can launch 7 next-gen satellites (the Block-2 BlueBird) and each Falcon 9 can launch 3.

However, you do have to trust management at their word, which might be a little difficult given how they’ve changed the design of their main satellites recently, and the entire process is rife with delays (naturally, it’s aerospace). Technically speaking, a lot of their technology does look really promising and it’s very well patent protected, so you could argue that they’ll probably get things working eventually, but it will take a lot of time.

Given the current launch scene, I think it will take at least a few years to get their constellation up to any proper sort of scale. If everything does work out, they will likely begin printing money in 2028 and scale that through 2030+, generating recurring cash flows at ~50% margin. I’ve modeled the size of those 2030+ cash flows, excluding working capital changes, at over 1/2 the current market cap of the entire company. So - if they can get things right, I think they’ll do really well.

You can apply a 10% discount rate to these cash flows (through 2034) and get a NPV 30% higher than the current market cap, and those revenue/satellite estimates might still be low. Though, I feel like forecasting anything out that far might as well be a complete shot in the dark. This carries a good amount of risk.

I want to do more research but the technical capabilities of telecoms satellites are very out of my depth. I am also not a telecoms analyst, so the general picture around their MNO partnerships and the competitive dynamics there are basically foreign to me, I’d need to do loads more research and if it’s a larger position, probably try to hedge away some of the insane volatility. Maybe I can get myself to roll with a 3-5% position and just… not sell it? We’ll see. I have a 1% position right now, but if I’d just stuck with my initial position heading into this week, I’d be up another 2% YTD. Argh.

Portfolio updates:

Continuing my work on Marex: My initial buy might have been hasty but it was well timed enough, with shares now up 8.5% since last Friday. A few more things I’ve learned, management actually only owns 8% of shares - still respectable, but down from the 50% that the data providers gave me before I went to read their annual report (curses, it happened again). The CEO owns 4%, which is equivalent to over $120mm worth at the current valuation, I’d call that well incentivized enough!

Most of the rest of their insider-owned shares are owned by a collection of three PE firms that helped shape the company since 2010 and helped take them public. That sounds like a red flag but I don’t think it is in this case, these PE firms have been with the company since 2010, which is a very long holding period for PE - I think they believe in the business reasonably enough, they still own a fair amount of shares. Today’s public float is around 50% with liquidity in the shares rapidly increasing as the stock price rises. Interestingly, they’ve said that becoming a public company and having the stock do well has actually helped them win more deals, which is super cool.

50% of their revenue comes from commodities transactions, across clearing, market making, hedging solutions, and execution. Given the tariff scares, we should be seeing some quirky activity begin to occur in commodities like metals and ag (if not already, I’m sure) and that sort of heightened volatility leads to more hedging activity from those who produce or consume commodities, which just increases volumes across every one of Marex’s business lines. Even if this doesn’t pan out like I’m hoping it will, commodities players still need to continually hedge around whatever market fluctuations do occur - the upside is mostly just a volume thing, I’m wagering.

The market making segment specifically is positively levered to volatility - not only do trading volumes increase, but bid/ask spreads widen, further juicing the profits. They make markets in a lot of metals and ag products. Market making is only 14% of the firm’s total profit but if we get some serious volatility that mix could shift up a good bit and provide a further boost to earnings, on top of the overall heightened trading volumes these guys will see, likely across most of the asset classes they handle.

Given this, it is no wonder shares have been flying like hot cakes recently. They might just have a fantastic few quarters ahead of them, if the tariff volatility can continue. This is still cheaper than the closest public competitor I’ve found, StoneX (SNEX) on a forward earnings basis - despite the fact that StoneX saw just 1/4 of the earnings growth last year.

Marex might be UK based but they have a US listing, same as StoneX, and both companies are around the same market cap - so they’re on equal footing at this point, I’d say. I think there’s a good chance Marex outperforms StoneX (along with the broader market) over the coming year. StoneX shares have also been doing really well, just not quite as well as Marex.

I’m gonna go ahead and keep both of these companies in my back pocket for the future, so I can make bets on things happening in commodities land, while they’re also just solid businesses that keep increasing their earnings. Technically the two are competitors in certain lines, so I’m planning to research StoneX a lot deeper as well, to determine how things might shake out between the two.

Technically speaking there is a small risk that one segment of their company gets hit with a customer default or some kind of blowup, but that’s rather unlikely I’d say. I doubt the earnings multiple will be too high long term given the credit risk involved with clearing, but I think at this point it’s a very solid deal considering their growth prospects and the diversification of the business today, with a lot of revenues that aren’t strictly recurring but can be expected to recur. Credit losses have remained very low over the past few years.

The growth prospects from here are primarily; geographic expansion, taking (and acquiring) more clients, increasing focus on more profitable desks, and adding additional services to their existing clients.

If they’re already handling clearing for a client, it makes a lot of sense for them to help with liquidity needs in market making or execution too. They also have opportunities in cross-selling to clients they’re only servicing in one particular region, winning those clients in more regions as Marex continues expanding its own geographic footprint.

There is a good bit more share to be taken in the core clearing segment (50% of profits for the firm) as a lot of the bigger players in clearing, mostly large banks and investment banks, have lapsed in focus on growing or improving their clearing lines. If you need clearing, would you rather get it from a large bank, or from a dedicated, global firm that does clearing really well? Especially if that firm has a bunch of liquidity they can help you access through execution and market making, with optionality for custom and dynamic hedging solutions (though I know some banks offer those too), I think it makes a lot of sense for some clients to pick a smaller but much more dedicated player like Marex.

Net interest income only accounted for 14% of revenues (though it might be more like 14% of profit as interest income is generally very high margin) during the peak in global interest rates last year - a 1% decline in rates knocks off roughly 6% of their adj. pretax profit, they estimate. That’s really not so bad, even if rates collapse. Technically I have some short rates exposure factored into plays like RDVT, but I might be looking to balance things out more within my holdings - I cannot remotely forecast where rates might go from here so I may wanna be a little more diversified.

Either way I need to do a little more work to justify my position size here - clearly I’ve caught this thing partway through a re-rating, I just need to see how high their multiple could realistically get given their future prospects, and how much growth they might see to grow the multiple base.

Onto the broader performance…

My portfolio did pretty well in April considering the volatility, but lately I’ve been giving back some outperformance this past week due to my poor trading ability in this sort of market. I ended up missing a lot of FOUR’s earnings move, I’ve been generally awful at trading ASTS - think I’ll either stop touching the name altogether or commit to a very small position. OPRA went back up on me after I sold, naturally, and they reported pretty good earnings too - alas. I had a feeling that would happen, but it’s OK. My wash sale period on that name ends in a few days, and it’s still a good bit lower than my original cost basis, so I could very well buy back in and have a decent tax loss. We’ll have to see I suppose, I haven’t looked too far into their results yet.

My max drawdown for the year (so far) was 9%, compared to 15% for the S&P, which I’ll take! I had tried to create a portfolio that would outperform in a U.S. equities drawdown, and it technically did work! Now I guess, I have to try and position well for either of the coming regimes, up or down. I think I could maintain my current cash balance and outperform in an up market, but I’m not sure. It might depend on how much the S&P ends up going up, but obviously I can’t know that.

I haven’t done nearly enough macro work over my investing journey to distill any future moves, but if I had to guess the situation 18 months from now assuming tariffs stay where they are, I’d say it will probably be worse. I don’t know why markets are rallying so much, but that’s just how it goes isn’t it? The only thing we can really expect markets to do is to confuse the majority, and I’m pretty much part of the majority here, even if I’m outperforming some (for now anyway).

Another thing is, I don’t know why I try so hard sometimes. I feel like this whole thing is really not that time intensive, once you own a few solid companies, the rest of the game is essentially just ‘sitting on your hands’ and monitoring the situation. Maybe I should be less active?

While I’m just spitballing here, I’d like to say that this whole thing is so subjective, truly, so much of it. You can find people who absolutely hate specific companies, and some people who love those companies. It all just depends on what their opinions and assumptions are, I guess.

I’ve learned that this is really just an information game. Once you know the financial analysis principles, that’s what it becomes. What do you know (or assume) that the market doesn’t? Why are the market’s assumptions wrong? It really helps if you can find certain widely held assumptions that might make people ignore certain opportunities - that’s part of the reason I rely on sentiment so much.

Currently, I am beating the SPY by 7.6% YTD. Proud of that.

Trade updates:

I actually got back into RDVT around 10% weighting last week but forgot to include it in the first Welfare Weekly. One of my better performers last year, and I still think they could go a long way yet - we’ll see.

I did trim a small amount of my GRND shares over worries about earnings downside, and also to free up some cash.

Earnings updates:

FOUR reported pretty solid earnings, actually raised their full year guidance which is nice to see considering… you know, the macro. I own this one at smaller allocation, mostly for a trade. If it goes up nicely I don’t think I’ll hang on too long.

GRND reports earnings May 8th, RDVT reports on the 7th - I own both these two.

I do worry a little about GRND, the stock is nearly parabolic lately so I’m hoping for good results or else I’m worried about some downside. A continuation of the 85% growth we saw in the ads business in Q4 would be amazing - doesn’t have to be 85% growth, but just high growth. Last year overall they grew ads 50%. As long as MAU, payer penetration, and ARPPU continue going well on top of that, I’m hoping things will be fine. I’m already up 30% on my position, so, no complaints from me. That’s been like, a godsend in this market, haha.

They’ll hopefully get a small EPS boost, I’m pretty sure they’ve been buying back shares this Q - we’ll see.

RDVT should be interesting. I think the street consensus estimates are a little too low depending on growth prospects - I hope they grow well this year. I’d like to see the move upmarket continue to work well, maybe some cross sells within IDI, and naturally more realtor adds for FOREWARN. That’s where the small bit of short rates exposure comes in, if interest rates drop, housing activity can pick back up, the number of realtors will increase (eventually) and expand that product’s TAM.

I think at some point, hopefully soon, RDVT will make a new ATH and ride the momentum from there - my magic trendline is telling me bullish things are in order, hopefully anyway!

Basket performance:

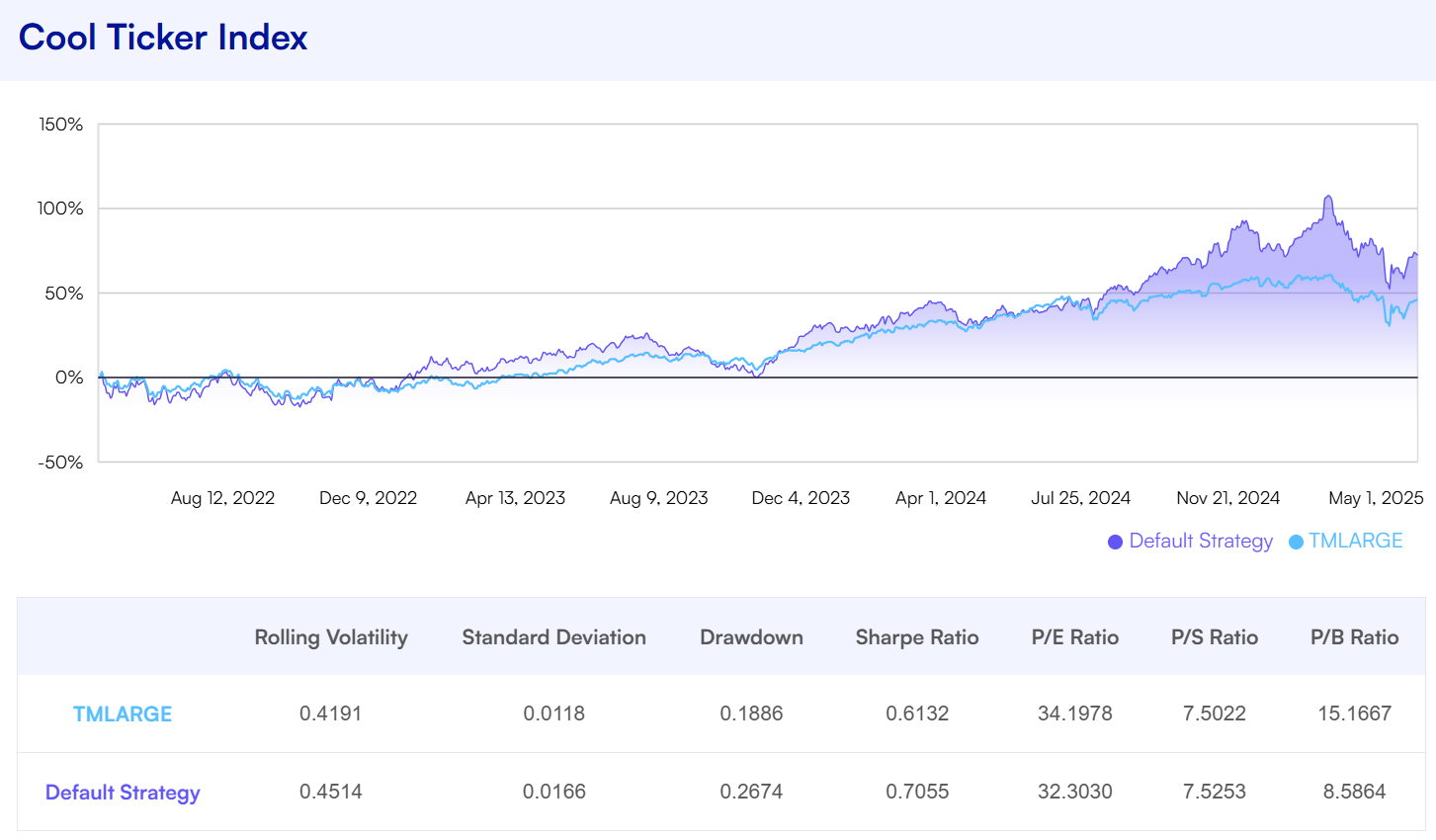

I’m adding a new basket this time only, one I fondly call the Cool Ticker Index. It is indented to be composed purely of decent companies that have good ticker symbols, just to see how stocks with good tickers might do against the index over time, and how they might differ during certain periods. I doubt many people give preference to names with cute tickers but I thought it was interesting enough to find out.

The Cool Ticker Index Consists of equal weight BABA, CRM, NOW, SHOP, RACE, MMM, SNOW, FICO, YUM, HOOD, IOT, TAP, COKE, HIMS, FOUR, FIZZ, YOU, HOG, CAKE, PZZA, JACK, HEAR. This is far from an exhaustive list, so at some point I’d like to go ticker by ticker and isolate every profitable company over a certain market cap with a good or fitting ticker, and throw it into this index.

This is just a backtest, not a live index. But still, it’s done pretty well, I guess. A little outperformance here and there isn’t too bad.

Diversified Financials: -0.36% over the past week, -5% on the year. Basically keeping pace with the SPY.

Some updates to this basket, I added in StoneX, the US clearing firm, and took out IGIC and VBNK, seeing as those two aren’t strictly “diversified financials”, but instead an insurer and a bank. I also moved to include three of the big four US exchanges, being ICE, NDAQ, and CBOE. Maybe at some point I’ll throw OTCM in there as well. The basket still holds IBKR shares, this is probably the last major change I’ll make before letting the basket run on its own.

Software Acquirers (WSERIAL):

No updates here, but the basket performed really well this week, with a 1% weekly gain and a 7% monthly gain for April. Am I going to immensely regret not buying ROP and CSU when I had the chance? Probably, yeah. Argh.