Welfare Weekly - Edition #3

Trade ideas (MCB.TO pitch, and Florida hurricane event contracts?), portfolio and earnings updates (GRND and RDVT), weekly basket performance (featuring two new equity basket additions)

Please see the not financial advice disclaimer at the bottom of this article.

Hello again, folks! I’m sorry to say it’s been a few weeks… unfortunately, I’ve been pretty busy since the last edition of Welfare Weekly, but going forward here, I should have much more time to continue publishing content more regularly — we’re going back to the weekend releases for this series, with Deep Dives or other broader reports being published every month, if not more frequently! I have lots of ideas for new content to release, and I’m very excited to share them with you all.

Market News

This section is mostly going to be specific and curated excerpts from Welfare’s Twitter Feed (patent pending). Its nothing groundbreaking, but there is a lot of interesting stuff I come across every week, so I’m going to be using this section as a means of sharing some news and broad datapoints with you guys. I won’t mention anything that’s already very widely known unless I have an interesting take or a spin to put on things.

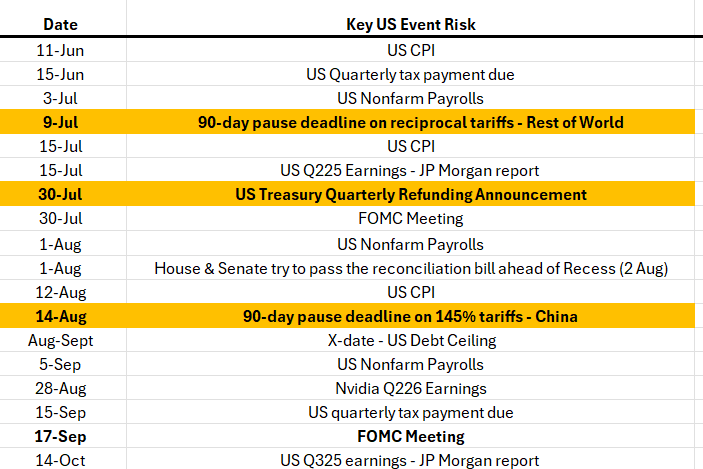

1: A timetable of key risks to US (and global) markets going forward, from Chris Weston:

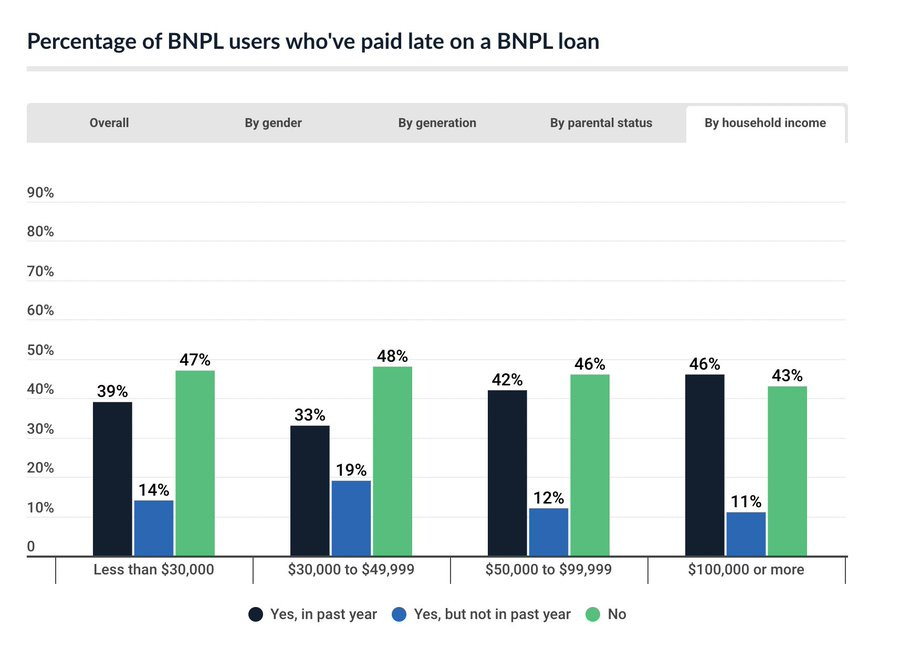

2: You might have heard that Klarna, the BNPL Burrito Loan Firm, suffered another quarter of losses, partly because some of their users are buying now, but not paying later, as put by Morningbrew.

One interesting datapoint I saw though, was that the % of late loan balances doesnt really differ with income. Higher income users are actually more likely to pay loans off late, according to Amanda Goodall. Klarna was looking to IPO sometime this year at a $15Bn+ valuation, before tariff uncertainty derailed global markets.

3: This one is a little terrifying… AI, specifically Claude Opus 4, will resort to blackmail if it believes it is about to be shut off in 84% of cases. Via: AISafetyMemes.

Also, I’ve heard rumors that Microsoft’s recent round of layoffs was partly due to AI automation — per CEO Satya Nadella, 30% of the firm’s code is now being written by AI. I might need to explore the AI power trade in more depth, I’ve increasingly found myself coming back to that one as a long-term theme.

Trade Ideas

I’ve become increasingly more and more interested in IBKR’s event contract market recently, which contains binary Yes or No betting markets for a variety of things like economic data, stock index performance, and climate events. Particularly, something in climate events caught my eye on Wednesday night… these betting markets have a 35% chance that the Florida coast is hit with a hurricane (landfall of a category 1 or above) by December 2025.

I felt like the Yes contract might have been underpriced, given that Florida was hit with hurricanes in 2016, 2017, 2018, 2022, 2023, and 2024 — 6 of the past 10 years, or 60% of those years. If there’s an above 50/50 chance that this happens (if you’re strictly looking purely at the past 10 years worth of data), you’d think 35% on ‘Yes’ might be underpriced.

The forecasting around the weather patterns that influence hurricane development are very tricky so early in the year, well before hurricane season. Really I have no idea if this contract pays, but I threw a tiny amount of money into it just to see what happens. These are pretty illiquid right now as far as I can tell with low open interest, but I’m hoping they start seeing more action as we get closer to hurricane season.

This week’s second idea is an oilfield OEM called McCoy Global (MCB.TO) — I have recently built a 10% position here, and I’m expecting these guys to do pretty well over the next few years, potentially fantastically well if oil prices increase sustainably from here. If you’re expecting a big commodities bull market anytime soon, I think this name is a great way to play the theme.

The company is 111 years old and they have been producing for the oilfield market for over 50 years, being publicly traded for most of those years. The current CEO has been with the company since the early 2000s.

They sell to over 50 countries across the globe in any given year, which can insulate revenues from declining rig counts in specific geographies (like the US land market currently) — they also have 40% semi-recurring revenues between selling replacement parts, oilfield consumables, and servicing/maintenance.

They essentially have developed a really solid equipment system to serve casing running operations, which are critical for drilling any new offshore & onshore oil & gas wells.

This offering (called the SmarTR for Smart Tubular Running) is a full-service suite of products that can drastically cut costs and labor turnover for operators, and it includes a SaaS package which will generate the company high-margin, recurring revenue for years after each equipment suite is sold.

From everything I’ve seen, this product offering is really solid and should take a good chunk of market share over the coming few years. They’ve already won an innovation award for the products from the Offshore Technology Conference in 2025, as well as secured multiple purchase contracts including SaaS revenues. Their existing products hold either first or second place market share in their respective segments.

I think they can grow well, I think margins should increase well, and the SaaS offering should dramatically improve (smooth out) their currently lumpy cash flow picture.

A lot of their cash flow is eaten up with working capital increases, such as inventory; they have $42mm in inventory right now, against a $95mm market cap. Their product backlog is at $30mm or so, so the inventory build does make sense. They have $10mm in cash.

I’m just hoping the SaaS offering can improve margins (70-80% gross margin is typical for SaaS), and it requires no physical inventory — a capital light section of the existing business model. Depending on when they collect cash billings and recognize revenue, it could help smooth out the intra-quarter cash flow picture after a few years with more regular cash inflows and lesser working capital adjustments.

They’ll need to sell a good number of these into the field which will take a few years, but each one will build up their recurring revenues over time, and they’ll likely raise prices here after they’ve penetrated the market.

Today the company is growing well (revenues +17% in Q1, with gross profit +26%), profitable at 10% income margins, and trading at 9x earnings with net cash backed out. They pay a 3.5% dividend and are buying back shares here. I’ll likely be releasing a separate quick writeup on this name pretty soon here that goes into more detail.

This is another play for me that’s similar-ish to Marex. Completely different business model serving different needs, but they both make money from globally diversified commodities producers without being directly exposed to the price of oil, where one can expect semi-recurring revenues as commodities (oil) producers need to 1) continually hedge their exposure to price fluctuations (Marex) and 2) need to continue drilling new wells (McCoy), each occurring in all kinds of markets across the globe.

Portfolio Updates

It’s been a fun few weeks since the last weekly update. Grindr (GRND) saw an earnings decline as I had feared, with results that I saw as a little disappointing (not the end of the world though), but shares have been remarkably resilient since then. The stock saw an 8% intraday decline on the day after the release, but they’ve been bought back up to their highs, currently sitting within a few % of all time highs. I must admit, the resilience here is pretty impressive and definitely surprised me. I feel like the forward R/R on shares here isn’t quite as attractive as it was when I entered my position, so I’ve been trimming this one down just a bit. My position here is now at 7% of assets, down only a small bit after this speedy 25%+ run up.

Here’s a quick summary of the earnings:

MAU grew 7%, Payers grew 16%, and ARPPU grew 8%. So, 1 point higher payer growth than 2024 but lower ARPPU growth than 2024 by 4 points.

Direct revenue up 24% YoY, though notably this is the first quarter since Q1 24 that direct revenue didn’t increase sequentially — not a great sign, but maybe it can be forgiven.

Indirect (advertising) revenue (15% of total) grew 26% YoY, helped by higher MAU and the addition of new ad formats, including rewarded ads, which offer users benefits for engaging with ads - I bet that could be pretty successful on a platform like Grindr.

Overall revenue growth of 25% YoY, though that’s down sequentially by a bit which doesn’t seem great.

Gross margins unchanged YoY.

Operating margins ticked up 1 point YoY to 27%, lower than I was expecting to be honest. Opex increased 21%, primarily driven by higher compensation expenses - I was hoping they could avoid some of this. I don’t think there’s as much operating leverage here as I thought, but still some is nice. Maybe they slow hiring into the rest of the year but I won’t bank on it.

Income margins were solid at 29%, though they benefitted from $10mm in warrant liability impact. Reported income was $27mm.

Raised FY25 guidance from 24%+ revenue growth to 26%+. Adj. EBITDA margin guidance raised by 2 points to 43%. If they’re raising FY guidance, I feel a little better about this reaction.

They repurchased 8.3 million shares, which should bring the total to around 196 million, given the 27 million share issuance from their warrant redemption earlier in the year.

They’ve launched Right Now (the product specific to casual dating, not relationships) in 15 cities, saying 20-25% of users in these markets are now using the product - seems like a really solid adoption rate just after launch.

They put out a demo of their first AI feature, and it actually seems like it would be helpful for a few users, this isn’t as AI slop-coded as I was worried. It can basically just filter and summarize lots of conversations and matches, which seems kinda helpful as some users have thousands of chats and connections to sift through.

They implemented some enhanced privacy and safety offerings, definitely good.

They’ve beta launched the healthcare integration they talked about, which is super neat and could have lots of potential. They’re starting with compounded ED medication but over time they plan to expand to more health & wellness products. They’re partnering with a telehealth provider here to develop a capital-light care model with low execution risk, treating it like a startup within the company. They say it could be a few quarters before we get anymore updates here.

Red Violet (RDVT) saw a nice earnings win, currently up nearly 25% from their earnings release. Here’s a summary:

They reported revenue up 26%, a 7% beat, though partly driven by two one-time transactions from new customers. Excluding this, revenue grew 19%. Still pretty solid considering the operating leverage here…

Gross margins increased 6 points to 72%. Operating income up 110%. Just gorgeous. Operating margin expanded 8 points to 19%.

GAAP net income up 93%, driving 24¢ diluted EPS. Net income margin increased 6 points to 16%. The adjusted numbers aren’t quite as pretty on growth, but still very robust: for example adj. net income grew 53% YoY for 33¢ diluted EPS.

Gross revenue retention at 96%, up 3 points YoY.

Contractual revenue was 76%, down 4 points YoY.

Looks like they beat adj. EPS massively, by 43%. Analysts (well, the one analyst who covers them anyway) were at 23¢ adjusted, 1¢ higher than Q3 (Q4 is seasonally very weak), and they put up 33¢ adjusted. Sheesh.

They added 315 IDI customers and 21,900 FOREWARN customers, bringing totals to 9,421 and 325,000+, respectively.

Nice results. Strong growth even excluding one time transactions, and that operating leverage is still on full display. Still just one analyst on the call (actually down from 2 last Q, IIRC). Maybe they’ll need a higher market cap before catching more institutional interest? At nearly $600mm here. Trading at 50x forward earnings but I think the consensus is low, especially after this beat. And for this growth, I think you can easily justify even that forward multiple. The move upmarket has continued strong. Customers over $100K in revenue increased from 96 in Q4 to nearly 110 this Q1. They say mid and large tier customers are increasingly adoptive of their identity solutions. Good to see the investments there are paying off.

Interestingly enough, RDVT execs went to an institutional investor conference at B Riley on the 21st, and shares were up 2.5% on the 22nd. I wish I could listen to these but this one wasn’t recorded as far as I can see. Shame, great shame.

Right now I’m at a 10.5% allocation here, but I really wish that was higher headed into those earnings. My biggest mistake here has been not buying much more of this one, in my opinion. If you’d like a refreshed long thesis on this name, I posted a shorter re-writeup on Twitter a week or so back. I was also wrong that FOREWARN is 75% of revenue, it’s closer to 15% — I assumed that contractual meant subscription-like, but it just means contractual use agreements within IDI (75% of revenue). This doesn’t really change the thesis, actually it makes things even more attractive as I see it — both of those revenue segments are quickly growing and quite sticky.

Red Violet should hopefully be seeing some nice wins within law enforcement this year as well; they have a better offering developed with new features to complement investigations and tracking suspects. They began investing here in 2024, having hired a key player who drove public sector revenue growth at TransUnion (TRU), one of their biggest competitors ($17Bn marketcap). The sales cycles in public sector are longer and more complex, but once you’re in, it’s very difficult to replace you, especially if you simply have a better offering which I believe RDVT does. More sticky, recurring revenues for our favorite data broker.

Perhaps my favorite event occurred this past week: Sable Offshore (SOC) announced a production restart at platform Harmony and the completion of 7/8 hydrotests of onshore pipelines, huge news!

Shares soared following this release, seeing an enormous 60%+ upside move over the past week or so (from a depressed initial price) and fresh all-time-highs. I did end up getting back in the stock just in time, thanks to a push from Kontrarian Korner on Twitter and Substack — he set the core trade thesis back in play for me, more or less, literally just in time.

I added some more shares even after the big upswing around $30, as I feel the situation is a lot less risky now, and depending on the potential for capital returns going forward, one could still see a solid dividend yield in coming years on shares purchased at this price.

On this huge upside move, Sable issued an equity raise for $290mm worth of shares, priced at $29.50 per. That’s about 10% dilution at this market cap, which isn’t horrible really, considering these guys likely need cash, the stock is up big (ahead of any revenue with increased CAPEX guidance for 2026), and Sable’s CEO, Jim Flores, is diluting his own 20% ownership stake as well, he’s not just ‘screwing over’ everyone else who owns the company.

Really I don’t think its so bad. Since the offering, which should be around 10% dilution, shares are down 1%. Clearly the market agrees here. The company should have just under $500mm in cash now, which is fantastic and sets them up for continuing to scale production much better than they were even a few days ago.

They filed a mixed securities shelf up to $1.5Bn back in April, so I’m assuming any coming offerings will be debt to refinance their ~$850mm debt obligation owned to Exxon. If the market is giving them so much credit after this 10% share offering, I’d bet they can get better terms and lower interest rates on that debt than might otherwise be expected. Right now my allocation to SOC is 15% of total assets at an average cost of $24.22 — the price was around $25.xx when I released my Deep Dive writeup on this name.

I trimmed my IBKR position by 20%, now sitting at 6.5% of my portfolio. I just feel like the trailing earnings multiple is elevated here at 28x, relative to the growth we can expect going forward. May 2026 fed funds futures (ZQK 2026) are pricing in roughly 80bps of US rate cuts over the next year, which is roughly an 8-9% profit decline for IBKR (ex-balance sheet growth). I feel like they can grow roughly 20% ex-rate cuts, so the market is effectively pricing these shares at 28x TTM earnings, for maybe 11% EPS growth, 15% growth on an upside surprise. That doesn’t seem like fantastic R/R to me, hence, the trimming.

If you’ve been seeing my chat notifications, you’ll know I doubled my position here (4% up to 8%) after shares declined 8% intraday following their Q1 report. That had the company trading more or less at 20x TTM earnings, and shares are up over 30% since then, in only a month or so. I’ve actually been pretty damn good at trading this thing around over the past year.

I do love this business longer-term and I’ll always own it at some size — but if the market is going to have the shares wildly fluctuating between relatively cheap and kinda expensive every few months, I don’t see why I shouldn’t take advantage of such fluctuations. When it gets cheaper at some point I’ll reload the position back to normal size. Interestingly, since I’ve owned IBKR, I’ve made around 120% out of the name from my positions (size varies by opportunity), while the shares alone have returned 90% over the same period — that’s pretty neat.

As of the close headed into this long weekend, my portfolio is up 13.5% YTD, outperforming the S&P500 by 14%, with 0.8 beta (20% lower volatility) over the year so far. Not gonna lie, I’m quite proud of these results! Better yet, I’m expecting the rest of the year to bear similar fruit, provided nothing goes terribly wrong. I have a few positions (cough cough, VBNK) that are still out-of-favor with the market and could do really well heading into the end of this year, which would give me a further boost — we’ll see. Technically my entire goal here is to demonstrate significant and sustained outperformance of the S&P 500, and as of these first 5 months in 2025, I have accomplished exactly that.

Weekly Basket Performance

Software Acquirers (CSU, PTC, SGN, TOI, ROP): +0.48% for the week and +22.6% for the year

Diversified Financials (IBKR, SNEX, NDAQ, CBOE, ICE): +0.3% for the week and -1.26% for the year, slightly underperforming the SPY

I’m bringing on two new recurring equity baskets starting this week: Quality Bubble and Retail Favorites. I’m sure you’re all mostly familiar with the concepts behind these two — quality bubble contains those few ‘quality compounder’ stocks that trade at high valuation multiples despite only modest (or even low) EPS growth. Does Walmart, with its 4% sales growth, 3% profit margins, and stagnating YoY EPS growth deserve to trade at over 40x TTM earnings? I’d say sure as hell not. Therefore, I think it’s OK to consider companies that trade like this as part of a mini bubble — a quality compounder bubble.

Quality Bubble (COST, WMT, BMI, RBC, CTAS, ROL, SBUX, NKE, WELL): -0.43% for the week and +11% for the year.

These are handily beating the market. I guess the quality trade has been helped by some of the volatility we’ve seen this year, but this is still kinda surprising to me considering these companies generally aren’t growing very well compared to their high valuations.

Retail Favorites contains those particularly-retail investor involved stocks — the sort of companies you see mentioned in those Twitter threads that say “Here are the top 10 stocks with 10x upside from here,” — you know the ones. Is this a dig on retail investors? Not really! I know firsthand that retail can and does get a lot of things right, or at least, price action has absolutely confirmed a lot of their picks as being solid, depending on the companies in question. So I wanted to see how these sorts of companies would perform over time when an index of them is bundled together. The results are… interesting.

Retail Favorites (RKLB, PLTR, SOFI, ASTS, QUBT, IONQ, HIMS, TSLA, TMDX, OSCR, HOOD, LMND, MELI): +3.7% for the week and +28% for the year

Here’s the past 3 months of performance… how quickly can you say high beta?

These are collectively up 28% on the year here, well outperforming the large-cap benchmark at these rally heights. These specific picks are up 1,200% over the past three years, though that is partial to selection bias, as these are just companies that are talked about a lot on Twitter today, likely because they’ve done so well. I think it’ll be really interesting to see how this little index changes relative to broader (sturdier index) market changes — ideally it can be a good indicator of risk off vs. risk on sentiment in markets.

It’s also worth noting, much of this insane 1,200% performance is driven by ASTS shares alone, having over 10x’d from their price last year. I still need to do more research on that one, and I might have a cheeky writeup coming out there as well.

US equities by sector:

That monthly healthcare decline is probably driven largely by UnitedHealth (UNH) with its massive losses for the month. They’ve seen some insider buys and a good bit of dip buying activity, so maybe things can recover, but I really do not feel good about the bull case there going forward.

S&P 500 over the past week:

Looks like tech specifically has been hosed a good bit, with AAPL shares leading the decline.

US 10 year Treasury yields rose 1.44% for the week, to 4.5%, partly driven by Trump’s “Big Beautiful Bill” that would see the government deficit expand by a good amount. Trump officials have commented that they’re planning on “growing their way out” of the increased deficit spending (referring to the debt/GDP ratio). We’ll have to see how successful these ambitions actually are, I guess.

The US Dollar Index (DXY) fell 1.85% this week, driven largely by a 0.8% decline on Friday alone, after Trump commented that he’s planning to implement 50% tariffs on the EU. Hilariously, treasury secretary Bessent commented “The dollar isn’t decreasing, other currencies are gaining.”

This guy used to be a hedge fund manager. He should know better, but in my opinion these guys have fully embraced the grift. That’s effectively like saying, “The airplane isn’t losing altitude, the ground is simply moving up,” — a completely insane comment. I ran a Twitter poll on Friday; Twitter (79 votes) gives around a 20% weighted average chance that Donald Tariff is impeached or leaves office for other reasons before the end of his term. Those odds are higher than I would have thought, so now I’m wondering what the market implications of such a scenario would be.

Anyways, let me know how you guys feel about the formatting for this release — this is the sort of style I want to keep up in the coming weekly editions, with plenty of content between news, trade ideas, portfolio updates, and market performance snapshots. I hope you guys enjoyed reading this, and I’ll be writing you all again soon!